Best Tax Saving Tips for Freelancers in the UK

Best Tax Saving Tips for Freelancers

Freelancing has become a popular way in the UK in the present era. As this opportunity to work independently brings freedom, the complexity of the tax system and finance management becomes a major challenge. In this blog post, we will discuss in detail the Tax Save Tips for Freelancers in the UK, which has been arranged according to the latest updates and instructions for 2025.

Tax saving tips for freelancers in the uk

Freelancers have some facilities and plans in the UK tax system, which can be used to save large taxes properly. In this section you will find out how to apply Tax Save Tips for Freelancers in the UK in real life.

Properly enrollment (PROPER INCOME TRAKING)

Income tracking is an important tax saving strategy. Freelancers have various sources of income - such as client payment, affiliate income, or digital product. It is very important to keep the correct record of all these incomes. Tax Saving Tips for Freelancers in the UK

Using a good income tracking software such as QuickBooks or XERO makes it easier to make monthly and annual income reports. These reports can be used in the HMRC Self-Assessment process and help in the wrong account.

HMRC Self-Assessment process is well burdened

Each freelancer has to complete the HMRC Self-Assessment form. This is a process where you yourself report your annual income, expenses and taxes.

As easy as this process may seem, it has a lot of complications. Especially if you give wrong information or hide some income, a large amount of fine may be multiplied. Filling the correct HMRC Self-Assessment can be saved only by filing. Tax Saving Tips for Freelancers in the UK

Deductible expenses to keep in recognition

Deductible Expenses is the cost that is done in the interest of the business and the tax reports are available on tax reports. As:

- Home Office Utility Bill

- Software subscription (eg Adobe, Canva)

- Internet and Mobile Bills (Parts used for business purposes)

- Travel Cost (to go to client meetings)

- Professional Development Course or Training

If you calculate these deductible expenses properly, you can greatly reduce the taxable income.

![iOS 18 Adoption Reaches 82% [Chart]](https://www.iclarified.com/images/news/97512/97512/97512-640.jpg)

![Apple Shares Official Trailer for 'The Wild Ones' [Video]](https://www.iclarified.com/images/news/97515/97515/97515-1280.jpg)

![[The AI Show Episode 151]: Anthropic CEO: AI Will Destroy 50% of Entry-Level Jobs, Veo 3’s Scary Lifelike Videos, Meta Aims to Fully Automate Ads & Perplexity’s Burning Cash](https://www.marketingaiinstitute.com/hubfs/ep%20151%20cover.png)

![[DEALS] FileJump 2TB Cloud Storage: Lifetime Subscription (85% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

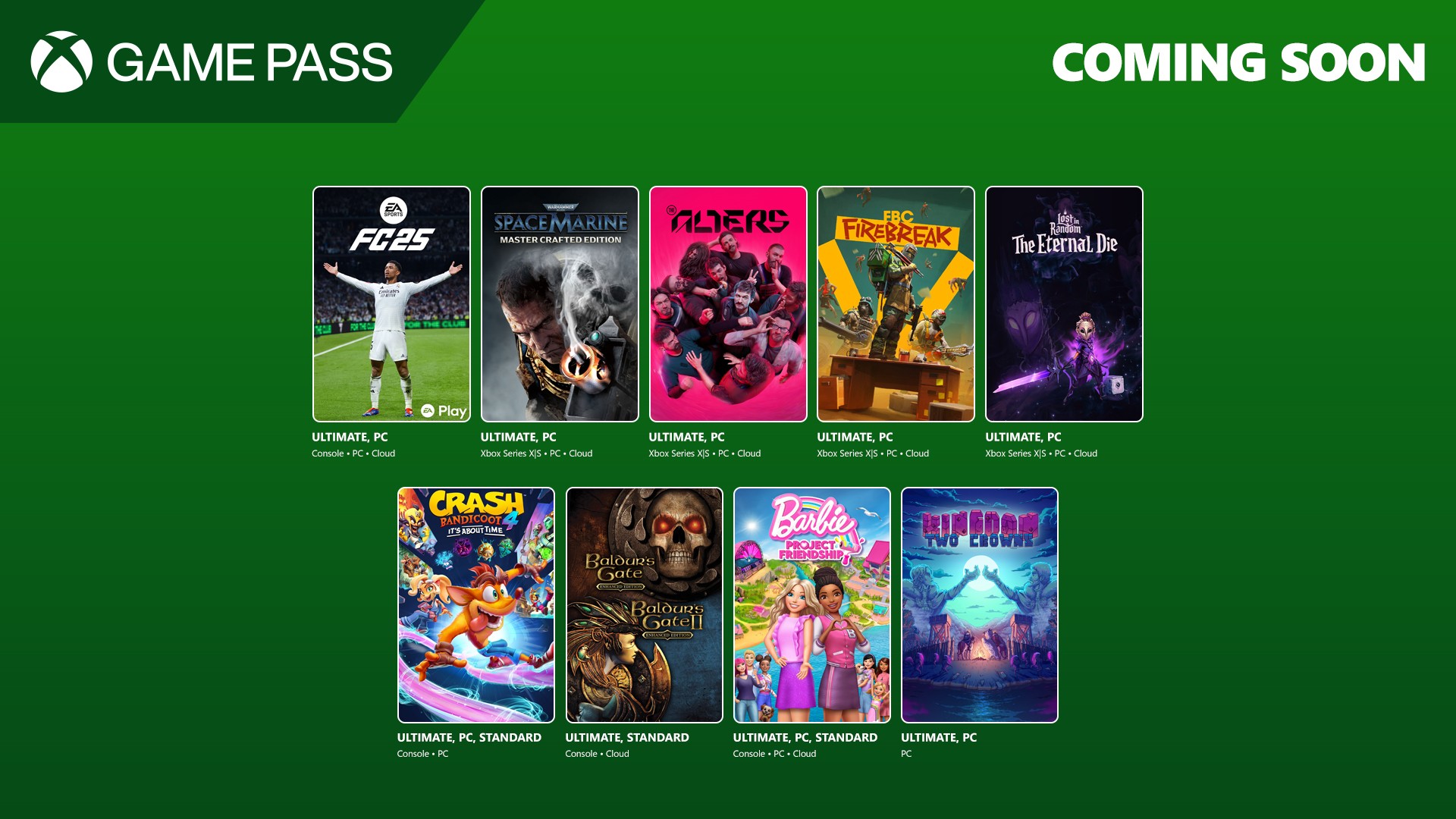

-0-8-screenshot.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)