iPhone Shipments Crash 50% In China As Local Brands Dominate

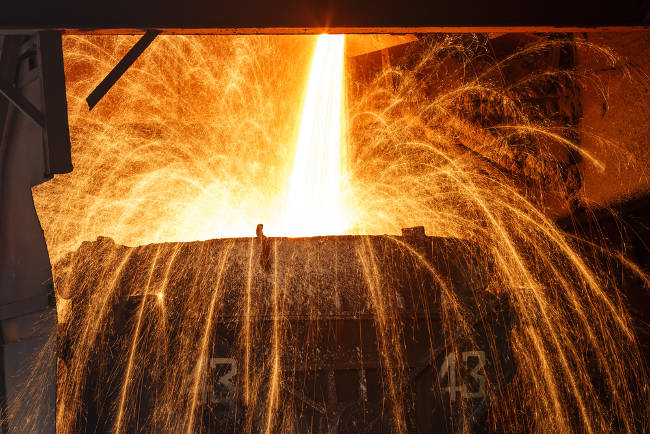

Apple's smartphone shipments in China plunged nearly 50% year-over-year in March 2025, as domestic brands like Huawei and Vivo surged ahead -- now controlling 92% of the market. MacRumors reports: The steep decline saw shipments fall to just 1.89 million units, down from 3.75 million during the same period last year. That shrinks Apple's share of the Chinese market to approximately 8%, while domestic brands now control 92% of smartphone shipments. For the entire first quarter, non-Chinese brand shipments declined over 25%, while total smartphone shipments in China actually increased by 3.3%. Apple's struggles come as domestic competitors have gained ground. Counterpoint Research reports Huawei now leads with a 19.4% share, followed by Vivo (17%), Xiaomi (16.6%), and Oppo (14.6%). Apple has slipped to fifth place with 14.1%. Several factors are driving Apple's declining fortunes. The company faces competition from rejuvenated local brands like Huawei, which has rebounded with proprietary chips and its HarmonyOS Next software. Chinese government policies appear to be playing a role too. Under government subsidies, consumers of electronics get a 15% refund of products that are priced under 6,000 yuan ($820). Apple's standard iPhone 16 starts at 5,999 yuan. Read more of this story at Slashdot.

Read more of this story at Slashdot.

![Apple Planning Bezel-Free iPhone With 'Four-Sided Bending' Display [Report]](https://www.iclarified.com/images/news/97321/97321/97321-640.jpg)

![Apple's 20th Anniversary iPhone May Feature Bezel-Free Display, AI Memory, Silicon Anode Battery [Report]](https://www.iclarified.com/images/news/97323/97323/97323-640.jpg)

![Vision Pro May Soon Let You Scroll With Your Eyes [Report]](https://www.iclarified.com/images/news/97324/97324/97324-640.jpg)

![Review: Sonnet MacCuff mini – a well-designed M4 Mac mini mount [Video]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/05/Sonnet-MacCuff-mini-2024-Mac-Review.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

-xl.jpg)

_Gang_Liu_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![[The AI Show Episode 147]: OpenAI Abandons For-Profit Plan, AI College Cheating Epidemic, Apple Says AI Will Replace Search Engines & HubSpot’s AI-First Scorecard](https://www.marketingaiinstitute.com/hubfs/ep%20147%20cover.png)

![How to Enable Remote Access on Windows 10 [Allow RDP]](https://bigdataanalyticsnews.com/wp-content/uploads/2025/05/remote-access-windows.jpg)