young adults are investing

young adults are investing

Young Adults Are Investing for the Wrong Reason

In recent years, a growing number of young adults are investing, but many financial experts warn they might be doing so for the wrong reasons. While it’s commendable that the younger generation is taking interest in building wealth, the motivation behind their investments often lacks a strong foundation in personal finance, money management, and strategic financial planning.

The Rise of Investing Among Young Adults

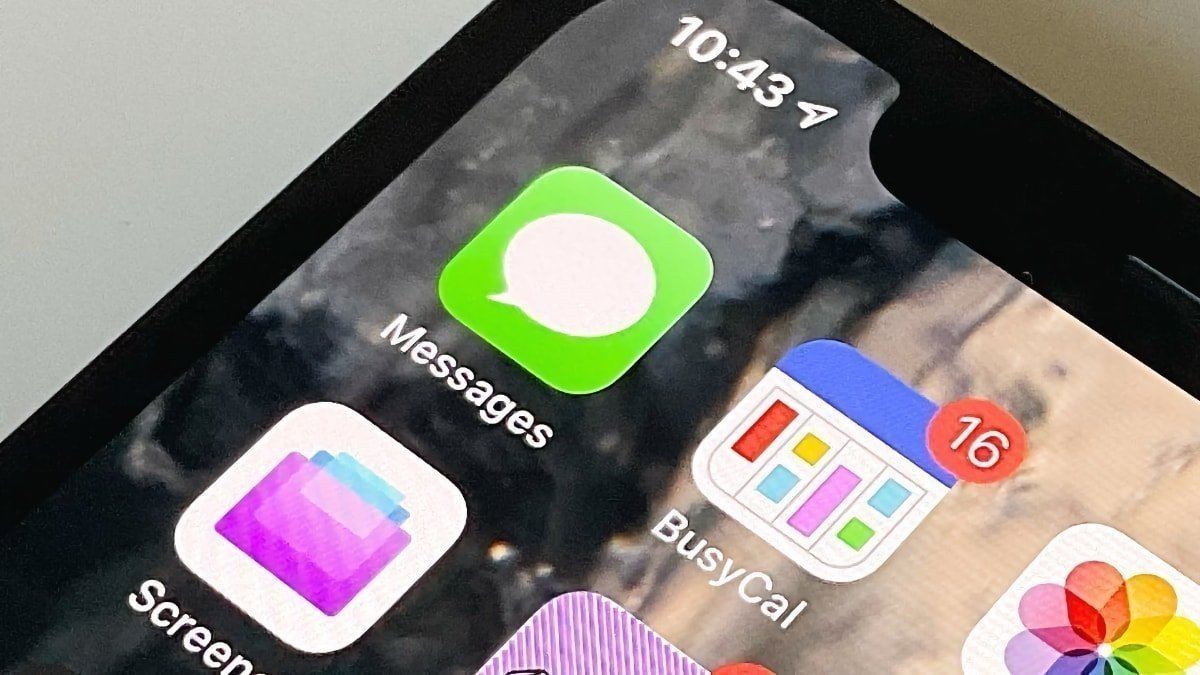

It’s no secret that young adults are investing more than ever before. With the rise of user-friendly apps like Robinhood and Webull, buying stocks, crypto, and ETFs has never been easier. Social media is also filled with stories of overnight success, driving many young people to jump on the bandwagon.

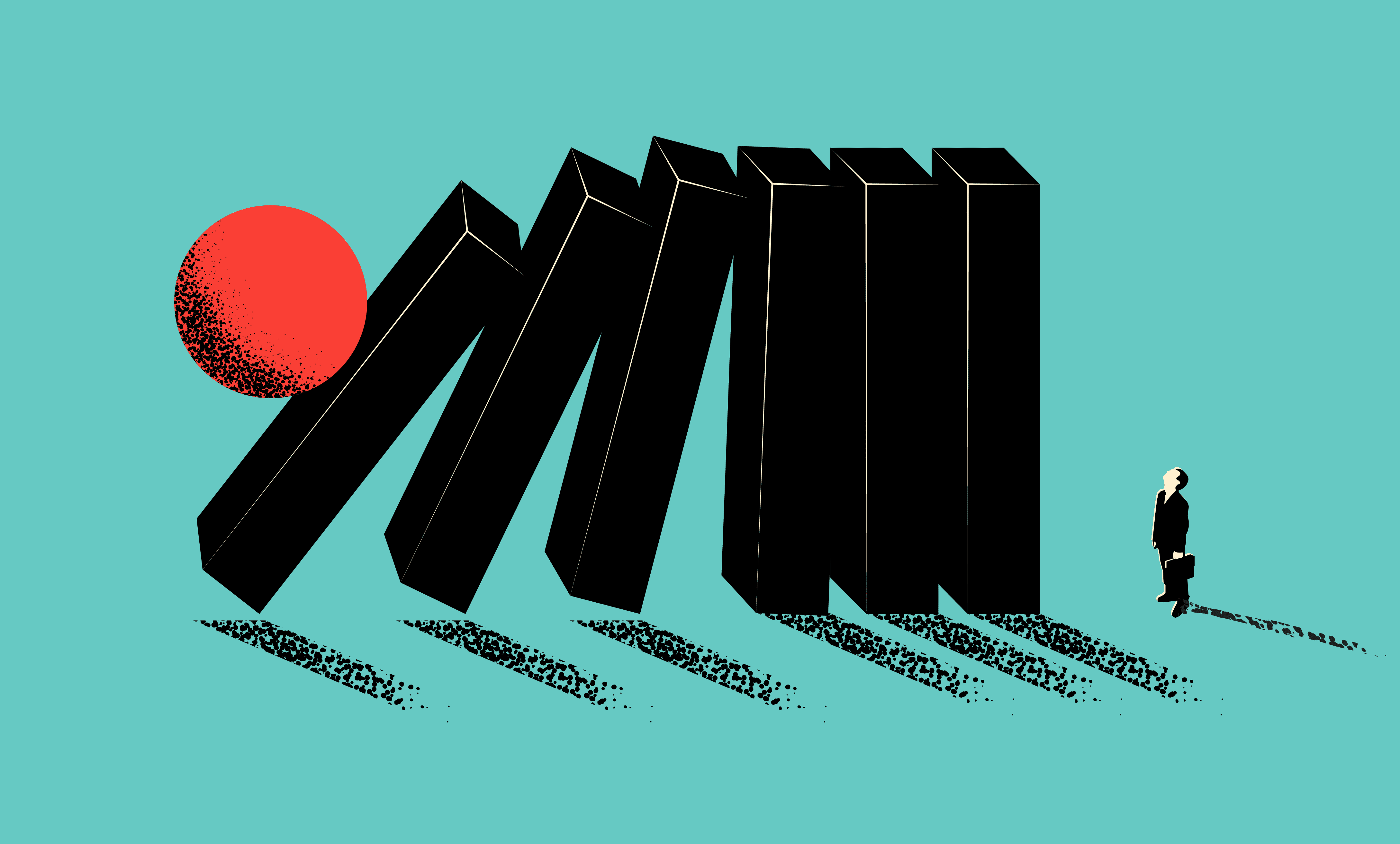

However, the problem isn’t that young adults are investing — it’s why they’re doing it. Many are hoping to “get rich quick” rather than focusing on long-term growth, diversification, and sustainable wealth. This mindset often leads to poor investment choices and financial stress.

Chasing Trends Instead of Building Wealth

One of the major pitfalls is that young adults are investing based on hype rather than research. Meme stocks, influencer tips, and crypto fads become irresistible, but without proper money management, these investments can backfire.

Personal finance experts emphasize that investing should be part of a broader financial planning strategy — not a replacement for it. Without understanding risk tolerance, asset allocation, or having an emergency fund, jumping into investing can do more harm than good.

The Role of Financial Planning

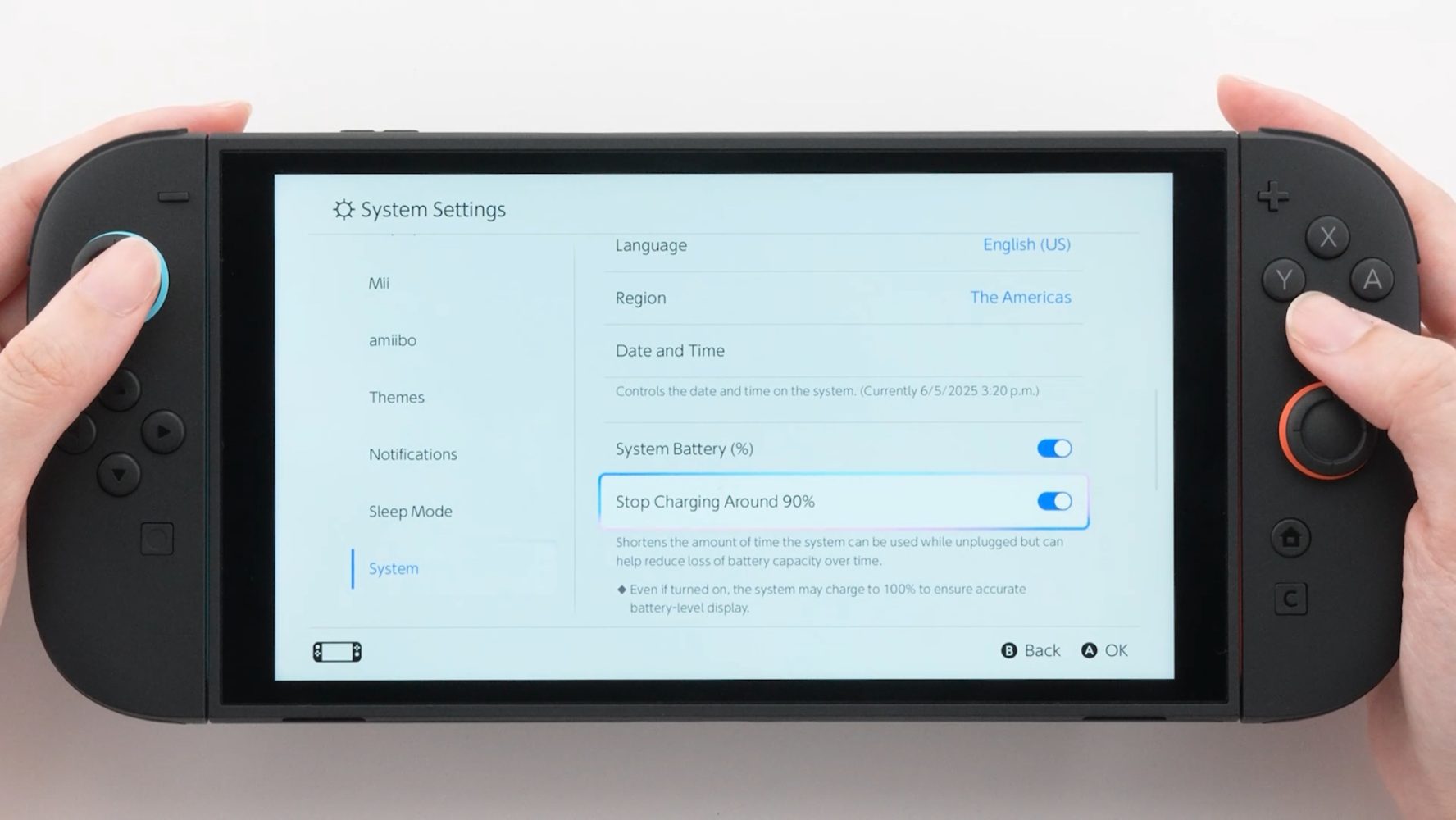

Good investing begins with strong financial planning. Before diving into the market, young investors should assess their financial goals, income stability, debt levels, and savings. A sound financial planning strategy ensures that investing contributes to long-term goals like retirement, buying a home, or starting a business.

Many young adults are investing without a plan, which makes it difficult to stay disciplined during market volatility. Planning not only reduces risk but also provides peace of mind — something money can’t buy.

Money Management Skills Are Crucial

Another overlooked area is money management. Before you invest your first dollar, you should understand budgeting, saving, and debt control. Without these basic money management skills, investing becomes a gamble rather than a calculated risk.

Personal finance literacy gives young adults the tools they need to assess opportunities critically. When young adults are investing with these tools in hand, they are far more likely to make informed and profitable decisions.

The Solution: Educate Before You Invest

Instead of investing out of fear of missing out (FOMO), young adults are investing more wisely when they are educated. Learning the principles of personal finance, developing solid money management habits, and engaging in strategic financial planning will set the foundation for lifelong financial success.

Final Thoughts

It’s encouraging that young adults are investing, but doing it for the wrong reason can be dangerous. Investing should be part of a well-thought-out financial plan, not a shortcut to wealth. With proper education and a disciplined approach, the next generation can transform their enthusiasm into long-term success.

Remember: Wealth isn’t built overnight. It’s built with patience, strategy, and sound money management.

![Samsung's New Galaxy S25 Edge Takes Aim at 'iPhone 17 Air' [Video]](https://www.iclarified.com/images/news/97276/97276/97276-640.jpg)

![Apple to Launch AI-Powered Battery Saver Mode in iOS 19 [Report]](https://www.iclarified.com/images/news/97309/97309/97309-640.jpg)

![Apple Officially Releases macOS Sequoia 15.5 [Download]](https://www.iclarified.com/images/news/97308/97308/97308-640.jpg)

![Walmart’s $30 Google TV streamer is now in stores and it supports USB-C hubs [Video]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/05/onn-4k-plus-store-reddit.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

_Piotr_Adamowicz_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Ditching a Microsoft Job to Enter Startup Purgatory with Lonewolf Engineer Sam Crombie [Podcast #171]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746753508177/0cd57f66-fdb0-4972-b285-1443a7db39fc.png?#)