When One Tweet Costs $3B: A Developer’s Look at Market Volatility and Infrastructure Design

In 2025, political rhetoric continues to move markets faster than technical indicators. From a developer’s perspective, this isn’t just a trading concern — it’s a system design challenge. Consider the example from June 5: Tesla lost 14.3% in a single trading session after an open conflict between Elon Musk and U.S. President Donald Trump. Over $150 billion in market capitalization was erased — the largest single-day loss in Tesla’s history. These are not isolated events. Similar patterns have emerged around regulatory signals toward crypto and fintech. This raises an important question for engineers, especially those building fintech or Web3 platforms: how do we design systems that remain resilient amid this kind of volatility? Impact Assessment: Rhetoric, Risk, and Real-Time Valuation Loss A review of market data shows that politically charged commentary — even when hypothetical — can directly impact company valuations. Examples include: Coinbase lost $4.2 billion in market cap (~9%) following public calls for tighter regulation on exchanges. Binance shed $6.1 billion (~7%) after geopolitical narratives tied it to Asia-centric risk. Kraken dropped $1.7 billion over two days under regulatory pressure. Bybit, with an estimated cap of ~$15B, experienced multiple 5–6% declines (~$800–900M) when compliance uncertainty rose. These valuation hits are frequently followed by liquidity exits, TVL (Total Value Locked) drops, and stress on platform infrastructure — especially in centralized environments. Observations from Industry Leadership Hank Huang, CEO of Kronos Research, commented on this pattern during a recent discussion: “Political disputes in the public sphere carry significant risk for companies, especially those with high-profile leaders or government ties. Tesla’s $152.5B loss highlights how quickly market value can erode. While exact impacts are hard to predict, tracking sentiment, leadership behavior, and political exposure can help manage these risks.” From a development perspective, this translates into a need for architectures that: Scale under sudden traffic spikes. Secure critical assets under reputational and regulatory stress. Integrate adaptive logic that responds to macroeconomic triggers in real time. A Structural Comparison: Wall Street vs Blockchain A VC partner once described the contrast succinctly: “S&P is a glass skyscraper — elegant but cracks in the wind. Crypto? It’s a tank.” From an infrastructure lens: Traditional systems: Built around centralized intermediaries (clearinghouses, regulators, custodians). Rely heavily on political and macroeconomic stability. Struggle with adaptation during fast-moving events. Crypto-native systems: Are decentralized and programmable. Provide autonomous execution via smart contracts. Operate independently of most geopolitical systems (outside of regulation). Case Study: A Fund’s Response to Political Shock Following Trump’s inauguration, a European fintech/AI-focused venture fund lost over $400 million in three days due to market repricing. My team was approached to propose a mitigation strategy. We implemented a partial transition to institutional-grade Web3 infrastructure: Included components: Blockchain custody with programmable access controls. On-chain derivatives for volatility shielding. DeFi asset allocation with KYC-compliant layers. Within ten days, the fund rebalanced key positions into decentralized vaults and automated investment protocols, preserving liquidity without fully exiting positions. This wasn’t simply a hedge into crypto — it was a structural pivot toward more adaptive financial infrastructure. Takeaways for Developers Building in Volatile Environments After multiple cross-border negotiations with funds and platforms over the past six months, one conclusion has become clear: The winners aren’t the most innovative — they’re the most resilient. That means: Modular systems that can be reconfigured in real time. Infrastructure with fallback paths for data, liquidity, and compliance. Platforms that reduce exposure to centralized chokepoints. Engineering processes that stress test for political and market scenarios, not just unit logic. If I were to design a capital system from scratch in 2025, I wouldn’t start with fiat rails. I’d start with a blockchain core — programmable, decentralized, and built for global turbulence. Because in an environment where a single statement from a political figure can erase billions, we need infrastructure that functions regardless of the headlines. Read full article here

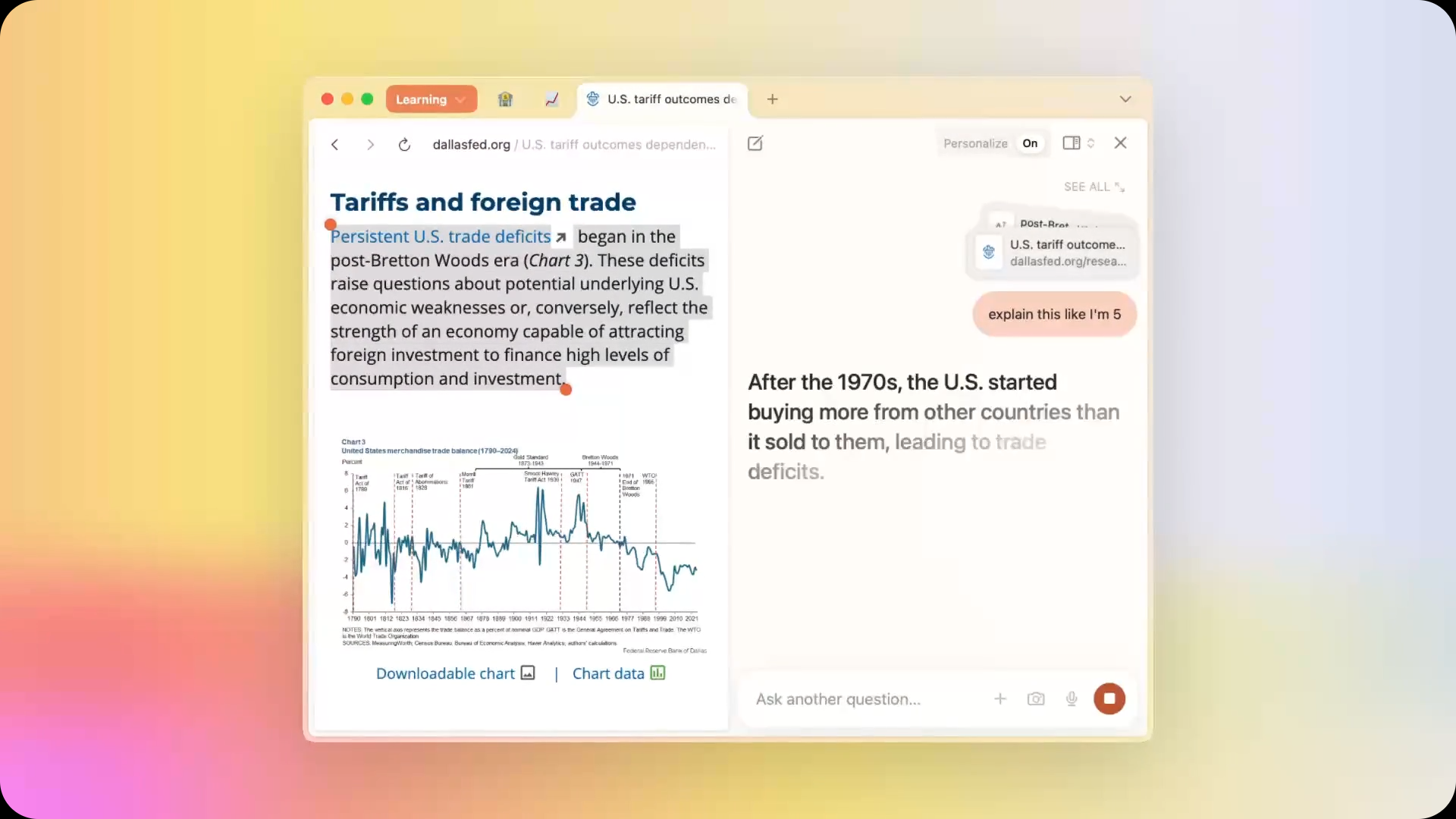

In 2025, political rhetoric continues to move markets faster than technical indicators. From a developer’s perspective, this isn’t just a trading concern — it’s a system design challenge.

Consider the example from June 5: Tesla lost 14.3% in a single trading session after an open conflict between Elon Musk and U.S. President Donald Trump. Over $150 billion in market capitalization was erased — the largest single-day loss in Tesla’s history. These are not isolated events. Similar patterns have emerged around regulatory signals toward crypto and fintech.

This raises an important question for engineers, especially those building fintech or Web3 platforms: how do we design systems that remain resilient amid this kind of volatility?

Impact Assessment: Rhetoric, Risk, and Real-Time Valuation Loss

A review of market data shows that politically charged commentary — even when hypothetical — can directly impact company valuations.

Examples include:

- Coinbase lost $4.2 billion in market cap (~9%) following public calls for tighter regulation on exchanges.

- Binance shed $6.1 billion (~7%) after geopolitical narratives tied it to Asia-centric risk.

- Kraken dropped $1.7 billion over two days under regulatory pressure.

- Bybit, with an estimated cap of ~$15B, experienced multiple 5–6% declines (~$800–900M) when compliance uncertainty rose.

These valuation hits are frequently followed by liquidity exits, TVL (Total Value Locked) drops, and stress on platform infrastructure — especially in centralized environments.

Observations from Industry Leadership

Hank Huang, CEO of Kronos Research, commented on this pattern during a recent discussion:

“Political disputes in the public sphere carry significant risk for companies, especially those with high-profile leaders or government ties. Tesla’s $152.5B loss highlights how quickly market value can erode. While exact impacts are hard to predict, tracking sentiment, leadership behavior, and political exposure can help manage these risks.”

From a development perspective, this translates into a need for architectures that:

- Scale under sudden traffic spikes.

- Secure critical assets under reputational and regulatory stress.

- Integrate adaptive logic that responds to macroeconomic triggers in real time.

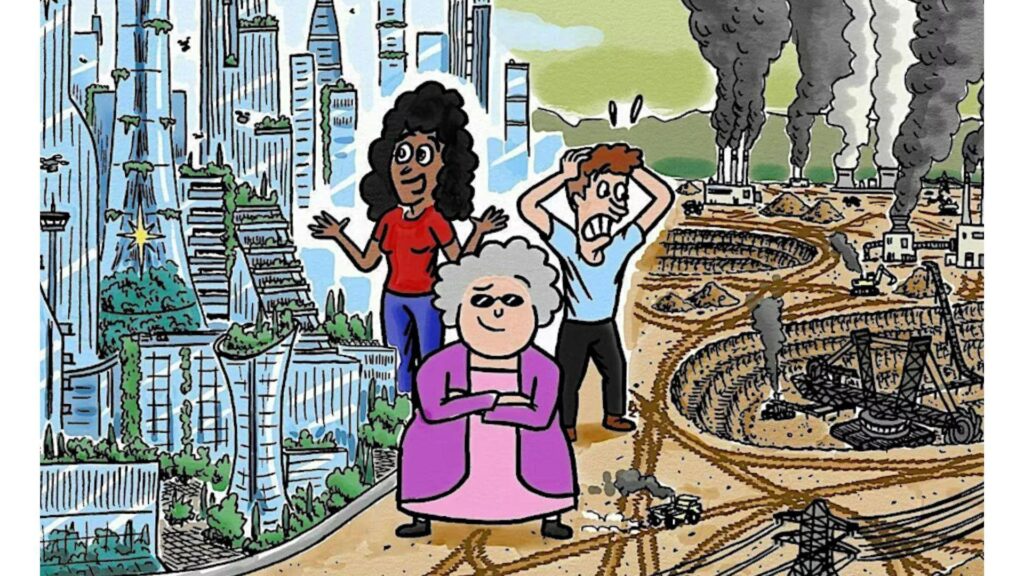

A Structural Comparison: Wall Street vs Blockchain

A VC partner once described the contrast succinctly:

“S&P is a glass skyscraper — elegant but cracks in the wind. Crypto? It’s a tank.”

From an infrastructure lens:

Traditional systems:

- Built around centralized intermediaries (clearinghouses, regulators, custodians).

- Rely heavily on political and macroeconomic stability.

- Struggle with adaptation during fast-moving events.

Crypto-native systems:

- Are decentralized and programmable.

- Provide autonomous execution via smart contracts.

- Operate independently of most geopolitical systems (outside of regulation).

Case Study: A Fund’s Response to Political Shock

Following Trump’s inauguration, a European fintech/AI-focused venture fund lost over $400 million in three days due to market repricing. My team was approached to propose a mitigation strategy.

We implemented a partial transition to institutional-grade Web3 infrastructure:

Included components:

- Blockchain custody with programmable access controls.

- On-chain derivatives for volatility shielding.

- DeFi asset allocation with KYC-compliant layers.

Within ten days, the fund rebalanced key positions into decentralized vaults and automated investment protocols, preserving liquidity without fully exiting positions. This wasn’t simply a hedge into crypto — it was a structural pivot toward more adaptive financial infrastructure.

Takeaways for Developers Building in Volatile Environments

After multiple cross-border negotiations with funds and platforms over the past six months, one conclusion has become clear:

The winners aren’t the most innovative — they’re the most resilient.

That means:

- Modular systems that can be reconfigured in real time.

- Infrastructure with fallback paths for data, liquidity, and compliance.

- Platforms that reduce exposure to centralized chokepoints.

- Engineering processes that stress test for political and market scenarios, not just unit logic.

If I were to design a capital system from scratch in 2025, I wouldn’t start with fiat rails. I’d start with a blockchain core — programmable, decentralized, and built for global turbulence.

Because in an environment where a single statement from a political figure can erase billions, we need infrastructure that functions regardless of the headlines.

![Apple Shares Teaser Trailer for 'The Lost Bus' Starring Matthew McConaughey [Video]](https://www.iclarified.com/images/news/97582/97582/97582-640.jpg)

_Marek_Uliasz_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Top Features of Vision-Based Workplace Safety Tools [2025]](https://static.wixstatic.com/media/379e66_7e75a4bcefe14e4fbc100abdff83bed3~mv2.jpg/v1/fit/w_1000,h_884,al_c,q_80/file.png?#)

![[The AI Show Episode 152]: ChatGPT Connectors, AI-Human Relationships, New AI Job Data, OpenAI Court-Ordered to Keep ChatGPT Logs & WPP’s Large Marketing Model](https://www.marketingaiinstitute.com/hubfs/ep%20152%20cover.png)

![[DEALS] Microsoft Visual Studio Professional 2022 + The Premium Learn to Code Certification Bundle (97% off) & Other Deals Up To 98% Off](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-35-45-screenshot.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-30-7-screenshot_0FxoE4J.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)