Arbitrum and Its Impact on Ethereum: A Deep Dive

Abstract: In this post, we examine Arbitrum, an innovative Layer‑2 scaling solution for Ethereum that leverages optimistic rollups to improve transaction speed, lower fees, and enhance security. We explore its background, core concepts, practical applications in NFT marketplaces and decentralized finance (DeFi), and challenges such as integration and centralization concerns. Furthermore, we discuss the future outlook with enhanced fraud detection, interoperability, and open‑source developments. This detailed deep dive connects insights from technical articles, real-world use cases, and complementary resources to provide a holistic view on how Arbitrum is reshaping the Ethereum ecosystem. Introduction Ethereum has revolutionized how decentralized applications (dApps) are built. Yet, its scalability issues—mainly high gas fees and network congestion—have left developers looking for innovative solutions. Arbitrum stands at the forefront of this change. As a Layer‑2 solution built on the optimistic rollup model, Arbitrum provides off‑chain transaction processing with periodic settlement on the Ethereum mainnet. This model reduces fees and increases throughput while preserving the security and decentralization that Ethereum is known for. In this post, we build upon the insights from the A Deep Dive into Arbitrum and Its Impact on Ethereum article. We explore its evolution, technical underpinnings, applications in NFTs and DeFi, along with challenges and future trends. By integrating additional resources—from discussions on open‑source licensing to privacy and fraud detection—we aim to offer a comprehensive look at Arbitrum and its role in shaping the blockchain landscape. Background and Context Ethereum’s popularity as a decentralized platform has led to an explosion in dApp development, particularly in finance and art. However, as adoption increases, the limitations of the Ethereum mainnet become apparent due to: High gas fees: Transactions can become costly during periods of congestion. Network congestion: Limited throughput slows down confirmation times. Scalability challenges: The mainnet struggles with handling increasingly complex operations. To address these issues, Layer‑2 scaling solutions emerged. Arbitrum is one such solution, utilizing optimistic rollups which assume that transactions are valid by default and rely on fraud proofs if discrepancies are detected. This design reduces on‑chain processing load and significantly lowers transaction costs. Historically, Ethereum was built as a platform for decentralized applications, but developers soon encountered its scaling limits. Innovators began exploring off‑chain transaction bundling—a method that accumulates numerous transactions into a single proof submitted to Ethereum. This approach has fueled developments in NFT markets and decentralized finance (DeFi), where fast and economical transactions are essential. Furthermore, the open‑source foundation of many blockchain projects has encouraged extensive community collaboration. However, licensing debates, such as those highlighted in The Downside of Apache License and Why I Never Would Use It, continue to shape how these projects evolve. Privacy concerns are also paramount; resources like Firefox Data Sharing Privacy and Best Privacy Browsers 2025 highlight the delicate balance between transparency and data protection—a principle that is also crucial in the blockchain environment. Core Concepts and Features Arbitrum introduces several technical innovations that boost Ethereum’s scalability while maintaining security. Here are the key components: Optimistic Rollups Transaction Aggregation: Arbitrum bundles thousands of transactions into a single rollout block that is later submitted to Ethereum. This significantly reduces on‑chain data usage. Assume Validity: By assuming transactions are valid unless challenged, Arbitrum improves transaction speed versus more computationally intensive zero‑knowledge rollups. Fraud Proofs: If any transaction is challenged during the preset challenge period, fraud proofs can reverse the operation, thereby maintaining the system’s integrity. Security and Compatibility Enhanced Security: The use of fraud proofs ensures that any attempted fraud does not go unnoticed. This decentralized check-mechanism fortifies the overall trust in the network. EVM Compatibility: Arbitrum is nearly fully compatible with Ethereum’s Virtual Machine (EVM), meaning that existing smart contracts require minimal changes. This seamless integration aids developers in migrating dApps without extensive rewrites. Interoperability: The design supports interoperability between Ethereum and many emerging blockchain networks, enabling a broader digital ecosystem. For further reading on related topics, see Arbitrum and Ethereum Gas Price and Arbitrum and DeFi Yield. Open‑Source and Developer Friendliness

Abstract:

In this post, we examine Arbitrum, an innovative Layer‑2 scaling solution for Ethereum that leverages optimistic rollups to improve transaction speed, lower fees, and enhance security. We explore its background, core concepts, practical applications in NFT marketplaces and decentralized finance (DeFi), and challenges such as integration and centralization concerns. Furthermore, we discuss the future outlook with enhanced fraud detection, interoperability, and open‑source developments. This detailed deep dive connects insights from technical articles, real-world use cases, and complementary resources to provide a holistic view on how Arbitrum is reshaping the Ethereum ecosystem.

Introduction

Ethereum has revolutionized how decentralized applications (dApps) are built. Yet, its scalability issues—mainly high gas fees and network congestion—have left developers looking for innovative solutions. Arbitrum stands at the forefront of this change. As a Layer‑2 solution built on the optimistic rollup model, Arbitrum provides off‑chain transaction processing with periodic settlement on the Ethereum mainnet. This model reduces fees and increases throughput while preserving the security and decentralization that Ethereum is known for.

In this post, we build upon the insights from the A Deep Dive into Arbitrum and Its Impact on Ethereum article. We explore its evolution, technical underpinnings, applications in NFTs and DeFi, along with challenges and future trends. By integrating additional resources—from discussions on open‑source licensing to privacy and fraud detection—we aim to offer a comprehensive look at Arbitrum and its role in shaping the blockchain landscape.

Background and Context

Ethereum’s popularity as a decentralized platform has led to an explosion in dApp development, particularly in finance and art. However, as adoption increases, the limitations of the Ethereum mainnet become apparent due to:

- High gas fees: Transactions can become costly during periods of congestion.

- Network congestion: Limited throughput slows down confirmation times.

- Scalability challenges: The mainnet struggles with handling increasingly complex operations.

To address these issues, Layer‑2 scaling solutions emerged. Arbitrum is one such solution, utilizing optimistic rollups which assume that transactions are valid by default and rely on fraud proofs if discrepancies are detected. This design reduces on‑chain processing load and significantly lowers transaction costs.

Historically, Ethereum was built as a platform for decentralized applications, but developers soon encountered its scaling limits. Innovators began exploring off‑chain transaction bundling—a method that accumulates numerous transactions into a single proof submitted to Ethereum. This approach has fueled developments in NFT markets and decentralized finance (DeFi), where fast and economical transactions are essential.

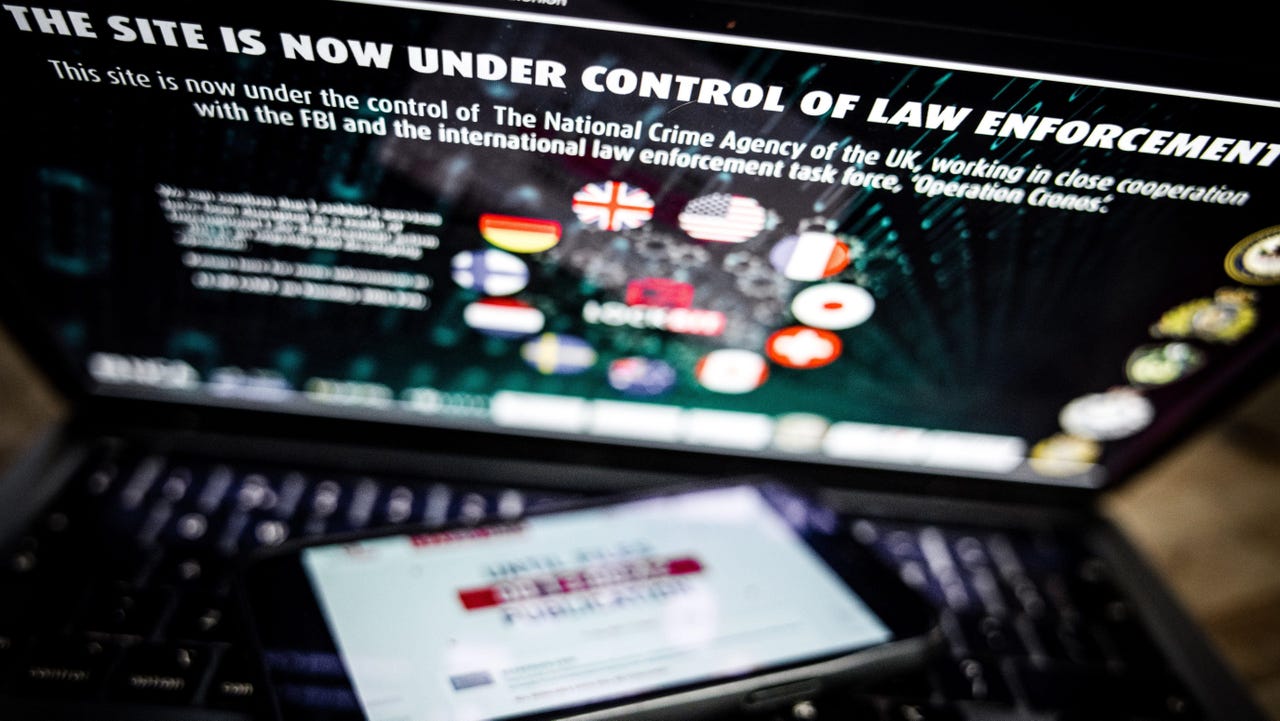

Furthermore, the open‑source foundation of many blockchain projects has encouraged extensive community collaboration. However, licensing debates, such as those highlighted in The Downside of Apache License and Why I Never Would Use It, continue to shape how these projects evolve. Privacy concerns are also paramount; resources like Firefox Data Sharing Privacy and Best Privacy Browsers 2025 highlight the delicate balance between transparency and data protection—a principle that is also crucial in the blockchain environment.

Core Concepts and Features

Arbitrum introduces several technical innovations that boost Ethereum’s scalability while maintaining security. Here are the key components:

Optimistic Rollups

- Transaction Aggregation: Arbitrum bundles thousands of transactions into a single rollout block that is later submitted to Ethereum. This significantly reduces on‑chain data usage.

- Assume Validity: By assuming transactions are valid unless challenged, Arbitrum improves transaction speed versus more computationally intensive zero‑knowledge rollups.

- Fraud Proofs: If any transaction is challenged during the preset challenge period, fraud proofs can reverse the operation, thereby maintaining the system’s integrity.

Security and Compatibility

- Enhanced Security: The use of fraud proofs ensures that any attempted fraud does not go unnoticed. This decentralized check-mechanism fortifies the overall trust in the network.

- EVM Compatibility: Arbitrum is nearly fully compatible with Ethereum’s Virtual Machine (EVM), meaning that existing smart contracts require minimal changes. This seamless integration aids developers in migrating dApps without extensive rewrites.

- Interoperability: The design supports interoperability between Ethereum and many emerging blockchain networks, enabling a broader digital ecosystem. For further reading on related topics, see Arbitrum and Ethereum Gas Price and Arbitrum and DeFi Yield.

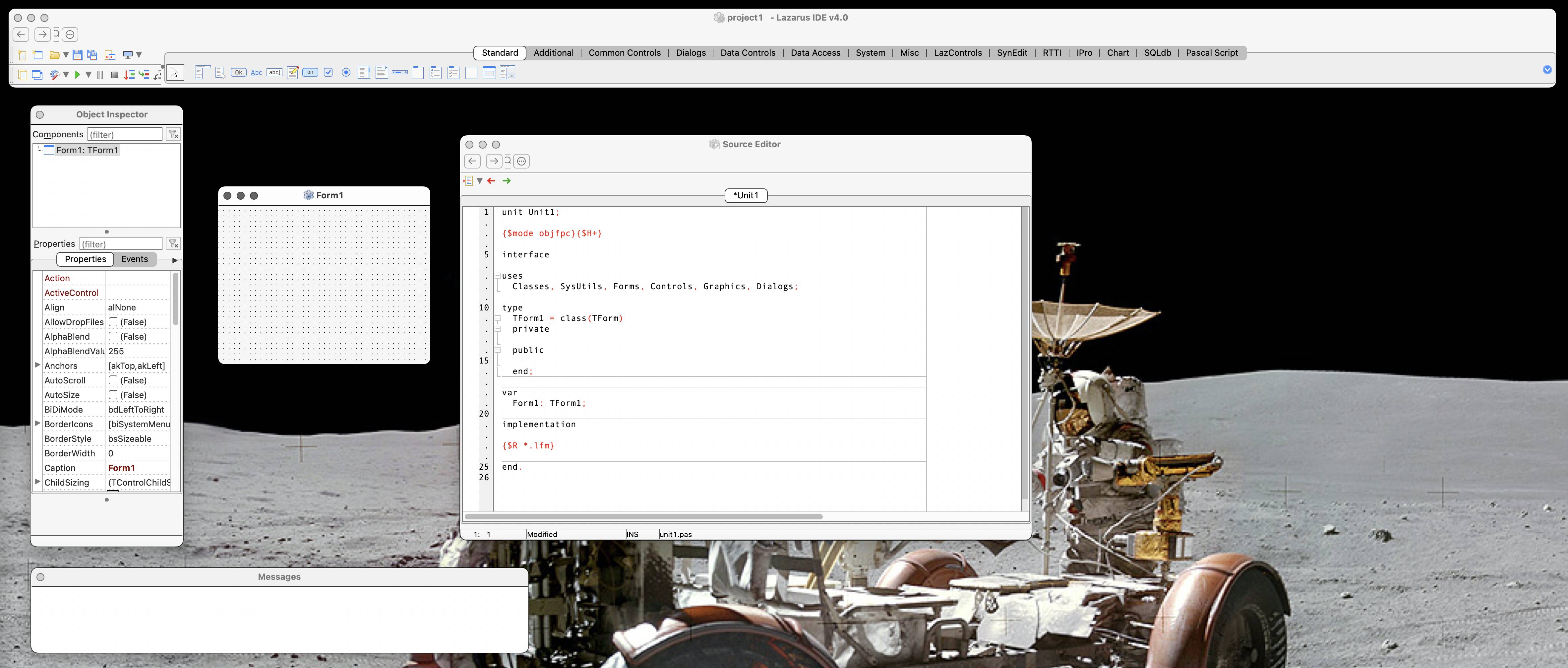

Open‑Source and Developer Friendliness

- Open‑Source Contributions: Arbitrum’s codebase is open to community contributions. Developers can inspect, test, and improve the platform, fostering a collaborative ecosystem.

- Licensing Considerations: The open‑source nature parallels discussions found in The Downside of Apache License and Why I Never Would Use It and is crucial for ensuring transparency and community trust.

- NFT Ecosystem Support: The efficient and low‑fee environment of Arbitrum is particularly beneficial for NFT marketplaces. Projects such as Zora NFT Collection - Zora Team leverage this technology to provide smooth user experiences in digital art trading.

Table: Ethereum Mainnet vs. Arbitrum

| Component | Ethereum Mainnet | Arbitrum (Layer‑2) |

|---|---|---|

| Transaction Throughput | Limited, leading to slower confirmations | Significantly higher throughput due to batching of transactions |

| Gas Fees | High during network congestion | Low and predictable fees as off‑chain processing minimizes costs |

| Security Model | Relies on EVM consensus with decentralization | Optimistic rollup secured by fraud proofs |

| Smart Contract Compatibility | Full EVM compatibility | Nearly full compatibility with minimal modifications |

| Scalability | Struggles during peak activity | Designed to scale seamlessly with increased transaction loads |

Applications and Use Cases

Arbitrum’s ability to scale Ethereum has opened the door to various real‑world applications, particularly where speed, low costs, and high capacity are critical.

NFT Marketplaces and Digital Art

NFTs have surged in popularity, yet high transaction fees on Ethereum have often hampered their potential. By utilizing Arbitrum, NFT platforms can offer:

- Fast Minting and Trading: Art collections like the Zora NFT Collection – Zora Team benefit from reduced gas fees, enabling artists and collectors to transact quickly.

- Fractional Ownership: Lower fees allow for micro‑transactions and fractional ownership models, thereby expanding the audience and accessibility for digital art.

- User Experience Enhancements: Reduced waiting times due to faster transaction confirmations enhance overall user satisfaction.

Decentralized Finance (DeFi) Protocols

DeFi applications demand high throughput and rapid, low‑cost transactions. Arbitrum’s solutions enable:

- Efficient Lending and Borrowing: Lower transaction fees attract small investors and reduce barriers to entry.

- Decentralized Exchanges (DEXs): Increased throughput allows more trades and fluid liquidity, which is essential for volatile markets.

- Yield Farming and Automated Market Making (AMM): Fast and cost‑efficient transactions improve yield aggregation and overall platform performance.

Additional Use Cases

Beyond NFTs and DeFi, Arbitrum is finding application in:

- Gaming & Metaverse Applications: In‑game economies and digital collectibles require real‑time updates and low fees, which Arbitrum provides.

- Supply Chain Management: Transparent asset tracking benefits from secure, low‑cost, scalable blockchain infrastructure.

- Data Privacy & Security: Developers use tools such as uBlock Origin Dead in Chrome and Firefox Data Sharing Privacy to refine privacy protections in blockchain applications.

Bullet List of Key Benefits for Use Cases:

- Lower Fees: Makes transactions economic even for high-volume micro‑transactions.

- Improved Speed: Enables real‑time interactive applications like gaming and live markets.

- Enhanced Interoperability: Bridges various blockchain networks with little modification.

- Optimized User Experience: Fast confirmations and low delay improve overall satisfaction.

- Robust Security: Fraud proofs and open‑source audits ensure transaction integrity.

Challenges and Limitations

Despite its many advantages, Arbitrum does face challenges that must be addressed as adoption increases and decentralized applications scale.

Technical Challenges

- Fraud Proof Delays: The optimistic assumption system relies on challenge periods. While this increases efficiency, it can introduce delays in final transaction settlement, especially for sensitive real‑time applications.

- Migration Complexities: Transitioning existing Ethereum‑based dApps to Arbitrum requires debugging and accommodating subtle differences in architecture. This may lead to temporary performance or compatibility issues.

- Centralization Concerns: Critics argue that a limited validator network might lead to risks of centralization. Maintaining diverse validator participation is crucial to balancing performance with decentralization.

User Experience and Ecosystem Adoption

- Withdrawal Delays: Users may experience waiting times when retrieving funds back to the Ethereum mainnet, affecting the overall perceived efficiency.

- Developer Learning Curve: Adopting Arbitrum’s environment requires time for developers to understand the nuances of optimistic rollups and Layer‑2 integration.

- Regulatory and Licensing Issues: With open‑source funding and evolving intellectual property debates—similar to those mentioned in The Downside of Apache License and Why I Never Would Use It—projects must carefully navigate regulatory landscapes.

Table Summarizing Challenges

| Challenge | Description |

|---|---|

| Fraud Proof Delays | Delays due to challenge periods may affect near‑instant confirmation skills. |

| Migration Complexities | Existing dApps face integration hurdles when moving from Ethereum mainnet to Arbitrum. |

| Centralization Risks | A smaller network of validators may risk reduced decentralization if not managed properly. |

| User Experience Friction | Withdrawal periods and learning curves can hinder user satisfaction despite lower fees. |

| Regulatory Barriers | Open‑source licensing debates continue to challenge project funding and compliance. |

Future Outlook and Innovations

The horizon for Arbitrum and similar Layer‑2 solutions is promising as the demands on Ethereum continue to grow. Several emerging trends and innovations are set to further enhance the ecosystem.

Enhanced Fraud Proof Mechanisms

Future iterations of optimistic rollups could address current delays by:

- Real-Time Validation: Integrating on‑chain dispute resolution mechanisms to verify transactions faster.

- Automated Dispute Resolution: Streamlining fraud proof challenges to reduce waiting periods and improve user confidence.

Interoperability and Cross‑Chain Solutions

The push for a unified digital ecosystem continues. Expected enhancements include:

- Multi‑Chain Integration: Enabling seamless asset and data transfers across various blockchain networks, further enhancing liquidity and broadening the application base.

- Layer‑3 and Beyond: Research in Layer‑3 solutions aims to further reduce latency while preserving trustless interactions. Innovations such as Arbitrum and Open Source License Compatibility help maintain robust integration in an ever‑expanding ecosystem.

Open‑Source Developments and Funding Innovations

Open‑source communities drive much of the innovation in blockchain technology. The future promises:

- Advanced Developer Tools: Tools that simplify the transition and testing of dApps between Ethereum and Arbitrum.

- Diverse Funding Models: New funding mechanisms such as tokenized grants, decentralized sponsorship programs, and community‑driven micropayments will bolster sustainability.

- Privacy and Security Enhancements: Emerging trends like zero‑knowledge proofs and improved peer‑to‑peer networking will secure both transaction integrity and data privacy.

Industry Adoption and Institutional Entrance

Institutional investors and traditional finance continue to explore blockchain:

- Adoption in Traditional Finance: Improved scalability and lower transaction fees make Arbitrum attractive for institutional applications.

- Enhanced Collaboration: Cross‑chain collaborations and partnerships can further validate decentralized finance platforms, as discussed in Arbitrum and Ethereum Gas Price.

- Developer Community Growth: Increased participation through open‑source contributions will ensure that Arbitrum’s ecosystem remains agile and secure.

Related Dev.to Perspectives

For additional insights into the broader context, check out these posts on Dev.to:

- Arbitrum and Data Availability: Paving the Way for a Scalable Blockchain Future

- Open‑Source Funding Fueling Innovation and Sustainability

- Unveiling the Future of Open‑Source Licensing

Summary

To summarize, Arbitrum represents a major leap forward in addressing Ethereum’s scalability and high‑fee challenges. By leveraging optimistic rollups, Arbitrum aggregates transactions off‑chain and submits them in batches, drastically reducing gas fees and increasing throughput. Key features, such as fraud proof mechanisms and near‑native EVM compatibility, make Arbitrum an attractive solution for developers migrating dApps—from NFT marketplaces to cutting‑edge DeFi protocols.

While challenges exist in terms of fraud proof delays, integration complexities, and potential centralization risks, continuous innovation and community collaboration point toward a strong future. Enhanced interoperability, improved dispute resolution systems, diversified funding strategies, and growing institutional interest all underscore Arbitrum’s role in transforming blockchain scalability.

For anyone invested in the future of decentralized finance and digital art, understanding Arbitrum’s architecture and evolving ecosystem is key. As Ethereum continues to be the backbone of dApp innovation, solutions like Arbitrum not only ease the current bottlenecks but also lay the groundwork for a more seamless, cost‑effective, and secure blockchain future.

Further Resources

For additional reading on related topics and to deepen your understanding, consider exploring these valuable resources:

- A Deep Dive into Arbitrum and Its Impact on Ethereum

- The Downside of Apache License and Why I Never Would Use It

- Firefox Data Sharing Privacy

- Best Privacy Browsers 2025

- Zora NFT Collection - Zora Team

- uBlock Origin Dead in Chrome

- Arbitrum and Ethereum Gas Price

- Arbitrum and DeFi Yield

- Arbitrum Rollups

By staying informed and engaged in the ongoing evolution of blockchain technology, you can appreciate how solutions like Arbitrum are not just technical upgrades, but vital enablers of innovation in finance, art, and beyond.

Embrace the dynamic intersection of technology and open‑source collaboration, and join the community of developers and investors who are shaping the future of decentralized ecosystems.

![New iPad 11 (A16) On Sale for Just $277.78! [Lowest Price Ever]](https://www.iclarified.com/images/news/97273/97273/97273-640.jpg)

![Apple Foldable iPhone to Feature New Display Tech, 19% Thinner Panel [Rumor]](https://www.iclarified.com/images/news/97271/97271/97271-640.jpg)

-xl.jpg)

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![Ditching a Microsoft Job to Enter Startup Hell with Lonewolf Engineer Sam Crombie [Podcast #171]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746753508177/0cd57f66-fdb0-4972-b285-1443a7db39fc.png?#)

-Nintendo-Switch-2-Hands-On-Preview-Mario-Kart-World-Impressions-&-More!-00-10-30.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)