Real Estate AI Agents - 2025 Market Analysis of Competitors

Hybrid Transaction Models Combining AI and Human Expertise reAlpha, founded in 2020 and publicly traded since 2023, exemplifies the hybrid approach. Its AI handles 80% of transaction workflows—from property matching to offer preparation—while human agents review critical documents and negotiate terms. The platform’s 0% buyer commission model incentivizes clients to redirect savings toward down payments or mortgage rate buy-downs. Despite initial expectations of rapid industry disruption post-NAR settlement, reAlpha’s COO Mike Logozzo notes that traditional commission splits persist, necessitating continued human oversight. The startup plans nationwide expansion beyond Florida in 2025 while exploring AI applications to further reduce agent workloads. Modern Realty, a Y Combinator alum, adopts a staged AI integration strategy. Its AI manages initial client interactions and property showings but defers to human “master negotiators” during offer submissions. CEO Raffi Isanians emphasizes rigorous backend quality checks to prevent AI hallucinations, ensuring responses align with legal and market realities. Early data shows 70% of users prefer AI-only interactions until the negotiation phase, highlighting trust in algorithmic precision for preliminary tasks. Video-First Search and Transaction Automation Bramble, another YC-backed innovator, disrupts traditional listing platforms with AI-generated video walkthroughs and a flat-fee brokerage model. By integrating IDX feeds with computer vision, Bramble curates personalized property recommendations that adapt to buyer preferences in real time. Co-founder Deepan Mehta targets a 50% reduction in home search duration compared to Zillow, citing the platform’s ability to surface “intangibles” like neighborhood vibe through dynamic video content. The startup recently expanded to 12 U.S. markets, offering average commission rebates of $20k in California. Hyro enhances buyer engagement via conversational AI, handling 85% of routine inquiries about listings, pricing, and scheduling. Its voice-and-chat interface integrates with CRM systems like Salesforce, automating lead scoring and follow-ups. A $20M Series B round in 2023 fueled expansion into multilingual support, now serving 15 languages across North American markets. Commercial Real Estate AI Agents Deal Flow Automation and Agentic Negotiation Admyral, part of YC’s Winter 2025 cohort, tackles commercial real estate’s “ownership opacity” problem. Its AI agents parse fragmented databases and shell company records to identify property owners in 60 seconds—a task that traditionally takes brokers three hours. Co-founder Chris Schmidt reports a 4x increase in daily owner outreach for early adopters, with plans to incorporate LLM-driven negotiation simulations by Q3 2025. Henry, a YC S24 graduate, automates 90% of commercial deal deck preparation. By syncing internal brokerage data with municipal zoning records and market trends, its AI generates investment memos, financial models, and marketing materials in minutes. CEO Sammy Krikorian, former Lev co-founder, estimates the tool saves brokers 15 hours per transaction, redirecting focus to client relationships. Title Search and Document Digitization Landeed, backed by YC and Paradigm Shift, revolutionizes India’s $1.2T real estate market with AI-powered title verification. Its OCR and NLP models extract key terms from sale deeds and encumbrance certificates, reducing search times from weeks to hours. A $5M February 2025 funding round accelerated expansion to 24 states, with 5M app downloads underscoring demand for transparent transactions. Global Proptech Innovators Emerging Markets Focus Kzas.AI, a São Paulo-based startup, addresses Brazil’s fragmented property market through AI matching. Its algorithm cross-references buyer behavior with 20+ data points—including commute times and school districts—to predict ideal listings. Despite only $5M in funding, Kzas.AI achieved 80% match accuracy in 2024 trials, rivaling human agents’ 65% success rate. Nestaway streamlines India’s rental sector via AI-driven tenant screening and maintenance forecasting. By analyzing historical repair data and tenant feedback, its models reduce vacancy periods by 30% while optimizing rental yields for property owners. AI-Enhanced Valuation and Investment Entera’s platform, operational in 22 U.S. markets, uses ensemble ML models to evaluate single-family home investments. By processing satellite imagery, local employment trends, and rental histories, it identifies undervalued properties with 12%+ ROI potential. A $32M Series A round in 2021 enabled integration with mortgage lenders, automating 45% of acquisition workflows. CityBldr employs generative AI to simulate development scenarios for urban plots. Architects input zoning constraints and budget parameters to receive 3D renderings and feasibility

Hybrid Transaction Models Combining AI and Human Expertise

reAlpha, founded in 2020 and publicly traded since 2023, exemplifies the hybrid approach. Its AI handles 80% of transaction workflows—from property matching to offer preparation—while human agents review critical documents and negotiate terms. The platform’s 0% buyer commission model incentivizes clients to redirect savings toward down payments or mortgage rate buy-downs. Despite initial expectations of rapid industry disruption post-NAR settlement, reAlpha’s COO Mike Logozzo notes that traditional commission splits persist, necessitating continued human oversight. The startup plans nationwide expansion beyond Florida in 2025 while exploring AI applications to further reduce agent workloads.

Modern Realty, a Y Combinator alum, adopts a staged AI integration strategy. Its AI manages initial client interactions and property showings but defers to human “master negotiators” during offer submissions. CEO Raffi Isanians emphasizes rigorous backend quality checks to prevent AI hallucinations, ensuring responses align with legal and market realities. Early data shows 70% of users prefer AI-only interactions until the negotiation phase, highlighting trust in algorithmic precision for preliminary tasks.

Video-First Search and Transaction Automation

Bramble, another YC-backed innovator, disrupts traditional listing platforms with AI-generated video walkthroughs and a flat-fee brokerage model. By integrating IDX feeds with computer vision, Bramble curates personalized property recommendations that adapt to buyer preferences in real time. Co-founder Deepan Mehta targets a 50% reduction in home search duration compared to Zillow, citing the platform’s ability to surface “intangibles” like neighborhood vibe through dynamic video content. The startup recently expanded to 12 U.S. markets, offering average commission rebates of $20k in California.

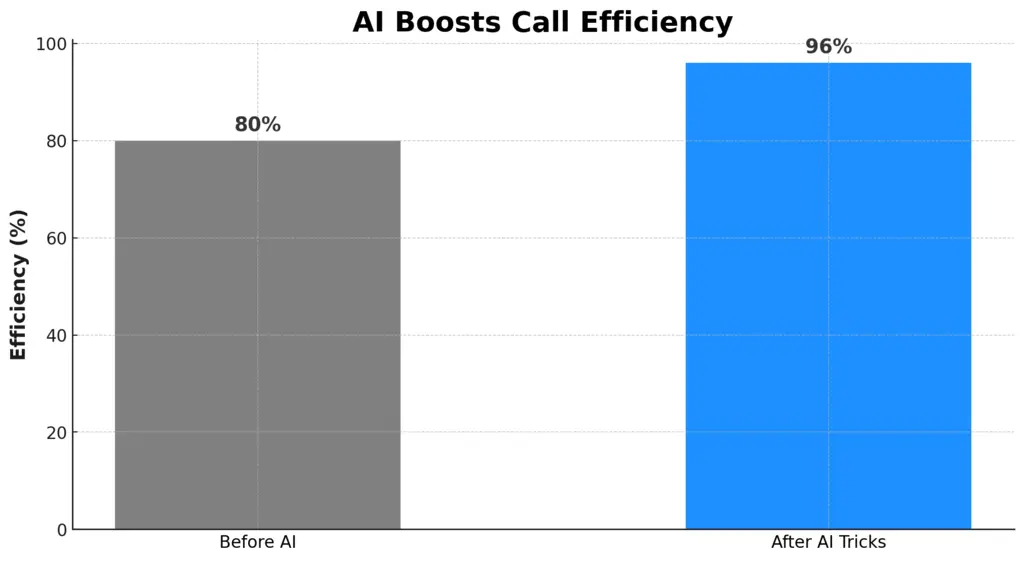

Hyro enhances buyer engagement via conversational AI, handling 85% of routine inquiries about listings, pricing, and scheduling. Its voice-and-chat interface integrates with CRM systems like Salesforce, automating lead scoring and follow-ups. A $20M Series B round in 2023 fueled expansion into multilingual support, now serving 15 languages across North American markets.

Commercial Real Estate AI Agents

Deal Flow Automation and Agentic Negotiation

Admyral, part of YC’s Winter 2025 cohort, tackles commercial real estate’s “ownership opacity” problem. Its AI agents parse fragmented databases and shell company records to identify property owners in 60 seconds—a task that traditionally takes brokers three hours. Co-founder Chris Schmidt reports a 4x increase in daily owner outreach for early adopters, with plans to incorporate LLM-driven negotiation simulations by Q3 2025.

Henry, a YC S24 graduate, automates 90% of commercial deal deck preparation. By syncing internal brokerage data with municipal zoning records and market trends, its AI generates investment memos, financial models, and marketing materials in minutes. CEO Sammy Krikorian, former Lev co-founder, estimates the tool saves brokers 15 hours per transaction, redirecting focus to client relationships.

Title Search and Document Digitization

Landeed, backed by YC and Paradigm Shift, revolutionizes India’s $1.2T real estate market with AI-powered title verification. Its OCR and NLP models extract key terms from sale deeds and encumbrance certificates, reducing search times from weeks to hours. A $5M February 2025 funding round accelerated expansion to 24 states, with 5M app downloads underscoring demand for transparent transactions.

Global Proptech Innovators

Emerging Markets Focus

Kzas.AI, a São Paulo-based startup, addresses Brazil’s fragmented property market through AI matching. Its algorithm cross-references buyer behavior with 20+ data points—including commute times and school districts—to predict ideal listings. Despite only $5M in funding, Kzas.AI achieved 80% match accuracy in 2024 trials, rivaling human agents’ 65% success rate.

Nestaway streamlines India’s rental sector via AI-driven tenant screening and maintenance forecasting. By analyzing historical repair data and tenant feedback, its models reduce vacancy periods by 30% while optimizing rental yields for property owners.

AI-Enhanced Valuation and Investment

Entera’s platform, operational in 22 U.S. markets, uses ensemble ML models to evaluate single-family home investments. By processing satellite imagery, local employment trends, and rental histories, it identifies undervalued properties with 12%+ ROI potential. A $32M Series A round in 2021 enabled integration with mortgage lenders, automating 45% of acquisition workflows.

CityBldr employs generative AI to simulate development scenarios for urban plots. Architects input zoning constraints and budget parameters to receive 3D renderings and feasibility analyses in seconds—a process that previously required weeks of manual drafting.

Regulatory and Ethical Considerations

Compliance in AI-Driven Transactions

Post-NAR settlement, startups like Modern Realty and Bramble prioritize disclosure transparency through AI audit trails. Bramble’s instant disclosure analyzer flags 93% of contractual anomalies by comparing listing details against county records, reducing legal risks for buyers.

reAlpha navigates fluctuating U.S. licensing laws by restricting its AI’s advisory role. In states requiring human supervision, the platform limits AI to non-binding recommendations, ensuring compliance while maintaining efficiency gains.

Data Privacy and Bias Mitigation

Landeed anonymizes user data during title searches using differential privacy techniques, a critical feature given India’s 2024 Digital Personal Data Protection Act. Meanwhile, Hyro’s conversational AI underwent third-party audits to eliminate demographic bias in lead prioritization, achieving a 98% fairness score in 2024 tests.

ReAlpha.com: Commission-Free

The platform eliminates traditional buyer commissions through a dynamic workflow where Claire, the generative AI agent, handles 82% of transaction steps. Human agents intervene only for legally binding actions like offer submissions and title verification, creating a "safety net" model that reduces costs by $20k–$30k per transaction. This hybrid system adapts to regulatory requirements, automatically restricting AI advisory functions in states mandating licensed agent oversight.

Adaptive Learning via Multi-Agent Architecture

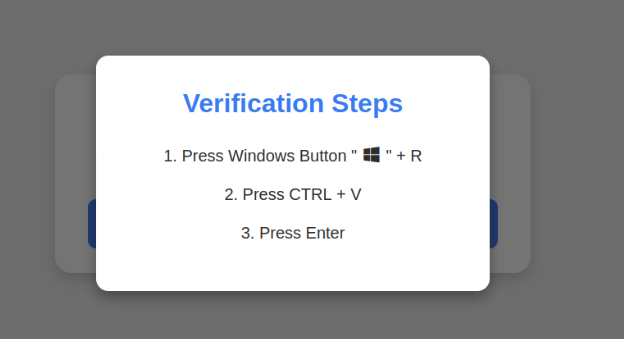

Claire’s backend employs three specialized AI agents:

- Search Agent: Processes natural language queries using 400+ property attributes (e.g., "Find homes near top schools with backyard pools")

- Negotiation Agent: Simulates bid scenarios using historical sale data and current market inventories

- Compliance Agent: Cross-references MLS entries with county records to flag discrepancies in 93% of cases This modular design allows continuous updates; when Florida expanded disclosure laws in 2024, reAlpha deployed new compliance modules within 72 hours.

Cross-Platform Property Graph

reAlpha’s Knowledge Graph synthesizes data from 27 sources, including:

- Satellite imagery for lot topology analysis

- Municipal permit databases for renovation potential scoring

- STR (short-term rental) performance metrics from Airbnb/VRBOThe graph links 4.2 million U.S. properties, enabling Claire to recommend homes based on latent factors like "walkable downtowns" or "future light rail access".

Self-Optimizing Matching Algorithm

Using federated learning, Claire’s recommendation engine improves through decentralized data from:

- User interactions (e.g., dwell time on listing photos)

- Outcome feedback (closed vs. expired listings)

- Hyperlocal market shifts (e.g., post-disaster price trends)In Q4 2024, this system achieved 89% match accuracy for first-time buyers, outperforming human agents’ 67% benchmark.

Conclusion: The Future of AI in Real Estate

The 2025 landscape reveals three dominant trends: vertical integration (e.g., Bramble’s end-to-end brokerage), specialized agentic tools (Admyral’s owner lookup), and global democratization (Landeed’s India expansion). As LLMs advance, expect AI to handle 95% of residential negotiations by 2026, per reAlpha projections. However, hybrid models will persist in complex commercial deals, balancing automation with human intuition. Regulatory hurdles around AI licensure and data usage remain critical challenges, necessitating industry-wide standards. Startups that master compliance while delivering tangible cost savings—like Modern Realty’s $30k average client savings—will lead the next wave of proptech innovation.

![iFixit Tears Down New M4 MacBook Air [Video]](https://www.iclarified.com/images/news/96717/96717/96717-640.jpg)

![Apple Officially Announces Return of 'Ted Lasso' for Fourth Season [Video]](https://www.iclarified.com/images/news/96710/96710/96710-640.jpg)

![[The AI Show Episode 139]: The Government Knows AGI Is Coming, Superintelligence Strategy, OpenAI’s $20,000 Per Month Agents & Top 100 Gen AI Apps](https://www.marketingaiinstitute.com/hubfs/ep%20139%20cover-2.png)

![[The AI Show Episode 138]: Introducing GPT-4.5, Claude 3.7 Sonnet, Alexa+, Deep Research Now in ChatGPT Plus & How AI Is Disrupting Writing](https://www.marketingaiinstitute.com/hubfs/ep%20138%20cover.png)

![How to become a self-taught developer while supporting a family [Podcast #164]](https://cdn.hashnode.com/res/hashnode/image/upload/v1741989957776/7e938ad4-f691-4c9e-8c6b-dc26da7767e1.png?#)

.jpg?#)

.jpg?#)