How Crypto Billionaires Spend: Signals of Power, Branding, and Strategy

The evolution of wealth in crypto circles has revealed a new type of capital behavior—unconventional, often symbolic, and frequently engineered to generate visibility or legacy impact. Beyond mere displays of affluence, many of these actions serve clear strategic functions: they consolidate influence, elevate personal brands, and shape narratives in the broader tech and Web3 ecosystems. This article explores how crypto billionaires allocate wealth—from investment in aerospace missions to cultural artifacts—and what developers and fintech professionals can infer about the changing landscape of capital behavior. Crypto billionaires tend to operate within one of the following strategic archetypes: 1. The Minimalist Builder These individuals maintain a low public profile and focus their wealth on infrastructure, research, and long-term ecosystem development. Examples include Vitalik Buterin (Ethereum) and Gavin Wood (Polkadot). 2. The Public-Facing Strategist Entrepreneurs such as Brian Armstrong (Coinbase) and Volodymyr Nosov (WhiteBIT) pursue public initiatives, often blending philanthropy with platform growth, in moves that reinforce their brands and organizations. 3. The Showman Investor Figures like Justin Sun and Richard Heart use spectacle, media presence, and provocative acts to amplify visibility. While these stunts may appear frivolous, they often correlate with strategic media cycles or product launches. $2M Buried Across the U.S. American crypto investor John Collins-Black launched a treasure hunt involving five hidden chests with items worth a combined $2 million, including a Casascius Bitcoin and historical artifacts. The clues are encrypted in a book he published. The campaign functions as a long-term brand asset and an experiment in gamified engagement. $55M SpaceX Mission Chun Wang, co-founder of F2Pool and Stakefish, privately financed a polar-orbit mission via SpaceX in 2025. The mission included 22 experiments and reflected a commitment to scientific exploration. It also demonstrated the technical and financial capabilities emerging from early-stage blockchain mining. $5M Art Performance TRON founder Justin Sun staged the consumption of a $5M art piece during a live event. This was a calculated PR operation blending digital art, licensing, and public performance, reinforcing his role as a highly visible player in the crypto sector. Private Zoo and Luxury Assets Djordje Novakovic, a trader who profited from NFTs and currency speculation, invested in luxury goods and exotic animals. While not aligned with infrastructure development, such cases highlight personal branding through radical lifestyle curation. Cultural and Institutional Acquisition Volodymyr Nosov (WhiteBIT) purchased the Eurovision trophy for $900K (500 ETH) and later acquired Freddie Mercury’s Rolls-Royce and a football club. These moves suggest a strategy of aligning crypto capital with cultural legacy, blending institutional credibility with public interest. - Wealth in crypto is no longer siloed: It's being deployed into space exploration, real-world cultural artifacts, and media spectacles. - Strategic spending serves narrative positioning: Whether aligning with legacy institutions or embracing meme culture, high-visibility spending choices create lasting brand identity. - Developers must understand this context: The allocation of capital in crypto is not just economic—it is performative, cultural, and deeply connected to how protocols, platforms, and leaders position themselves globally. Crypto's billionaire class is actively redefining wealth utilization. For developers building in the space, it’s important to recognize that financial decisions are often crafted to send signals—about leadership, about vision, and about long-term positioning. As the ecosystem matures, expect these signals to become even more sophisticated—and strategic.

The evolution of wealth in crypto circles has revealed a new type of capital behavior—unconventional, often symbolic, and frequently engineered to generate visibility or legacy impact. Beyond mere displays of affluence, many of these actions serve clear strategic functions: they consolidate influence, elevate personal brands, and shape narratives in the broader tech and Web3 ecosystems.

This article explores how crypto billionaires allocate wealth—from investment in aerospace missions to cultural artifacts—and what developers and fintech professionals can infer about the changing landscape of capital behavior.

Crypto billionaires tend to operate within one of the following strategic archetypes:

1. The Minimalist Builder

These individuals maintain a low public profile and focus their wealth on infrastructure, research, and long-term ecosystem development. Examples include Vitalik Buterin (Ethereum) and Gavin Wood (Polkadot).

2. The Public-Facing Strategist

Entrepreneurs such as Brian Armstrong (Coinbase) and Volodymyr Nosov (WhiteBIT) pursue public initiatives, often blending philanthropy with platform growth, in moves that reinforce their brands and organizations.

3. The Showman Investor

Figures like Justin Sun and Richard Heart use spectacle, media presence, and provocative acts to amplify visibility. While these stunts may appear frivolous, they often correlate with strategic media cycles or product launches.

$2M Buried Across the U.S.

American crypto investor John Collins-Black launched a treasure hunt involving five hidden chests with items worth a combined $2 million, including a Casascius Bitcoin and historical artifacts. The clues are encrypted in a book he published. The campaign functions as a long-term brand asset and an experiment in gamified engagement.

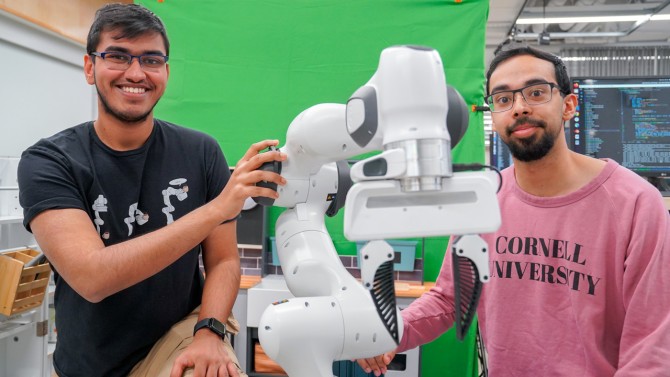

$55M SpaceX Mission

Chun Wang, co-founder of F2Pool and Stakefish, privately financed a polar-orbit mission via SpaceX in 2025. The mission included 22 experiments and reflected a commitment to scientific exploration. It also demonstrated the technical and financial capabilities emerging from early-stage blockchain mining.

$5M Art Performance

TRON founder Justin Sun staged the consumption of a $5M art piece during a live event. This was a calculated PR operation blending digital art, licensing, and public performance, reinforcing his role as a highly visible player in the crypto sector.

Private Zoo and Luxury Assets

Djordje Novakovic, a trader who profited from NFTs and currency speculation, invested in luxury goods and exotic animals. While not aligned with infrastructure development, such cases highlight personal branding through radical lifestyle curation.

Cultural and Institutional Acquisition

Volodymyr Nosov (WhiteBIT) purchased the Eurovision trophy for $900K (500 ETH) and later acquired Freddie Mercury’s Rolls-Royce and a football club. These moves suggest a strategy of aligning crypto capital with cultural legacy, blending institutional credibility with public interest.

- Wealth in crypto is no longer siloed: It's being deployed into space exploration, real-world cultural artifacts, and media spectacles.

- Strategic spending serves narrative positioning: Whether aligning with legacy institutions or embracing meme culture, high-visibility spending choices create lasting brand identity.

- Developers must understand this context: The allocation of capital in crypto is not just economic—it is performative, cultural, and deeply connected to how protocols, platforms, and leaders position themselves globally.

Crypto's billionaire class is actively redefining wealth utilization. For developers building in the space, it’s important to recognize that financial decisions are often crafted to send signals—about leadership, about vision, and about long-term positioning.

As the ecosystem matures, expect these signals to become even more sophisticated—and strategic.

![Apple Unveils Powerful New Accessibility Features for iOS 19 and macOS 16 [Video]](https://www.iclarified.com/images/news/97311/97311/97311-640.jpg)

-xl.jpg)

![[The AI Show Episode 147]: OpenAI Abandons For-Profit Plan, AI College Cheating Epidemic, Apple Says AI Will Replace Search Engines & HubSpot’s AI-First Scorecard](https://www.marketingaiinstitute.com/hubfs/ep%20147%20cover.png)