Arbitrum Liquidity and TVL: Navigating the Layer-2 Landscape in DeFi

Abstract This post provides an extensive overview of Arbitrum—a leading Layer-2 scaling solution addressing Ethereum’s congestion and gas fee challenges. We cover Arbitrum’s efficient rollup architecture, robust liquidity pools, and the Total Value Locked (TVL) metric, which reassures users of security and trust. The article discusses core concepts, various practical applications in decentralized exchanges (DEXs), NFT marketplaces, and stablecoin lending protocols, while also exploring technical, adoption, and regulatory challenges. Finally, we examine future innovations, including enhanced interoperability, sustainable liquidity incentives, and regulatory advances essential for the continued evolution of decentralized finance (DeFi). Introduction Decentralized finance (DeFi) is rapidly reshaping financial innovation by reducing traditional intermediaries and allowing trustless transactions. As the Ethereum network faces scalability issues—high gas fees and slow transaction times—Layer-2 solutions like Arbitrum have emerged as a viable alternative. In this post, we explore how Arbitrum’s liquidity, measured in TVL, is at the heart of its success in supporting a wide range of decentralized applications (dApps). By intertwining aspects of smart contract audits, Ethereum gas fees, and blockchain interoperability, we offer a deep dive into how Arbitrum is transforming the DeFi space. Background and Context Ethereum’s limitations have spurred the development of solutions that offload the transactional burden from the main chain. Arbitrum employs optimistic rollups that bundle multiple off-chain transactions and then settle a summary on-chain. This method reduces gas fees and increases throughput while preserving EVM compatibility, meaning developers can easily migrate or port existing dApps. Historically, Ethereum’s congestion hindered the growth of dApps, particularly in the NFT and stablecoin markets. As the DeFi ecosystem matured, TVL emerged as a crucial metric—a measure of the total assets locked within a protocol’s smart contracts. A high TVL indicates that users and investors trust the platform, ensuring liquidity and mitigating market manipulation risks. Furthermore, Arbitrum has supported open-source funding and community governance models that encourage developer participation and continuous system improvements. The platform's ability to maintain robust liquidity pools and adapt to market demands makes it a promising bridge between Ethereum and the broader blockchain ecosystem. Below is a table summarizing key differences between traditional Ethereum operations and Arbitrum’s rollup mechanism: Feature Ethereum Mainchain Arbitrum Rollups Transaction Fees High and variable Low, thanks to batching of transactions Confirmation Time Slower due to network congestion Faster, as off-chain processing reduces delays Scalability Limited by on-chain data High scalability using optimistic rollups Developer Compatibility Native Solidity support Full EVM compatibility for seamless migration Liquidity Impact Susceptible to slippage Enhanced liquidity with efficient pooling strategies This context sets the stage for understanding why TVL and liquidity are not merely metrics—they are indicators of security and trust in the ecosystem. Core Concepts and Features Arbitrum’s success is built on several core features that enable a robust and efficient decentralized ecosystem: Arbitrum’s Architectural Paradigm Optimistic Rollups: Arbitrum offloads computation by batching several transactions off-chain, then filing a compressed summary on Ethereum. This significantly reduces gas fees and network congestion. Learn more about this mechanism in the Arbitrum Rollups guide. EVM Compatibility: Since Arbitrum supports the Ethereum Virtual Machine, developers can deploy their Solidity smart contracts without major modifications. This seamless migration promotes broader adoption and quicker integration across various DeFi protocols. Enhancing Liquidity and TVL Liquidity is a cornerstone of any successful DeFi ecosystem. On Arbitrum, liquidity pools are designed to reduce trading slippage and ensure smoother asset transfers. With high liquidity, platforms such as decentralized exchanges and lending protocols can offer more stable, reliable services. A high Total Value Locked (TVL) is not only an indicator of the capital invested but also a testament to the underlying security, trust, and operational efficiency of the network. Security and Smart Contract Audits Robust security protocols are vital for decentralized applications. Arbitrum employs sophisticated fraud proofs and regular security audits to detect vulnerabilities and protect user assets. This vigilant approach reassures liquidity providers and investors regarding the safety of their funds. For a deeper dive into smart contract security, refer to Arbitrum and Smart Contra

Abstract

This post provides an extensive overview of Arbitrum—a leading Layer-2 scaling solution addressing Ethereum’s congestion and gas fee challenges. We cover Arbitrum’s efficient rollup architecture, robust liquidity pools, and the Total Value Locked (TVL) metric, which reassures users of security and trust. The article discusses core concepts, various practical applications in decentralized exchanges (DEXs), NFT marketplaces, and stablecoin lending protocols, while also exploring technical, adoption, and regulatory challenges. Finally, we examine future innovations, including enhanced interoperability, sustainable liquidity incentives, and regulatory advances essential for the continued evolution of decentralized finance (DeFi).

Introduction

Decentralized finance (DeFi) is rapidly reshaping financial innovation by reducing traditional intermediaries and allowing trustless transactions. As the Ethereum network faces scalability issues—high gas fees and slow transaction times—Layer-2 solutions like Arbitrum have emerged as a viable alternative. In this post, we explore how Arbitrum’s liquidity, measured in TVL, is at the heart of its success in supporting a wide range of decentralized applications (dApps). By intertwining aspects of smart contract audits, Ethereum gas fees, and blockchain interoperability, we offer a deep dive into how Arbitrum is transforming the DeFi space.

Background and Context

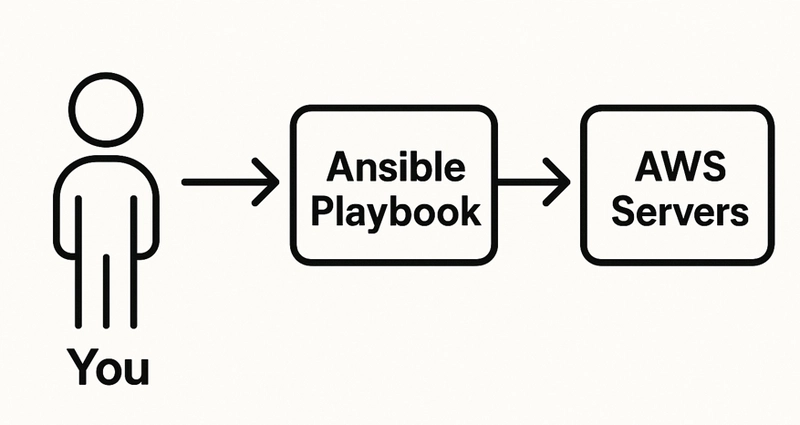

Ethereum’s limitations have spurred the development of solutions that offload the transactional burden from the main chain. Arbitrum employs optimistic rollups that bundle multiple off-chain transactions and then settle a summary on-chain. This method reduces gas fees and increases throughput while preserving EVM compatibility, meaning developers can easily migrate or port existing dApps.

Historically, Ethereum’s congestion hindered the growth of dApps, particularly in the NFT and stablecoin markets. As the DeFi ecosystem matured, TVL emerged as a crucial metric—a measure of the total assets locked within a protocol’s smart contracts. A high TVL indicates that users and investors trust the platform, ensuring liquidity and mitigating market manipulation risks.

Furthermore, Arbitrum has supported open-source funding and community governance models that encourage developer participation and continuous system improvements. The platform's ability to maintain robust liquidity pools and adapt to market demands makes it a promising bridge between Ethereum and the broader blockchain ecosystem.

Below is a table summarizing key differences between traditional Ethereum operations and Arbitrum’s rollup mechanism:

| Feature | Ethereum Mainchain | Arbitrum Rollups |

|---|---|---|

| Transaction Fees | High and variable | Low, thanks to batching of transactions |

| Confirmation Time | Slower due to network congestion | Faster, as off-chain processing reduces delays |

| Scalability | Limited by on-chain data | High scalability using optimistic rollups |

| Developer Compatibility | Native Solidity support | Full EVM compatibility for seamless migration |

| Liquidity Impact | Susceptible to slippage | Enhanced liquidity with efficient pooling strategies |

This context sets the stage for understanding why TVL and liquidity are not merely metrics—they are indicators of security and trust in the ecosystem.

Core Concepts and Features

Arbitrum’s success is built on several core features that enable a robust and efficient decentralized ecosystem:

Arbitrum’s Architectural Paradigm

Optimistic Rollups:

Arbitrum offloads computation by batching several transactions off-chain, then filing a compressed summary on Ethereum. This significantly reduces gas fees and network congestion. Learn more about this mechanism in the Arbitrum Rollups guide.EVM Compatibility:

Since Arbitrum supports the Ethereum Virtual Machine, developers can deploy their Solidity smart contracts without major modifications. This seamless migration promotes broader adoption and quicker integration across various DeFi protocols.

Enhancing Liquidity and TVL

Liquidity is a cornerstone of any successful DeFi ecosystem. On Arbitrum, liquidity pools are designed to reduce trading slippage and ensure smoother asset transfers. With high liquidity, platforms such as decentralized exchanges and lending protocols can offer more stable, reliable services. A high Total Value Locked (TVL) is not only an indicator of the capital invested but also a testament to the underlying security, trust, and operational efficiency of the network.

Security and Smart Contract Audits

Robust security protocols are vital for decentralized applications. Arbitrum employs sophisticated fraud proofs and regular security audits to detect vulnerabilities and protect user assets. This vigilant approach reassures liquidity providers and investors regarding the safety of their funds. For a deeper dive into smart contract security, refer to Arbitrum and Smart Contract Audits.

Incentives for Liquidity Providers

A well-designed incentive mechanism is crucial for maintaining high liquidity. Yield farming, fee-sharing models, and staking benefits are offered to liquidity providers, creating a virtuous cycle where increased liquidity attracts more users and further bolsters TVL. The ecosystem dynamically adjusts rewards to reflect market conditions, ensuring sustainability.

Interoperability and Ecosystem Expansion

Arbitrum's interoperability with Ethereum and other blockchain networks is a significant advantage. Cross-chain transactions allow assets to move seamlessly with reduced fees, enhancing liquidity and expanding the ecosystem’s reach. This interoperability fosters collaboration across different DeFi and NFT projects, leading to innovative financial products.

Related Perspectives from the DeFi Ecosystem

Arbitrum is influencing various aspects of the blockchain space:

- NFT Markets: Lower gas fees enable NFT marketplaces to support micro-transactions, facilitating a broader range of digital art and collectibles.

- Stablecoins and Lending Protocols: High liquidity on Arbitrum stabilizes collateral values and reduces borrowing costs, making financial services more accessible.

- Open-Source Contribution: Developers benefit from transparent licensing models, such as those detailed in the Copyleft Licenses Ultimate Guide.

Below is a bullet list summarizing some key features:

- Optimistic rollups for efficient transaction batching.

- EVM compatibility ensuring a smooth migration process.

- Robust liquidity pools to minimize slippage.

- High TVL reflecting network trust and security.

- Interoperable with multiple blockchain networks.

- Dynamic incentive models challenging traditional finance.

Additionally, platforms like Arbitrum and Ethereum Gas Price provide insights on how reduced gas fees drive user adoption.

Applications and Use Cases

The enhanced scalability and liquidity architecture offered by Arbitrum translates into tangible benefits across various sectors. Here are a few practical examples:

Decentralized Exchanges (DEXs)

DEXs have become an integral part of the DeFi ecosystem. With Arbitrum’s low-cost, fast transaction processing, DEXs can handle high volumes of trades with negligible slippage.

Key Benefits for DEXs on Arbitrum:

- Reduced Costs: Users benefit from minimal transaction fees.

- Enhanced Liquidity: Improved price discovery through efficient liquidity pools.

- Faster Trades: Near real-time confirmation times improve user experience.

These improvements reaffirm Arbitrum’s role as highlighted in Arbitrum and DeFi Yield.

NFT Marketplaces

NFT platforms have witnessed exponential growth, and Arbitrum’s infrastructure has become a game changer. With significantly lower fees, artists and collectors can engage in frequent, lower-value transactions without excessive costs.

Features Beneficial to NFT Marketplaces:

- Economic Viability: Lower fees encourage more frequent transactions, making it feasible for emerging NFT projects.

- Cross-Chain Integration: Bridging assets between Ethereum’s mainnet and Arbitrum reduces transaction friction.

- Transparency and Security: Continuous audits protect against fraud, boosting trust among participants.

For more insights on NFT market trends, check Berita NFT Indonesia 2025.

Stablecoin and Lending Protocols

Stablecoins and lending platforms also reap significant benefits from Arbitrum’s scalable solutions. These platforms rely on large liquidity pools to reduce volatility risk and provide secure collateral mechanisms for borrowers.

Below is a comparative table highlighting the benefits for lending protocols on Ethereum versus Arbitrum:

| Feature | Ethereum Lending Protocols | Arbitrum-Based Lending Protocols |

|---|---|---|

| Fee Structure | High and unpredictable gas fees | Low and predictable fees |

| Collateral Efficiency | Moderate liquidity with high slippage | High liquidity with minimal slippage |

| User Adoption | Hindered by high transaction costs | Broad participation due to lower fees |

| System Stability | Vulnerable in volatile environments | More stable, supported by robust liquidity pools |

These characteristics enable a safer and more inclusive environment for decentralized financial services.

Additional Use Cases

Other noteworthy applications include:

- Gaming: Blockchain games benefit from faster microtransactions and low fees on Arbitrum.

- Institutional Adoption: Institutional investors find the enhanced security and reduced gas fee volatility appealing.

- Cross-Chain Integrations: Improved interoperability fosters an ecosystem where assets can flow easily across different blockchains.

For further reading on cross-chain impact, see Arbitrum and Blockchain Interoperability.

Challenges and Limitations

Despite its many advantages, Arbitrum faces several challenges that need addressing for long-term success.

Technical Challenges

Scalability Overheads:

Even with optimistic rollups, Arbitrum periodically relies on the Ethereum mainnet for data publication. During peak periods, this dependency can create bottlenecks.Security Vulnerabilities:

While routine audits and fraud proofs help secure the network, vulnerabilities in smart contracts and liquidity protocols may present risks. Transition errors between Layer-1 and Layer-2 require refined bridging protocols.Integration Complexity:

Developers accustomed to pure on-chain operations may face a learning curve integrating off-chain components. Ensuring seamless interoperability while maintaining security can be challenging.

Adoption Barriers

User Onboarding and Experience:

New users may find switching between Ethereum and Arbitrum confusing, hindering broader adoption despite the lower costs.Market Volatility:

Even a robust system can experience liquidity shocks during market instability. A sudden withdrawal of significant capital might affect asset prices and overall network stability.Regulatory Landscape:

As global regulators begin to scrutinize decentralized finance, Arbitrum may need to adapt to changing legal frameworks. Regulatory challenges could impact both institutional and retail investor confidence.

Economic and Environmental Considerations

Sustainable Incentives:

Designing yield farming and staking incentives that are both attractive and sustainable is difficult. An imbalance can lead to token inflation, destabilizing the economic model.Energy Impact:

While Layer-2 mechanisms reduce energy consumption compared to on-chain transactions, increased network demand could still strain overall energy efficiency.Capital Concentration:

High TVL often attracts institutional capital, which might marginalize smaller investors unless adequate measures are implemented.

For more on these challenges and potential solutions, the Copyleft Licenses Ultimate Guide provides useful perspectives on sustainable open-source models.

Future Outlook and Innovations

The future of Arbitrum appears promising as continuous improvements drive efficiency and wider adoption.

Continued Technological Enhancements

Optimization of Rollup Protocols:

Future improvements may include advanced fraud proofs, better data compression techniques, and further optimization of consensus mechanisms. These updates can reduce fees further while increasing throughput.Enhanced Interoperability:

Expect broader cross-chain connectivity enabling seamless asset transfers between multiple blockchain networks. This will be key for evolving NFT marketplaces and other decentralized applications.Sustainable Incentive Structures:

Adaptive yield farming rewards and dynamic staking mechanisms are on the horizon to ensure liquidity incentives remain sustainable without compromising tokenomics.

Regulatory and Governance Innovations

Decentralized Governance Models:

Empowering users to vote on protocol upgrades and security measures will bolster trust. Strengthened governance processes may reduce regulatory scrutiny by ensuring transparent operation.Compliance and Transparency:

Future protocols will likely integrate real-time auditing and compliance tools, promoting higher standards in decentralized ecosystems.

Open-Source and Community-Driven Developments

The success of Arbitrum is also tied to a vibrant developer community. Open-source funding and support systems are crucial in fostering innovation. As detailed in articles like Arbitrum: A Game Changer for Ethereum’s Scalability and Scaling Ethereum with Arbitrum: Transforming Blockchain Scalability, community-driven contributions not only improve the code but also ensure that the system adapts to market needs.

Summary

Arbitrum stands at the forefront of blockchain innovation by addressing Ethereum’s limitations through Layer-2 scaling solutions. Its rollup architecture reduces gas fees, enhances transaction speeds, and provides robust liquidity—hallmarks that contribute to high TVL, a powerful signal of trust and stability in decentralized finance.

In this post, we have explored:

- The foundational technologies behind Arbitrum, including optimistic rollups and EVM compatibility.

- How dynamic liquidity pools enable smoother trading on DEXs and power NFT marketplaces.

- Practical applications in stablecoin lending protocols and broader DeFi usage.

- Various challenges, including scalability overheads, potential security vulnerabilities, user onboarding complexities, and regulatory uncertainties.

- Future trends involving enhanced interoperability, regulatory compliance, and innovative incentive models that promise to drive both technological and community-led improvements.

By offering lower transaction costs, better liquidity management, and enhanced security, Arbitrum not only paves the way for a more sustainable DeFi ecosystem but also ensures that the convergence of blockchain, NFTs, and open-source technology fosters a vibrant, inclusive financial landscape.

References and Further Reading

For further insights and additional resources on Arbitrum and its impact on decentralized finance:

- News AI News Q1 2025

- Berita NFT Indonesia 2025

- Copyleft Licenses Ultimate Guide

- Firefox Data Sharing Privacy

- Best Privacy Browsers 2025

Additionally, explore these developer-driven perspectives:

- Arbitrum: A Game Changer for Ethereum’s Scalability

- Scaling Ethereum with Arbitrum: Transforming Blockchain Scalability for a Decentralized Future

Conclusion

Arbitrum represents a significant evolution in the blockchain space by addressing Ethereum’s longstanding challenges of high fees and sluggish transaction times. With its innovative optimistic rollup architecture, heightened liquidity pools, and consistently growing TVL, Arbitrum sets a high standard for modern decentralized finance. This technology not only catalyzes smoother transactions and secure asset management but also empowers NFT marketplaces, lending platforms, and even blockchain gaming projects.

Looking forward, continued technological advancements, better interoperability, and progressive governance models promise to solidify Arbitrum’s role as a backbone for scalable DeFi ecosystems. As regulators refine frameworks and open-source communities rally behind sustainable models, Arbitrum and similar Layer-2 solutions are poised to lead the next wave of blockchain innovation. Embracing these technologies now means stepping into a decentralized future where efficiency, transparency, and community-driven growth form the bedrock of modern finance.

In summary, whether you are a developer, investor, or blockchain enthusiast, understanding Arbitrum’s ecosystem provides critical insight into the broader trends shaping DeFi. By leveraging lower transaction costs, scalable smart contracts, and robust liquidity, Arbitrum accelerates our journey toward a more inclusive, efficient, and transparent digital economy.

Happy exploring, and may this knowledge empower you to navigate the evolving world of decentralized finance!

![Apple Drops New Immersive Adventure Episode for Vision Pro: 'Hill Climb' [Video]](https://www.iclarified.com/images/news/97133/97133/97133-640.jpg)

![Most iPhones Sold in the U.S. Will Be Made in India by 2026 [Report]](https://www.iclarified.com/images/news/97130/97130/97130-640.jpg)

_Olekcii_Mach_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![[FREE EBOOKS] AI and Business Rule Engines for Excel Power Users, Machine Learning Hero & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)