How to Use MACD Like a Pro: 3 Technical Signals Developers Should Know

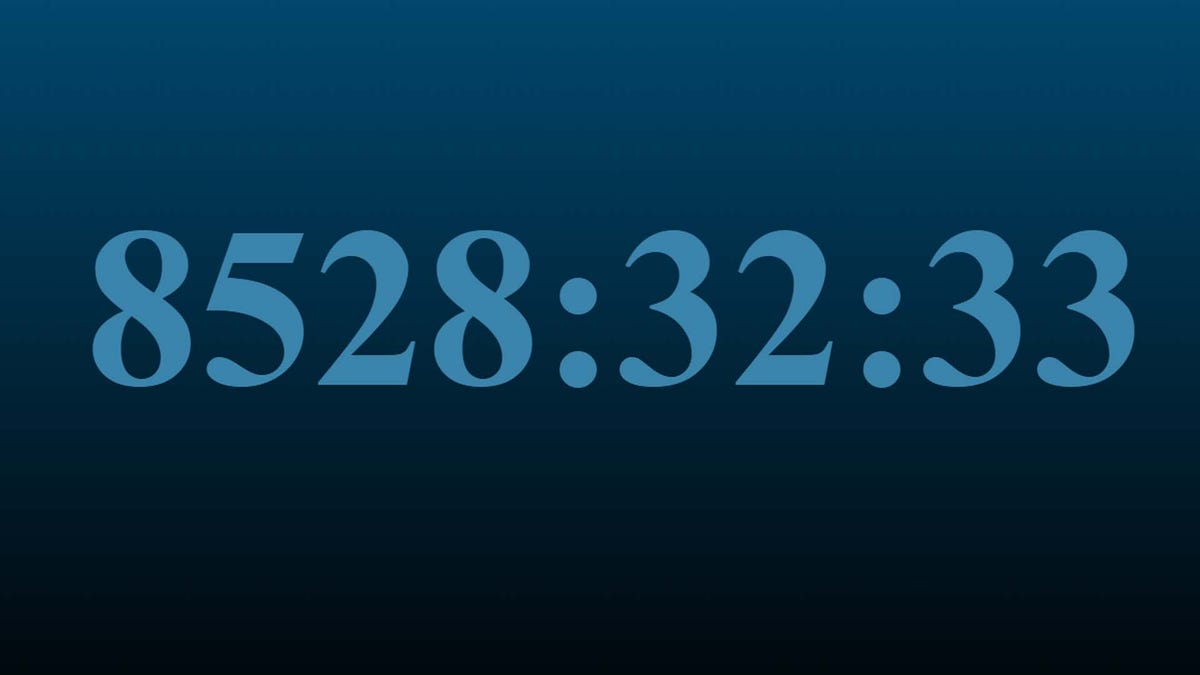

The Moving Average Convergence Divergence (MACD) indicator is often misinterpreted as a simple crossover tool. In reality, it offers a nuanced view of market momentum, trend health, and potential reversals—especially when analyzed over longer timeframes. This breakdown outlines how MACD identified major market movements on the BTC/USDT weekly chart using data-driven signals. 1. Momentum Breakout – Early 2023 In early 2023, MACD moved above the signal line with an expanding histogram. This was not just a routine crossover; it indicated strong bullish momentum following BTC’s recovery from 2022 lows. What to monitor: A rising MACD histogram with increasing bar height Signal line separation confirming acceleration Insight: A rapidly expanding histogram often confirms a new sustained trend, not just a temporary price bounce. 2. Momentum Peak – Late 2023 Despite continued upward price movement in late 2023, MACD and its histogram began to plateau. This divergence between price action and declining momentum was an early warning signal. Key considerations: A flattening MACD curve Price making higher highs while the indicator shows declining momentum Insight: This type of bearish divergence typically indicates trend exhaustion, even before a visible reversal in price. 3. Momentum Fading – Q1 2025 In Q1 2025, MACD crossed below the signal line. However, BTC did not crash. Instead, the asset entered a controlled pullback phase. The histogram turned negative, flagging early weakness in buying pressure. Diagnostic signals: MACD crossing below signal line Histogram turning red with gradually shrinking bars Insight: MACD can often signal weakening trend strength before it is visible in price action. It is particularly valuable in identifying transitions from trending to consolidating market conditions. Summary: Key MACD Observations for Systematic Traders • Large histogram bars generally reflect strong directional conviction in the market. • Flat MACD with rising prices signals hidden bearish divergence and trend weakening. • Shrinking histogram bars are an early indicator of a stalling trend or potential reversal. Conclusion MACD is not a basic entry/exit indicator. It functions as a momentum model, especially on higher timeframes such as weekly charts. Traders and developers integrating technical indicators into algorithms or platforms should treat MACD as a source of early market context rather than a reactive tool. Proper use of MACD in system design or manual strategy development can offer forward-looking momentum analysis—an edge often overlooked by short-term market participants.

The Moving Average Convergence Divergence (MACD) indicator is often misinterpreted as a simple crossover tool. In reality, it offers a nuanced view of market momentum, trend health, and potential reversals—especially when analyzed over longer timeframes.

This breakdown outlines how MACD identified major market movements on the BTC/USDT weekly chart using data-driven signals.

1. Momentum Breakout – Early 2023

In early 2023, MACD moved above the signal line with an expanding histogram. This was not just a routine crossover; it indicated strong bullish momentum following BTC’s recovery from 2022 lows.

What to monitor:

- A rising MACD histogram with increasing bar height

- Signal line separation confirming acceleration

Insight: A rapidly expanding histogram often confirms a new sustained trend, not just a temporary price bounce.

2. Momentum Peak – Late 2023

Despite continued upward price movement in late 2023, MACD and its histogram began to plateau. This divergence between price action and declining momentum was an early warning signal.

Key considerations:

- A flattening MACD curve

- Price making higher highs while the indicator shows declining momentum

Insight: This type of bearish divergence typically indicates trend exhaustion, even before a visible reversal in price.

3. Momentum Fading – Q1 2025

In Q1 2025, MACD crossed below the signal line. However, BTC did not crash. Instead, the asset entered a controlled pullback phase. The histogram turned negative, flagging early weakness in buying pressure.

Diagnostic signals:

- MACD crossing below signal line

- Histogram turning red with gradually shrinking bars

Insight: MACD can often signal weakening trend strength before it is visible in price action. It is particularly valuable in identifying transitions from trending to consolidating market conditions.

Summary: Key MACD Observations for Systematic Traders

• Large histogram bars generally reflect strong directional conviction in the market.

• Flat MACD with rising prices signals hidden bearish divergence and trend weakening.

• Shrinking histogram bars are an early indicator of a stalling trend or potential reversal.

Conclusion

MACD is not a basic entry/exit indicator. It functions as a momentum model, especially on higher timeframes such as weekly charts. Traders and developers integrating technical indicators into algorithms or platforms should treat MACD as a source of early market context rather than a reactive tool.

Proper use of MACD in system design or manual strategy development can offer forward-looking momentum analysis—an edge often overlooked by short-term market participants.

![Apple Shares Official Teaser for 'Highest 2 Lowest' Starring Denzel Washington [Video]](https://www.iclarified.com/images/news/97221/97221/97221-640.jpg)

![New Powerbeats Pro 2 Wireless Earbuds On Sale for $199.95 [Lowest Price Ever]](https://www.iclarified.com/images/news/97217/97217/97217-640.jpg)

![Chrome 136 tones down some Dynamic Color on Android [U]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2023/03/google-chrome-logo-4.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

Stolen 884,000 Credit Card Details on 13 Million Clicks from Users Worldwide.webp?#)

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

-Assassin's-Creed-Shadows---How-to-Romance-Lady-Oichi-00-06-00.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)