Analyst AI: A Founder's Journey to Revolutionize Market Research

Hello world, I'm the founder of Analyst AI, and this post isn’t just a product story. It’s about an obsession — with truth, speed, and clarity in a world that’s overloaded with noise. If you’ve ever felt paralyzed by conflicting market data, or frustrated by the time it takes to find real answers — you’re not alone. I was there. That’s why Analyst AI exists. The Problem That Sparked It All Market research is broken. Reports take hours to generate The data is scattered across dozens of tabs Analysts depend on gut feel more than systems The good tools are hidden behind expensive subscriptions We’re in a world where markets move in milliseconds — yet decisions are still made using tools from the last decade. The Vision Behind Analyst AI From day one, our mission has been crystal clear: To create an AI that thinks like an analyst — only faster, more scalable, and deeply data-driven. I wanted a system that could reason, not just retrieve. A platform that didn’t just summarize — but actually analyzed, critiqued, contextualized, and forecasted. And I wanted it to work for everyone — not just hedge funds or elite finance pros. What Makes Analyst AI Unique? This isn’t just another wrapper around ChatGPT. Analyst AI was engineered from the ground up with advanced AI architecture: LangChain + RAG + LLM Orchestration We built a self-collaborating network of language models — using LangChain agents and Retrieval-Augmented Generation (RAG) pipelines. These agents query each other like an internal debate team. One model may extract risk data, another synthesizes earnings history, while another interprets sentiment signals. It’s like having multiple analysts in a room, talking to each other, in real time. Quantum-Inspired Structuring Instead of analyzing data linearly, we structured our system to mimic quantum superposition logic — evaluating multiple perspectives on the same asset simultaneously. This drastically reduces time and increases relevance. Real-Time Multi-Asset Analysis Stocks? Crypto? Forex? Commodities? ETFs? From blue-chip equities to micro-cap tokens, our AI dives deep — evaluating risk, catalyst impact, liquidity strength, fundamentals, sentiment, and macro context in minutes. The Building Journey — Not All Glamorous What people don’t see is the 4AM debugging sprints, the dead-end experiments, the API limitations we pushed past, and the hundreds of prompts we had to rewrite to make LLMs actually useful for finance. We didn’t just connect OpenAI and call it a day. We fine-tuned reasoning agents. We built fallback chains. We cross-validated signals with raw data to catch hallucinations. We implemented self-reflection layers so LLMs could critique their own answers before output. This is engineering meets philosophy meets behavioral finance — all inside one platform. What It Looks Like Today Here’s what Analyst AI delivers right now: Full research reports in under 15 minutes Clear scores: Risk %, Catalyst Impact %, Liquidity Strength % Visuals that don’t just look good — they explain trends Instant PDF downloads with references, insights, and more Ongoing updates powered by machine learning feedback loops And all of this works seamlessly — whether you’re researching a token on Solana or analyzing earnings on the NYSE. The Human Element: Why I Care So Much I didn’t come from privilege. I had to learn markets the hard way — with losses, mistakes, and confusion. But through it all, one thing became clear: The biggest edge in investing is clarity. Not hype. Not fancy dashboards. Just clarity. And that’s what I built Analyst AI to give. Clarity, delivered fast. Clarity that compounds your decision-making edge. Clarity you can scale. Where We’re Headed Next We’re just getting started. Here’s what’s coming: Forward-Looking Simulations using behavioral pattern models AI Chat Mode to ask questions like “What’s the upside risk on NVDA this quarter?” Explainable AI Layers so every output comes with a “why” and “how” Macro + Micro Fusion Models blending news + fundamentals + chain data This is the future of market research. And we’re building it in public — with feedback from every trader, founder, and analyst who’s tired of the noise. Try Analyst AI — It’s Built for You This isn’t a product for “techies.” This is for the investor who wants insight without delay. For the founder who wants clarity without cost. For the curious mind who wants an edge. You can generate your first AI-powered report right now, for free. Try Analyst AI Today Thank you for reading. If you’ve made it this far, I appreciate your time — truly. I built this not just as a tool, but as a philosophy: Clarity is power. Speed is strategy. AI is the unlock. And we’re just getting started. — [Prajwal.V.V], Founder of Analyst AI

Hello world,

I'm the founder of Analyst AI, and this post isn’t just a product story. It’s about an obsession — with truth, speed, and clarity in a world that’s overloaded with noise. If you’ve ever felt paralyzed by conflicting market data, or frustrated by the time it takes to find real answers — you’re not alone. I was there. That’s why Analyst AI exists.

The Problem That Sparked It All

Market research is broken.

- Reports take hours to generate

- The data is scattered across dozens of tabs

- Analysts depend on gut feel more than systems

- The good tools are hidden behind expensive subscriptions

We’re in a world where markets move in milliseconds — yet decisions are still made using tools from the last decade.

The Vision Behind Analyst AI

From day one, our mission has been crystal clear:

To create an AI that thinks like an analyst — only faster, more scalable, and deeply data-driven.

I wanted a system that could reason, not just retrieve. A platform that didn’t just summarize — but actually analyzed, critiqued, contextualized, and forecasted.

And I wanted it to work for everyone — not just hedge funds or elite finance pros.

What Makes Analyst AI Unique?

This isn’t just another wrapper around ChatGPT. Analyst AI was engineered from the ground up with advanced AI architecture:

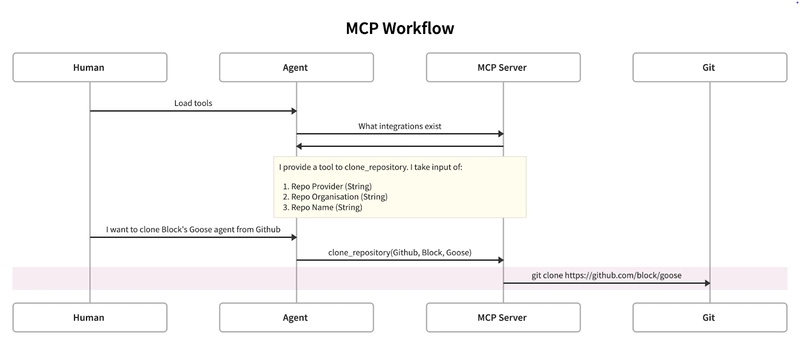

LangChain + RAG + LLM Orchestration

We built a self-collaborating network of language models — using LangChain agents and Retrieval-Augmented Generation (RAG) pipelines. These agents query each other like an internal debate team. One model may extract risk data, another synthesizes earnings history, while another interprets sentiment signals. It’s like having multiple analysts in a room, talking to each other, in real time.

Quantum-Inspired Structuring

Instead of analyzing data linearly, we structured our system to mimic quantum superposition logic — evaluating multiple perspectives on the same asset simultaneously. This drastically reduces time and increases relevance.

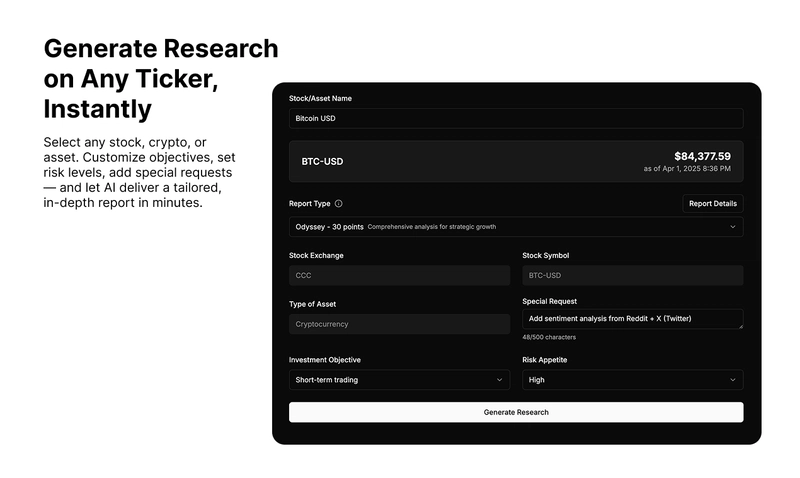

Real-Time Multi-Asset Analysis

- Stocks?

- Crypto?

- Forex?

- Commodities?

- ETFs?

From blue-chip equities to micro-cap tokens, our AI dives deep — evaluating risk, catalyst impact, liquidity strength, fundamentals, sentiment, and macro context in minutes.

The Building Journey — Not All Glamorous

What people don’t see is the 4AM debugging sprints, the dead-end experiments, the API limitations we pushed past, and the hundreds of prompts we had to rewrite to make LLMs actually useful for finance.

We didn’t just connect OpenAI and call it a day. We fine-tuned reasoning agents. We built fallback chains. We cross-validated signals with raw data to catch hallucinations. We implemented self-reflection layers so LLMs could critique their own answers before output.

This is engineering meets philosophy meets behavioral finance — all inside one platform.

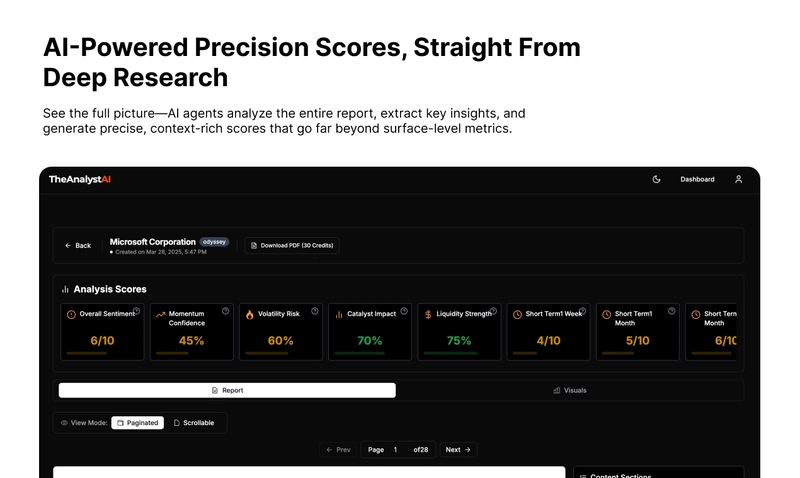

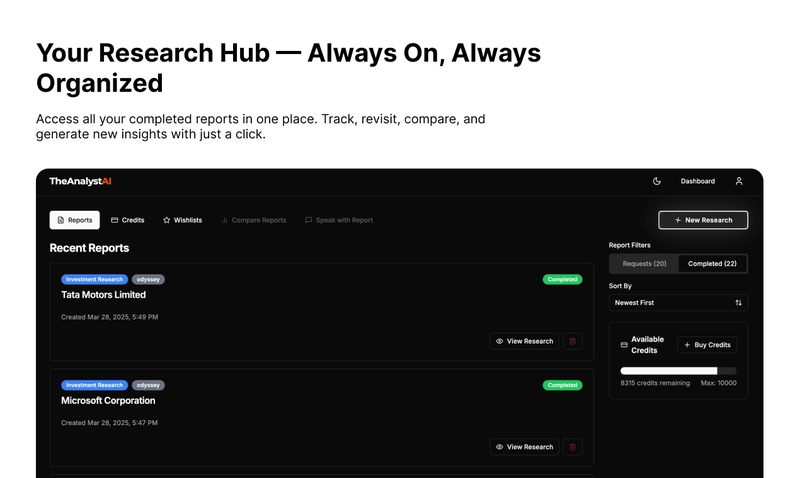

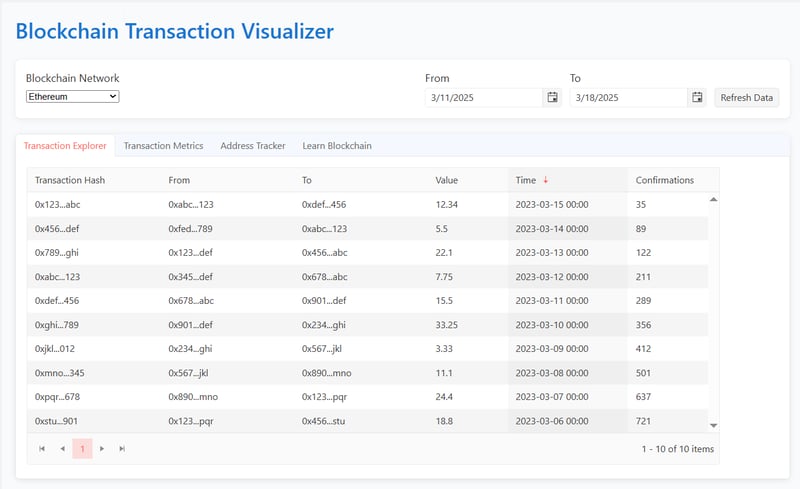

What It Looks Like Today

Here’s what Analyst AI delivers right now:

- Full research reports in under 15 minutes

- Clear scores: Risk %, Catalyst Impact %, Liquidity Strength %

- Visuals that don’t just look good — they explain trends

- Instant PDF downloads with references, insights, and more

- Ongoing updates powered by machine learning feedback loops

And all of this works seamlessly — whether you’re researching a token on Solana or analyzing earnings on the NYSE.

The Human Element: Why I Care So Much

I didn’t come from privilege. I had to learn markets the hard way — with losses, mistakes, and confusion. But through it all, one thing became clear:

The biggest edge in investing is clarity.

Not hype. Not fancy dashboards. Just clarity.

And that’s what I built Analyst AI to give. Clarity, delivered fast. Clarity that compounds your decision-making edge. Clarity you can scale.

Where We’re Headed Next

We’re just getting started. Here’s what’s coming:

- Forward-Looking Simulations using behavioral pattern models

- AI Chat Mode to ask questions like “What’s the upside risk on NVDA this quarter?”

- Explainable AI Layers so every output comes with a “why” and “how”

- Macro + Micro Fusion Models blending news + fundamentals + chain data

This is the future of market research. And we’re building it in public — with feedback from every trader, founder, and analyst who’s tired of the noise.

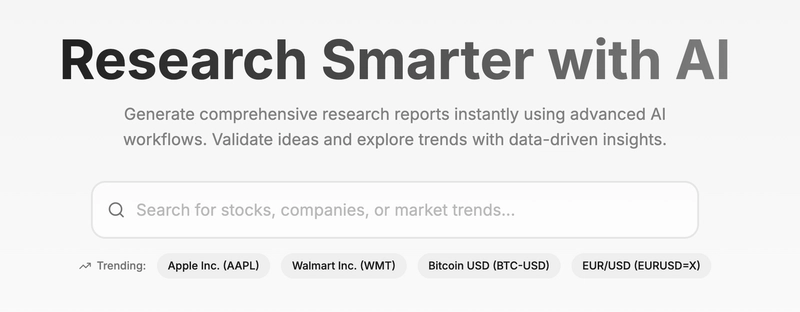

Try Analyst AI — It’s Built for You

This isn’t a product for “techies.” This is for the investor who wants insight without delay. For the founder who wants clarity without cost. For the curious mind who wants an edge.

You can generate your first AI-powered report right now, for free.

Thank you for reading.

If you’ve made it this far, I appreciate your time — truly. I built this not just as a tool, but as a philosophy:

Clarity is power. Speed is strategy. AI is the unlock.

And we’re just getting started.

— [Prajwal.V.V], Founder of Analyst AI

![Apple Vision Pro 2 Allegedly in Production Ahead of 2025 Launch [Rumor]](https://www.iclarified.com/images/news/96965/96965/96965-640.jpg)

![Yes, the Gemini icon is now bigger and brighter on Android [U]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/02/Gemini-on-Galaxy-S25.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

-xl.jpg)

_ArtemisDiana_Alamy.jpg?#)

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![From drop-out to software architect with Jason Lengstorf [Podcast #167]](https://cdn.hashnode.com/res/hashnode/image/upload/v1743796461357/f3d19cd7-e6f5-4d7c-8bfc-eb974bc8da68.png?#)