Electronic Payment Solutions Development

As global commerce shifts rapidly toward digital platforms, electronic payment solutions are at the heart of every successful business model. From e-commerce websites to mobile apps, integrating secure and efficient payment systems is a crucial part of modern software development. In this post, we’ll dive into the essentials of building robust electronic payment systems. What Are Electronic Payment Solutions? Electronic payment (e-payment) systems allow customers to pay for goods and services using digital methods such as credit/debit cards, mobile wallets, online banking, and cryptocurrencies. These systems replace traditional cash or check payments, enabling faster and more secure transactions. Key Components of a Payment Solution Payment Gateway: A service that processes credit/debit card payments securely. Merchant Account: An account where funds from customer payments are temporarily held. Payment Processor: Handles transaction requests and communicates with card networks and banks. User Interface: The checkout flow, payment forms, and feedback to users. Popular Payment Platforms PayPal Stripe Square Razorpay Braintree Google Pay / Apple Pay Integrating Stripe with a Web Application (Example) # server.py (Flask backend example) from flask import Flask, request, jsonify import stripe app = Flask(name) stripe.api_key = 'your_stripe_secret_key' @app.route('/create-payment-intent', methods=['POST']) def create_payment(): try: intent = stripe.PaymentIntent.create( amount=1000, # in cents currency='usd', automatic_payment_methods={'enabled': True} ) return jsonify({'clientSecret': intent.client_secret}) except Exception as e: return jsonify(error=str(e)), 403 Security and Compliance PCI DSS: Follow Payment Card Industry Data Security Standards. SSL/TLS: Use HTTPS to encrypt data in transit. Tokenization: Replace sensitive data with non-sensitive tokens. Fraud Detection: Implement tools to detect and prevent suspicious activity. Best Practices Use trusted payment SDKs and APIs Validate and sanitize all input on the client and server Provide clear user feedback for successful or failed payments Ensure mobile responsiveness and cross-platform compatibility Store minimal sensitive data — use tokens or third-party secure vaults Trends in E-Payments Biometric payments (face, fingerprint) Cryptocurrency integration One-click and recurring payments Buy Now, Pay Later (BNPL) systems Embedded finance and digital wallets Conclusion Building secure and user-friendly electronic payment solutions is essential for modern digital platforms. With the right tools, security measures, and user experience design, you can create a seamless checkout experience that boosts customer trust and business revenue. Start with trusted payment gateways and scale as your application grows!

As global commerce shifts rapidly toward digital platforms, electronic payment solutions are at the heart of every successful business model. From e-commerce websites to mobile apps, integrating secure and efficient payment systems is a crucial part of modern software development. In this post, we’ll dive into the essentials of building robust electronic payment systems.

What Are Electronic Payment Solutions?

Electronic payment (e-payment) systems allow customers to pay for goods and services using digital methods such as credit/debit cards, mobile wallets, online banking, and cryptocurrencies. These systems replace traditional cash or check payments, enabling faster and more secure transactions.

Key Components of a Payment Solution

- Payment Gateway: A service that processes credit/debit card payments securely.

- Merchant Account: An account where funds from customer payments are temporarily held.

- Payment Processor: Handles transaction requests and communicates with card networks and banks.

- User Interface: The checkout flow, payment forms, and feedback to users.

Popular Payment Platforms

- PayPal

- Stripe

- Square

- Razorpay

- Braintree

- Google Pay / Apple Pay

Integrating Stripe with a Web Application (Example)

# server.py (Flask backend example)

from flask import Flask, request, jsonify

import stripeapp = Flask(name)

stripe.api_key = 'your_stripe_secret_key'@app.route('/create-payment-intent', methods=['POST'])

def create_payment():

try:

intent = stripe.PaymentIntent.create(

amount=1000, # in cents

currency='usd',

automatic_payment_methods={'enabled': True}

)

return jsonify({'clientSecret': intent.client_secret})

except Exception as e:

return jsonify(error=str(e)), 403

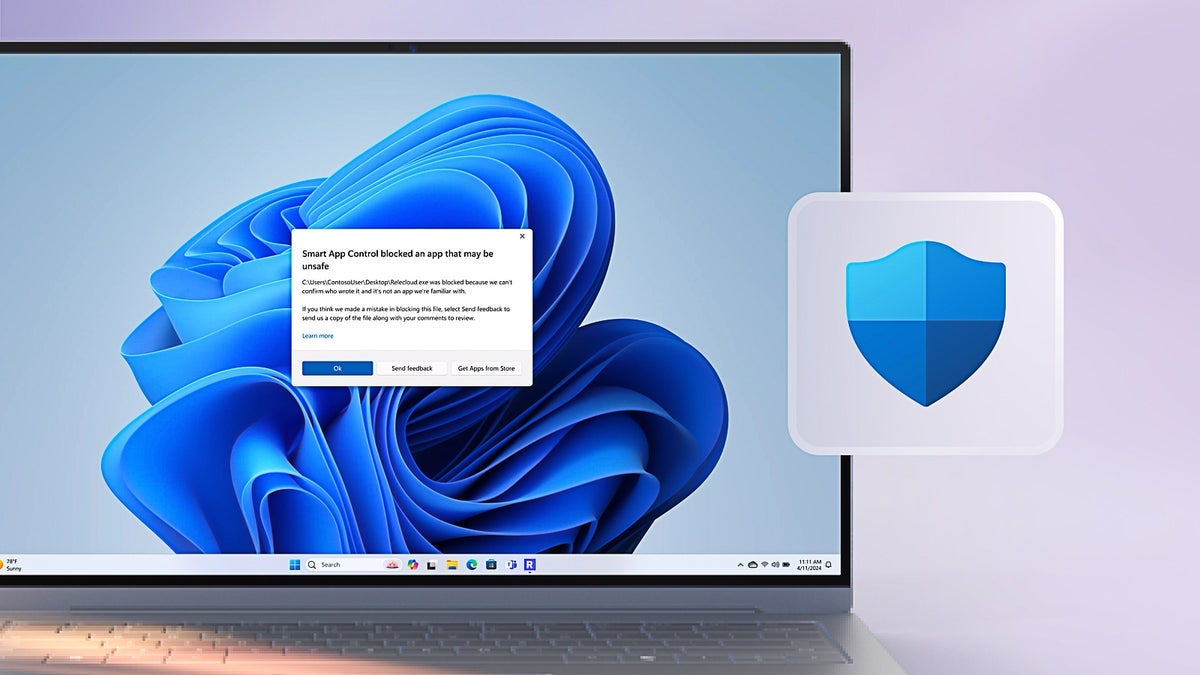

Security and Compliance

- PCI DSS: Follow Payment Card Industry Data Security Standards.

- SSL/TLS: Use HTTPS to encrypt data in transit.

- Tokenization: Replace sensitive data with non-sensitive tokens.

- Fraud Detection: Implement tools to detect and prevent suspicious activity.

Best Practices

- Use trusted payment SDKs and APIs

- Validate and sanitize all input on the client and server

- Provide clear user feedback for successful or failed payments

- Ensure mobile responsiveness and cross-platform compatibility

- Store minimal sensitive data — use tokens or third-party secure vaults

Trends in E-Payments

- Biometric payments (face, fingerprint)

- Cryptocurrency integration

- One-click and recurring payments

- Buy Now, Pay Later (BNPL) systems

- Embedded finance and digital wallets

Conclusion

Building secure and user-friendly electronic payment solutions is essential for modern digital platforms. With the right tools, security measures, and user experience design, you can create a seamless checkout experience that boosts customer trust and business revenue. Start with trusted payment gateways and scale as your application grows!

![Apple to Split Enterprise and Western Europe Roles as VP Exits [Report]](https://www.iclarified.com/images/news/97032/97032/97032-640.jpg)

![Nanoleaf Announces New Pegboard Desk Dock With Dual-Sided Lighting [Video]](https://www.iclarified.com/images/news/97030/97030/97030-640.jpg)

![Apple's Foldable iPhone May Cost Between $2100 and $2300 [Rumor]](https://www.iclarified.com/images/news/97028/97028/97028-640.jpg)

.webp?#)

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)