Citi Predicts Stablecoins Will Become Part of the Mainstream Economy

Stablecoins, digital assets pegged to stable currencies like the US dollar, are poised to move far beyond their roots in cryptocurrency trading and become a key part of the global financial system. According to a recent Citi report, these tokens will soon play a central role in economic activity, reshaping how money is held, moved, and managed. From Crypto Tool to Financial Staple Originally designed for crypto traders, stablecoins are finding broader uses in payments, remittances, and business liquidity management. Citi’s Future Finance think tank predicts stablecoins could soon replace a portion of both foreign and domestic U.S. currency reserves and become a standard tool for banks’ short-term liquidity. If yield-generating stablecoins emerge, they may even be used in term deposits and retail money market funds. Ronit Ghose, Citi’s Global Head of Future Finance, explains, “We are witnessing the incorporation of stablecoins into the mainstream economy. Stablecoins could act as the cash component for tokenized financial assets or facilitate payments for businesses of all sizes. They enable people globally to easily and affordably hold dollars or euros.” Rapid Growth Ahead Citi forecasts the stablecoin market will grow from its current $250 billion to $1.6 trillion by 2030, and possibly up to $3.7 trillion in a bull case, outpacing the current total crypto market cap. Citi expects about 90% of stablecoins will remain US dollar-denominated. Key drivers include: Increased use in global payments and remittances Substitution for physical cash and checking accounts Adoption as the cash leg in tokenized financial transactions Demand in regions with unstable local currencies. Citi also predicts stablecoin issuers could purchase up to $1 trillion in US Treasuries by 2030, potentially making them the largest holders of US government debt. Regulatory and Structural Challenges Regulatory clarity is crucial. While the US and EU are working on stablecoin legislation, recent efforts like the GENIUS Act failed to pass the US Senate, reflecting ongoing debate and uncertainty. Citi warns that if adoption and integration challenges persist, stablecoin growth could stall at $500 billion by 2030. Citi suggests 2025 could be “blockchain’s ChatGPT moment,” with stablecoins driving rapid adoption in both finance and the public sector, including government spending and digital identity. If Citi’s predictions are correct, stablecoins will soon expand far beyond crypto trading and become a cornerstone of the mainstream economy by the end of this decade.

Stablecoins, digital assets pegged to stable currencies like the US dollar, are poised to move far beyond their roots in cryptocurrency trading and become a key part of the global financial system. According to a recent Citi report, these tokens will soon play a central role in economic activity, reshaping how money is held, moved, and managed.

From Crypto Tool to Financial Staple

Originally designed for crypto traders, stablecoins are finding broader uses in payments, remittances, and business liquidity management. Citi’s Future Finance think tank predicts stablecoins could soon replace a portion of both foreign and domestic U.S. currency reserves and become a standard tool for banks’ short-term liquidity. If yield-generating stablecoins emerge, they may even be used in term deposits and retail money market funds.

Ronit Ghose, Citi’s Global Head of Future Finance, explains,

“We are witnessing the incorporation of stablecoins into the mainstream economy. Stablecoins could act as the cash component for tokenized financial assets or facilitate payments for businesses of all sizes. They enable people globally to easily and affordably hold dollars or euros.”

Rapid Growth Ahead

Citi forecasts the stablecoin market will grow from its current $250 billion to $1.6 trillion by 2030, and possibly up to $3.7 trillion in a bull case, outpacing the current total crypto market cap. Citi expects about 90% of stablecoins will remain US dollar-denominated.

Key drivers include:

Increased use in global payments and remittances

Substitution for physical cash and checking accounts

Adoption as the cash leg in tokenized financial transactions

Demand in regions with unstable local currencies. Citi also predicts stablecoin issuers could purchase up to $1 trillion in US Treasuries by 2030, potentially making them the largest holders of US government debt.

Regulatory and Structural Challenges

Regulatory clarity is crucial. While the US and EU are working on stablecoin legislation, recent efforts like the GENIUS Act failed to pass the US Senate, reflecting ongoing debate and uncertainty. Citi warns that if adoption and integration challenges persist, stablecoin growth could stall at $500 billion by 2030.

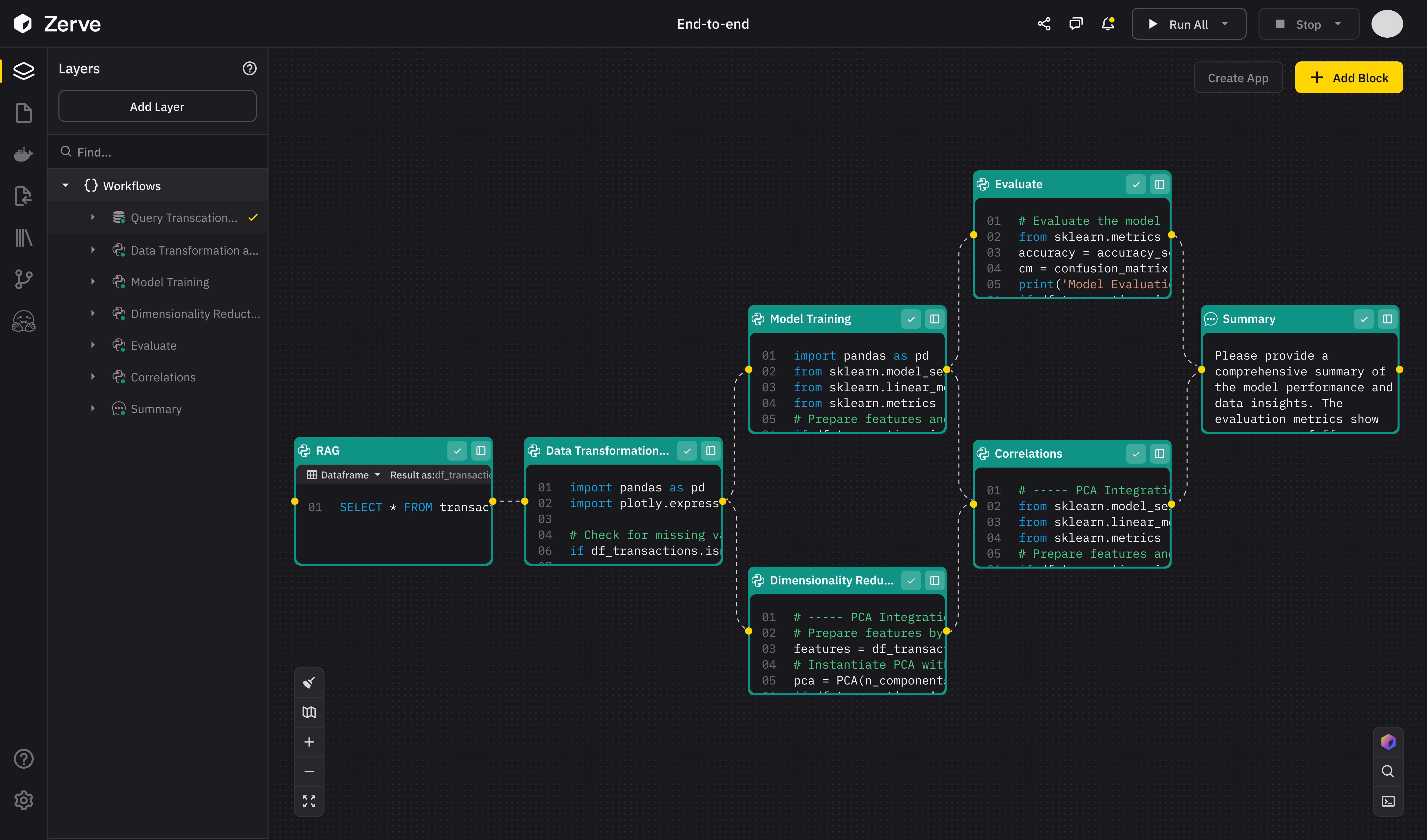

Citi suggests 2025 could be “blockchain’s ChatGPT moment,” with stablecoins driving rapid adoption in both finance and the public sector, including government spending and digital identity. If Citi’s predictions are correct, stablecoins will soon expand far beyond crypto trading and become a cornerstone of the mainstream economy by the end of this decade.

![Apple Unveils Powerful New Accessibility Features for iOS 19 and macOS 16 [Video]](https://www.iclarified.com/images/news/97311/97311/97311-640.jpg)

-xl.jpg)

![[The AI Show Episode 147]: OpenAI Abandons For-Profit Plan, AI College Cheating Epidemic, Apple Says AI Will Replace Search Engines & HubSpot’s AI-First Scorecard](https://www.marketingaiinstitute.com/hubfs/ep%20147%20cover.png)