Leveraging Cloud Analytics to Combat Banking Fraud

Banking fraud is an unrelenting foe in our digital-first world, draining billions from the industry and shaking customer trust to its core. Legacy detection tools—slow, rigid, and outdated—struggle to keep pace with cunning cybercriminals who exploit every gap. Fortunately, cloud analytics to combat banking fraud offers a transformative solution. By leveraging the power of cloud-based data analysis, banks can detect fraud in real time, minimize losses, and protect their clients like never before. This article explores how cloud analytics is revolutionizing banking security, why it’s a must-have in 2025, and how it positions financial institutions to outsmart fraudsters at every turn. The Escalating Threat of Banking Fraud The stakes are higher than ever. Fraudsters wielding tactics like identity theft, account takeovers, and sophisticated phishing schemes are thriving in the digital age. In 2024, global banking fraud losses soared to $42 billion, a staggering 15% jump from the previous year, fueled by the rapid rise of online and mobile banking. Traditional systems, bogged down by silos and static rule-based triggers, are no match for this onslaught. That’s where cloud analytics to combat banking fraud steps in—a fast, intelligent, and scalable answer to a growing crisis that demands urgent action. What Is Cloud Analytics? Cloud analytics is the engine driving modern data processing, using cloud platforms to store, manage, and analyze vast datasets with speed and precision. Unlike clunky on-premises infrastructure, it’s flexible, cost-efficient, and designed to handle the exponential data growth banks face daily. Here’s what sets it apart: Unified View: Integrates data from ATMs, mobile apps, online banking, and more into a single, actionable snapshot. Advanced Tech Stack: Harnesses AI, machine learning, and big data analytics for deeper, smarter insights. Real-Time Processing: Delivers instant results, catching fraud as it unfolds rather than after the damage is done. Accessibility: Enables seamless updates and collaboration without heavy hardware investments. This powerful framework forms the backbone of cloud analytics to combat banking fraud, turning raw information into a proactive defense mechanism. How Cloud Analytics Stops Fraud in Its Tracks Leveraging cloud analytics isn’t just a buzzword—it’s a practical, proven strategy. Here’s how it dismantles banking fraud step by step: Lightning-Fast Detection: Analyzes transactions in milliseconds, flagging anomalies—like a $5,000 withdrawal attempt from two continents simultaneously—before funds vanish. Scalable Resilience: Adapts to massive data spikes, from holiday shopping surges to coordinated fraud attacks, without missing a beat. Adaptive Intelligence: Machine learning studies past fraud patterns and evolves to counter new tricks, leaving rigid rule-based systems in the dust. Cost Efficiency: Shifts infrastructure burdens to cloud providers like AWS or Azure, saving banks millions in upkeep while boosting security. Refined Accuracy: Reduces false positives by 25%, ensuring legitimate customers aren’t flagged unnecessarily and trust remains intact. These capabilities make cloud analytics to combat banking fraud an indispensable tool for any bank serious about staying secure in a digital world. Proof in Action: Real-World Wins The evidence is compelling—cloud analytics delivers results across the board. Consider these examples: Global Titans: JPMorgan Chase leverages cloud analytics to monitor millions of transactions daily, catching fraud with pinpoint accuracy and minimal delay. European Breakthrough: A leading bank cut fraud losses by 30% in 2024 after adopting cloud-based detection, thanks to its real-time cross-border tracking. Fintech Pioneers: Revolut, a digital banking trailblazer, relies on cloud analytics to combat banking fraud, keeping its fast-growing user base safe without sacrificing speed. Smaller Players: Even regional banks are jumping in, using cloud tools to level the playing field against larger competitors. These success stories highlight the tangible, bottom-line impact of cloud analytics in action. Hurdles to Overcome No solution is perfect, and cloud analytics comes with challenges banks must address: Data Privacy Concerns: Storing sensitive customer info in the cloud requires ironclad encryption and strict access controls to prevent breaches. Regulatory Compliance: Laws like GDPR and CCPA set high bars; partnering with reputable cloud providers ensures adherence without headaches. Legacy Integration: Older systems resist cloud adoption, but phased migrations and hybrid approaches smooth the transition over time. Skill Gaps: Staff may need training to maximize cloud tools, though many platforms now offer user-friendly interfaces. Overcome these, and cloud analytics to combat banking fraud becomes a seamless, powerhouse solution.

Banking fraud is an unrelenting foe in our digital-first world, draining billions from the industry and shaking customer trust to its core. Legacy detection tools—slow, rigid, and outdated—struggle to keep pace with cunning cybercriminals who exploit every gap. Fortunately, cloud analytics to combat banking fraud offers a transformative solution. By leveraging the power of cloud-based data analysis, banks can detect fraud in real time, minimize losses, and protect their clients like never before. This article explores how cloud analytics is revolutionizing banking security, why it’s a must-have in 2025, and how it positions financial institutions to outsmart fraudsters at every turn.

The Escalating Threat of Banking Fraud

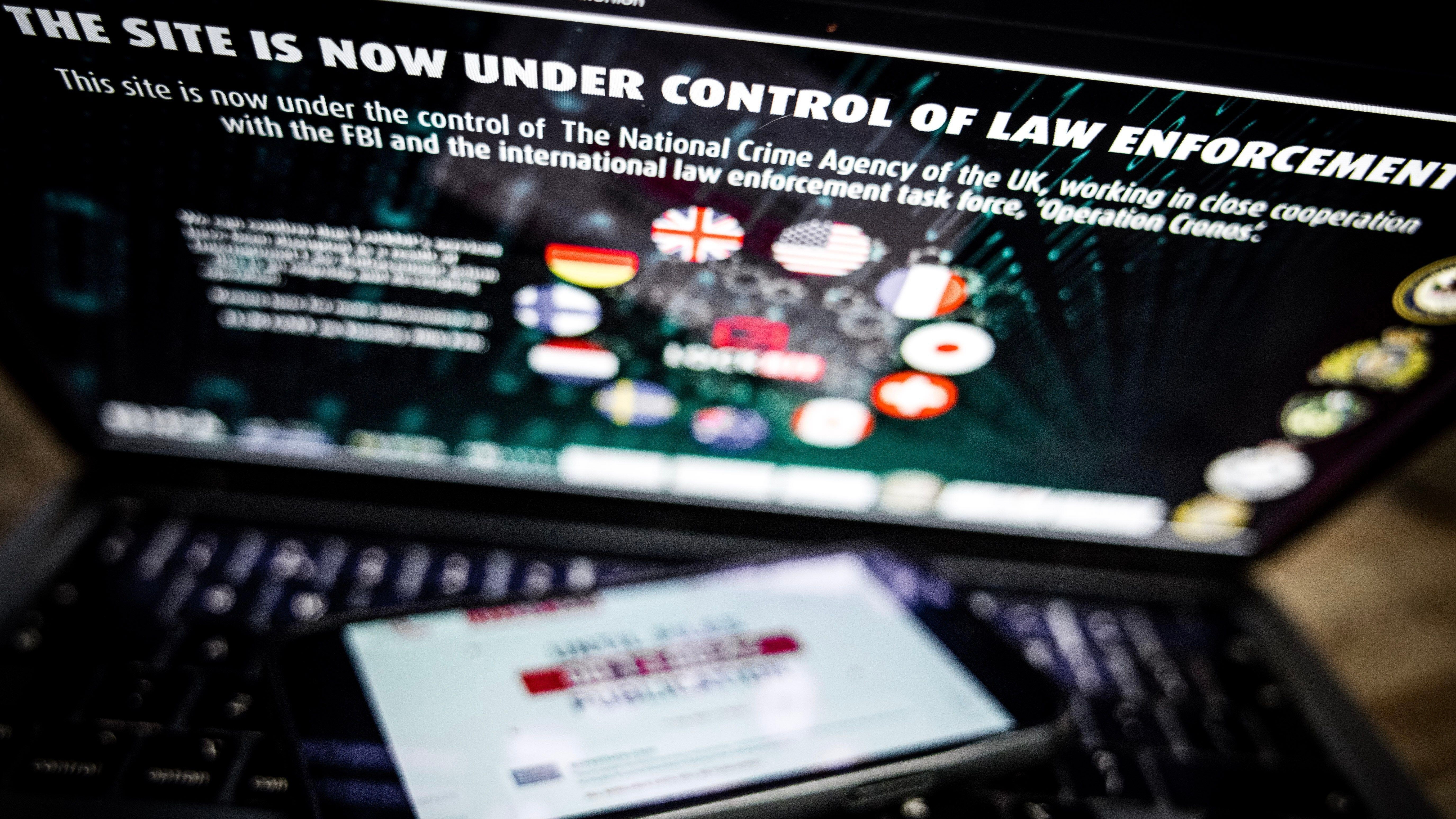

The stakes are higher than ever. Fraudsters wielding tactics like identity theft, account takeovers, and sophisticated phishing schemes are thriving in the digital age. In 2024, global banking fraud losses soared to $42 billion, a staggering 15% jump from the previous year, fueled by the rapid rise of online and mobile banking. Traditional systems, bogged down by silos and static rule-based triggers, are no match for this onslaught. That’s where cloud analytics to combat banking fraud steps in—a fast, intelligent, and scalable answer to a growing crisis that demands urgent action.

What Is Cloud Analytics?

Cloud analytics is the engine driving modern data processing, using cloud platforms to store, manage, and analyze vast datasets with speed and precision. Unlike clunky on-premises infrastructure, it’s flexible, cost-efficient, and designed to handle the exponential data growth banks face daily. Here’s what sets it apart:

- Unified View: Integrates data from ATMs, mobile apps, online banking, and more into a single, actionable snapshot.

- Advanced Tech Stack: Harnesses AI, machine learning, and big data analytics for deeper, smarter insights.

- Real-Time Processing: Delivers instant results, catching fraud as it unfolds rather than after the damage is done.

- Accessibility: Enables seamless updates and collaboration without heavy hardware investments.

This powerful framework forms the backbone of cloud analytics to combat banking fraud, turning raw information into a proactive defense mechanism.

How Cloud Analytics Stops Fraud in Its Tracks

Leveraging cloud analytics isn’t just a buzzword—it’s a practical, proven strategy. Here’s how it dismantles banking fraud step by step:

- Lightning-Fast Detection: Analyzes transactions in milliseconds, flagging anomalies—like a $5,000 withdrawal attempt from two continents simultaneously—before funds vanish.

- Scalable Resilience: Adapts to massive data spikes, from holiday shopping surges to coordinated fraud attacks, without missing a beat.

- Adaptive Intelligence: Machine learning studies past fraud patterns and evolves to counter new tricks, leaving rigid rule-based systems in the dust.

- Cost Efficiency: Shifts infrastructure burdens to cloud providers like AWS or Azure, saving banks millions in upkeep while boosting security.

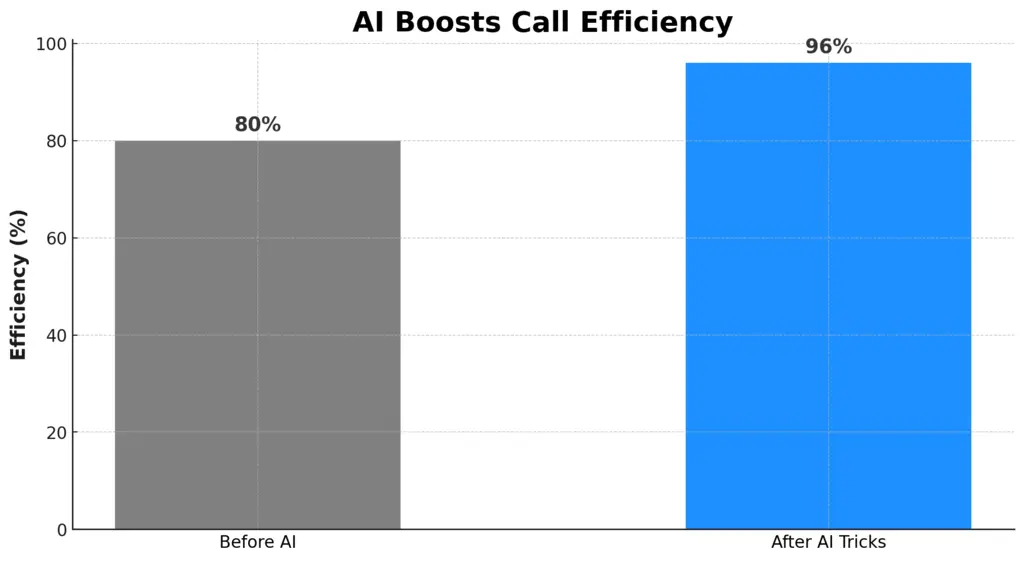

- Refined Accuracy: Reduces false positives by 25%, ensuring legitimate customers aren’t flagged unnecessarily and trust remains intact. These capabilities make cloud analytics to combat banking fraud an indispensable tool for any bank serious about staying secure in a digital world.

Proof in Action: Real-World Wins

The evidence is compelling—cloud analytics delivers results across the board. Consider these examples:

- Global Titans: JPMorgan Chase leverages cloud analytics to monitor millions of transactions daily, catching fraud with pinpoint accuracy and minimal delay.

- European Breakthrough: A leading bank cut fraud losses by 30% in 2024 after adopting cloud-based detection, thanks to its real-time cross-border tracking.

- Fintech Pioneers: Revolut, a digital banking trailblazer, relies on cloud analytics to combat banking fraud, keeping its fast-growing user base safe without sacrificing speed.

- Smaller Players: Even regional banks are jumping in, using cloud tools to level the playing field against larger competitors. These success stories highlight the tangible, bottom-line impact of cloud analytics in action.

Hurdles to Overcome

No solution is perfect, and cloud analytics comes with challenges banks must address:

- Data Privacy Concerns: Storing sensitive customer info in the cloud requires ironclad encryption and strict access controls to prevent breaches.

- Regulatory Compliance: Laws like GDPR and CCPA set high bars; partnering with reputable cloud providers ensures adherence without headaches.

- Legacy Integration: Older systems resist cloud adoption, but phased migrations and hybrid approaches smooth the transition over time.

- Skill Gaps: Staff may need training to maximize cloud tools, though many platforms now offer user-friendly interfaces. Overcome these, and cloud analytics to combat banking fraud becomes a seamless, powerhouse solution.

The Future of Fraud Detection

The horizon is bright—and bold. Cloud analytics is poised to evolve in exciting ways:

- Quantum Speed: Emerging quantum computing could shrink detection times to microseconds, redefining rapid response.

- Predictive Power: AI might soon predict fraud—like spotting a phishing click before funds are compromised—shifting from reaction to prevention.

- Collaborative Networks: Banks sharing anonymized fraud data via the cloud could build a global, impenetrable defense system.

- Automation Surge: Routine fraud checks could become fully autonomous, freeing human teams for strategic oversight. Cloud analytics to combat banking fraud is at the forefront of a revolutionary leap forward.

Why Banks Can’t Afford to Delay

Fraud waits for no one, and neither should banks. Here’s why cloud analytics is an urgent priority:

- Speed Is Survival: Real-time detection trumps costly cleanups, sparing customers and reputations.

- Scale Is Essential: As threats grow, only flexible tools can keep up without breaking budgets.

- Trust Is King: Stopping fraud fast preserves customer loyalty—a priceless asset in banking.

- Competition Demands It: Rivals adopting cloud analytics will outpace laggards in security and efficiency. Leveraging cloud analytics isn’t a luxury—it’s a necessity for thriving in today’s banking landscape.

The Bottom Line

Fraud is a cunning adversary, but cloud analytics is sharper, faster, and tougher. It turns data into a shield, empowering banks to fight back with precision and scale. Those embracing cloud analytics to combat banking fraud aren’t just surviving—they’re leading the charge into a safer, smarter future. Ready to outwit fraudsters and secure your bank’s tomorrow? Cloud analytics is the ace up your sleeve. You can opt for top-notch Cloud Consulting Services, to help you in easing the entire journey.

![iFixit Tears Down New M4 MacBook Air [Video]](https://www.iclarified.com/images/news/96717/96717/96717-640.jpg)

![Apple Officially Announces Return of 'Ted Lasso' for Fourth Season [Video]](https://www.iclarified.com/images/news/96710/96710/96710-640.jpg)

![[The AI Show Episode 139]: The Government Knows AGI Is Coming, Superintelligence Strategy, OpenAI’s $20,000 Per Month Agents & Top 100 Gen AI Apps](https://www.marketingaiinstitute.com/hubfs/ep%20139%20cover-2.png)

![[The AI Show Episode 138]: Introducing GPT-4.5, Claude 3.7 Sonnet, Alexa+, Deep Research Now in ChatGPT Plus & How AI Is Disrupting Writing](https://www.marketingaiinstitute.com/hubfs/ep%20138%20cover.png)

![[FREE EBOOKS] ChatGPT Prompts Book – Precision Prompts, Priming, Training & AI Writing Techniques for Mortals & Five More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![How to become a self-taught developer while supporting a family [Podcast #164]](https://cdn.hashnode.com/res/hashnode/image/upload/v1741989957776/7e938ad4-f691-4c9e-8c6b-dc26da7767e1.png?#)

.jpg?#)

.jpg?#)