Starting with Statistics towards Decisions: An Effect of Equity Analysis on The Portfolio

Investing in the stock market can be both thrilling and daunting, especially for those seeking to increase their financial assets over the long term. With countless options and diverse market conditions, rendering informed decisions is essential. This is where equity analysis comes into play, providing important information into the financial health and potential growth of companies. By utilizing equity research report s, investors can navigate the complexity of market trends and determine which stocks align with their investment strategies. Equity analysis involves a thorough examination into a company's financial statements, industry performance, and economic indicators that could affect its market value. These reports provide investors with the knowledge they need to take well-informed decisions, potentially enhancing their portfolio's performance. Understanding the nuances of equity research allows investors to not just respond to market changes, but to anticipate and strategically allocate their resources for better outcomes. Understanding Equity Research Stock analysis involves the evaluation of public firms to determine their ability for investment opportunities. This form of analysis centers on economic indicators, market conditions, and competitive positioning to offer perspectives into a company's future results. Researchers evaluate a company's economic statements, growth prospects, and industry developments to formulate detailed stock research reports. These reports act as critical tools for stakeholders wanting to make educated decisions regarding stock buying or divestments. One of the key purposes of equity analysis is to support investors evaluate the reasonable worth of a stock. Analysts utilize various valuation methods and strategies, such as DCF calculations and price-to-earnings ratios, to determine expected prices for shares. By comparing these target prices to current market prices, traders can identify potential buying or divestment opportunities. This process necessitates not only quantitative analysis but also qualitative assessments of a firm's management, operational model, and market standing. In addition, stock analysis provides information into broader market patterns and economic signs that can impact share results. Researchers take into account large-scale elements such as borrowing costs, price increases, and joblessness when evaluating the investment scenario. By understanding these external elements along with company-specific data, investors can more effectively handle the challenges of the investment markets and improve their financial strategies. Ultimately, stock research enables investors to make more educated decisions, leading to better portfolio outcomes. Key Metrics in Equity Analysis When the stock of a company, several key metrics are crucial for making educated investment decisions. One prominent metric is the Earnings Per Share (EPS). EPS denotes a company's profitability on a share basis, allowing investors to gauge how well the company is producing profits relative to its outstanding shares. A increasing EPS may suggest that the company is efficiently managing its operations and growing its earnings, making it an important factor in determining stock value. Another essential metric is the Price to Earnings (P/E) ratio, which compares a company’s current share price to its earnings per share. This ratio helps investors determine whether a stock is too expensive or underpriced relative to its earnings. A large P/E ratio may imply that investors are expecting considerable growth in the future, while a decreased P/E could suggest that the stock is too cheap or that the company is facing challenges. Comprehending the P/E ratio is vital for making comparisons within an industry or sector. In conclusion, the Return on Equity (ROE) metric offers insights into a company's efficiency in producing profits from its equity. ROE assesses how well management is using shareholders’ funds to create growth. A elevated ROE indicates that the company is more efficient at generating profit on investments made by shareholders, which can shape investment strategies. Investors commonly look for companies with reliable and strong ROE as suitable choices for their portfolios, reflecting robust management and lucrative operations. Applying Analysis to Portfolio Strategy Making use of stock analysis reports is vital for forming a strong investment strategy. These documents provide detailed evaluations of companies, including insights into their financial status, competitive landscape, and market trends. By examining the information presented in these reports, portfolio managers can find which stocks suit their investment objectives and risk appetite. This approach allows for greater informed decisions, allowing them to discover growth opportunities and steer clear of potential pitfalls. Integrating the findings from equity analysis into portfolio management inv

Investing in the stock market can be both thrilling and daunting, especially for those seeking to increase their financial assets over the long term. With countless options and diverse market conditions, rendering informed decisions is essential. This is where equity analysis comes into play, providing important information into the financial health and potential growth of companies. By utilizing equity research report s, investors can navigate the complexity of market trends and determine which stocks align with their investment strategies.

Equity analysis involves a thorough examination into a company's financial statements, industry performance, and economic indicators that could affect its market value. These reports provide investors with the knowledge they need to take well-informed decisions, potentially enhancing their portfolio's performance. Understanding the nuances of equity research allows investors to not just respond to market changes, but to anticipate and strategically allocate their resources for better outcomes.

Understanding Equity Research

Stock analysis involves the evaluation of public firms to determine their ability for investment opportunities. This form of analysis centers on economic indicators, market conditions, and competitive positioning to offer perspectives into a company's future results. Researchers evaluate a company's economic statements, growth prospects, and industry developments to formulate detailed stock research reports. These reports act as critical tools for stakeholders wanting to make educated decisions regarding stock buying or divestments.

One of the key purposes of equity analysis is to support investors evaluate the reasonable worth of a stock. Analysts utilize various valuation methods and strategies, such as DCF calculations and price-to-earnings ratios, to determine expected prices for shares. By comparing these target prices to current market prices, traders can identify potential buying or divestment opportunities. This process necessitates not only quantitative analysis but also qualitative assessments of a firm's management, operational model, and market standing.

In addition, stock analysis provides information into broader market patterns and economic signs that can impact share results. Researchers take into account large-scale elements such as borrowing costs, price increases, and joblessness when evaluating the investment scenario. By understanding these external elements along with company-specific data, investors can more effectively handle the challenges of the investment markets and improve their financial strategies. Ultimately, stock research enables investors to make more educated decisions, leading to better portfolio outcomes.

Key Metrics in Equity Analysis

When the stock of a company, several key metrics are crucial for making educated investment decisions. One prominent metric is the Earnings Per Share (EPS). EPS denotes a company's profitability on a share basis, allowing investors to gauge how well the company is producing profits relative to its outstanding shares. A increasing EPS may suggest that the company is efficiently managing its operations and growing its earnings, making it an important factor in determining stock value.

Another essential metric is the Price to Earnings (P/E) ratio, which compares a company’s current share price to its earnings per share. This ratio helps investors determine whether a stock is too expensive or underpriced relative to its earnings. A large P/E ratio may imply that investors are expecting considerable growth in the future, while a decreased P/E could suggest that the stock is too cheap or that the company is facing challenges. Comprehending the P/E ratio is vital for making comparisons within an industry or sector.

In conclusion, the Return on Equity (ROE) metric offers insights into a company's efficiency in producing profits from its equity. ROE assesses how well management is using shareholders’ funds to create growth. A elevated ROE indicates that the company is more efficient at generating profit on investments made by shareholders, which can shape investment strategies. Investors commonly look for companies with reliable and strong ROE as suitable choices for their portfolios, reflecting robust management and lucrative operations.

Applying Analysis to Portfolio Strategy

Making use of stock analysis reports is vital for forming a strong investment strategy. These documents provide detailed evaluations of companies, including insights into their financial status, competitive landscape, and market trends. By examining the information presented in these reports, portfolio managers can find which stocks suit their investment objectives and risk appetite. This approach allows for greater informed decisions, allowing them to discover growth opportunities and steer clear of potential pitfalls.

Integrating the findings from equity analysis into portfolio management involves adjusting various assets based on the recommendations from the documents. By staying updated on analysts' recommendations, such as purchase, maintain, or sell advice, portfolio managers can adjust their portfolios as needed. For instance, an upgrade on a firm's stock may encourage an investor to acquire additional stocks, while a downgrade might trigger the offloading of poorly performing stocks. This dynamic adjustment is key for maximizing investment returns.

Additionally, the practice of frequent evaluation and adjustment of your portfolio based on persisting equity analysis fosters a responsive portfolio management strategy. Market conditions and company performances can change rapidly, and regular or weekly evaluations based on the most recent analysis ensure that individuals remain aligned with their strategic objectives. By dedicating oneself to this iterative process, they can improve their portfolio's strength against market volatility, thereby boosting the probability of achieving continued economic prosperity.

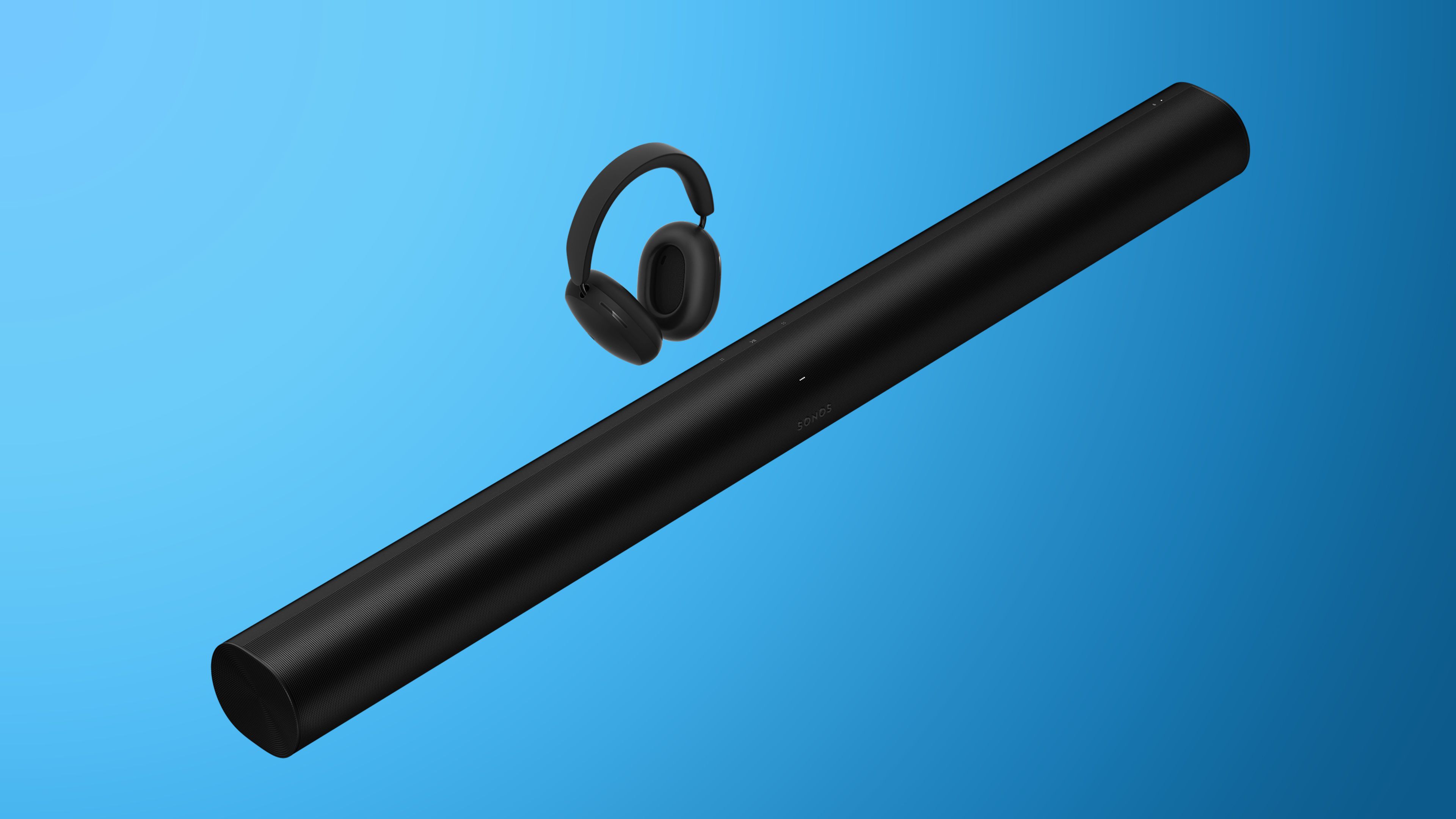

![Sonos Father's Day Sale: Save Up to 26% on Arc Ultra, Ace, Move 2, and More [Deal]](https://www.iclarified.com/images/news/97469/97469/97469-640.jpg)

.webp?#)

_Delphotos_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![[The AI Show Episode 150]: AI Answers: AI Roadmaps, Which Tools to Use, Making the Case for AI, Training, and Building GPTs](https://www.marketingaiinstitute.com/hubfs/ep%20150%20cover.png)

![[The AI Show Episode 149]: Google I/O, Claude 4, White Collar Jobs Automated in 5 Years, Jony Ive Joins OpenAI, and AI’s Impact on the Environment](https://www.marketingaiinstitute.com/hubfs/ep%20149%20cover.png)

![[FREE EBOOKS] Solutions Architect’s Handbook, The Embedded Linux Security Handbook & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![How to Survive in Tech When Everything's Changing w/ 21-year Veteran Dev Joe Attardi [Podcast #174]](https://cdn.hashnode.com/res/hashnode/image/upload/v1748483423794/0848ad8d-1381-474f-94ea-a196ad4723a4.png?#)