Arrests in Tap-to-Pay Scheme Powered by Phishing

Authorities in at least two U.S. states last week independently announced arrests of Chinese nationals accused of perpetrating a novel form of tap-to-pay fraud using mobile devices. Details released by authorities so far indicate the mobile wallets being used by the scammers were created through online phishing scams, and that the accused were relying on a custom Android app to relay tap-to-pay transactions from mobile devices located in China.

Authorities in at least two U.S. states last week independently announced arrests of Chinese nationals accused of perpetrating a novel form of tap-to-pay fraud using mobile devices. Details released by authorities so far indicate the mobile wallets being used by the scammers were created through online phishing scams, and that the accused were relying on a custom Android app to relay tap-to-pay transactions from mobile devices located in China.

Image: WLVT-8.

Authorities in Knoxville, Tennessee last week said they arrested 11 Chinese nationals accused of buying tens of thousands of dollars worth of gift cards at local retailers with mobile wallets created through online phishing scams. The Knox County Sheriff’s office said the arrests are considered the first in the nation for a new type of tap-to-pay fraud.

Responding to questions about what makes this scheme so remarkable, Knox County said that while it appears the fraudsters are simply buying gift cards, in fact they are using multiple transactions to purchase various gift cards and are plying their scam from state to state.

“These offenders have been traveling nationwide, using stolen credit card information to purchase gift cards and launder funds,” Knox County Chief Deputy Bernie Lyon wrote. “During Monday’s operation, we recovered gift cards valued at over $23,000, all bought with unsuspecting victims’ information.”

Asked for specifics about the mobile devices seized from the suspects, Lyon said “tap-to-pay fraud involves a group utilizing Android phones to conduct Apple Pay transactions utilizing stolen or compromised credit/debit card information,” [emphasis added].

Lyon declined to offer additional specifics about the mechanics of the scam, citing an ongoing investigation.

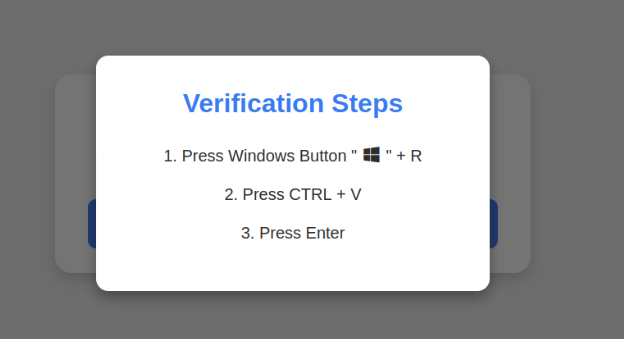

Ford Merrill works in security research at SecAlliance, a CSIS Security Group company. Merrill said there aren’t many valid use cases for Android phones to transmit Apple Pay transactions. That is, he said, unless they are running a custom Android app that KrebsOnSecurity wrote about last month as a part of a deep dive into the sprawling operations of China-based phishing cartels that are breathing new life into the payment card fraud industry (a.k.a. “carding”).

How are these China-based phishing groups obtaining stolen payment card data and then loading it onto Google and Apple phones? It all starts with phishing.

If you own a mobile phone, the chances are excellent that at some point in the past two years it has received at least one phishing message that spoofs the U.S. Postal Service to supposedly collect some outstanding delivery fee, or an SMS that pretends to be a local toll road operator warning of a delinquent toll fee.

These messages are being sent through sophisticated phishing kits sold by several cybercriminals based in mainland China. And they are not traditional SMS phishing or “smishing” messages, as they bypass the mobile networks entirely. Rather, the missives are sent through the Apple iMessage service and through RCS, the functionally equivalent technology on Google phones.

People who enter their payment card data at one of these sites will be told their financial institution needs to verify the small transaction by sending a one-time passcode to the customer’s mobile device. In reality, that code will be sent by the victim’s financial institution in response to a request by the fraudsters to link the phished card data to a mobile wallet.

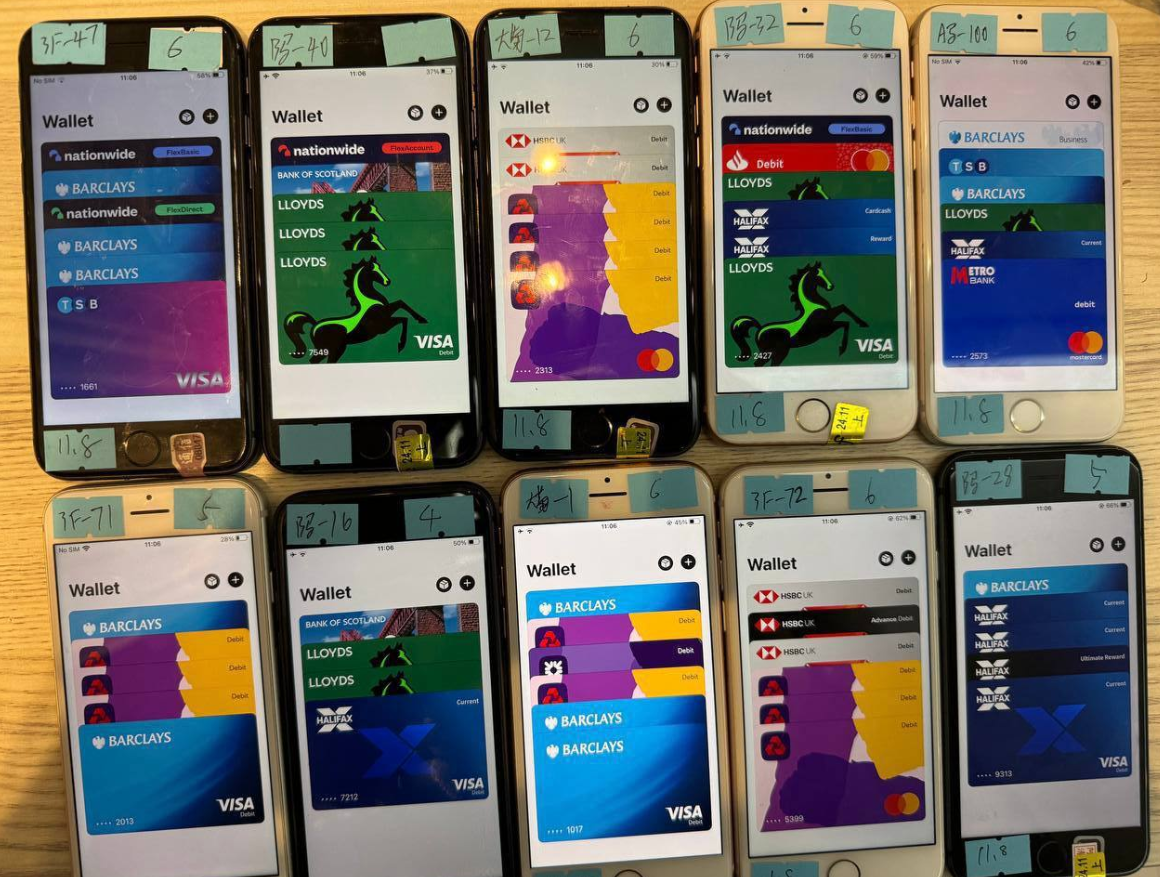

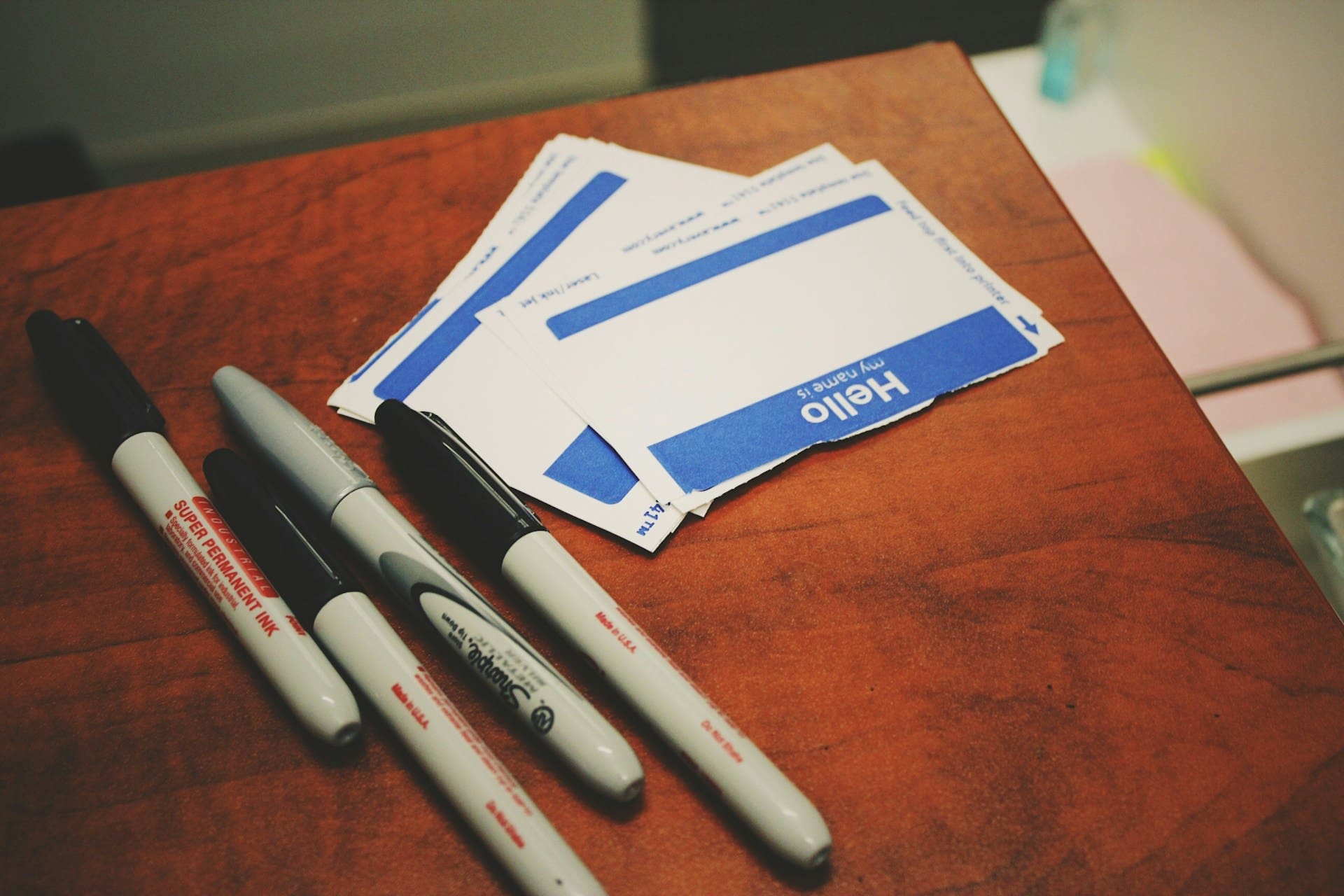

If the victim then provides that one-time code, the phishers will link the card data to a new mobile wallet from Apple or Google, loading the wallet onto a mobile phone that the scammers control. These phones are then loaded with multiple stolen wallets (often between 5-10 per device) and sold in bulk to scammers on Telegram.

An image from the Telegram channel for a popular Chinese smishing kit vendor shows 10 mobile phones for sale, each loaded with 5-7 digital wallets from different financial institutions.

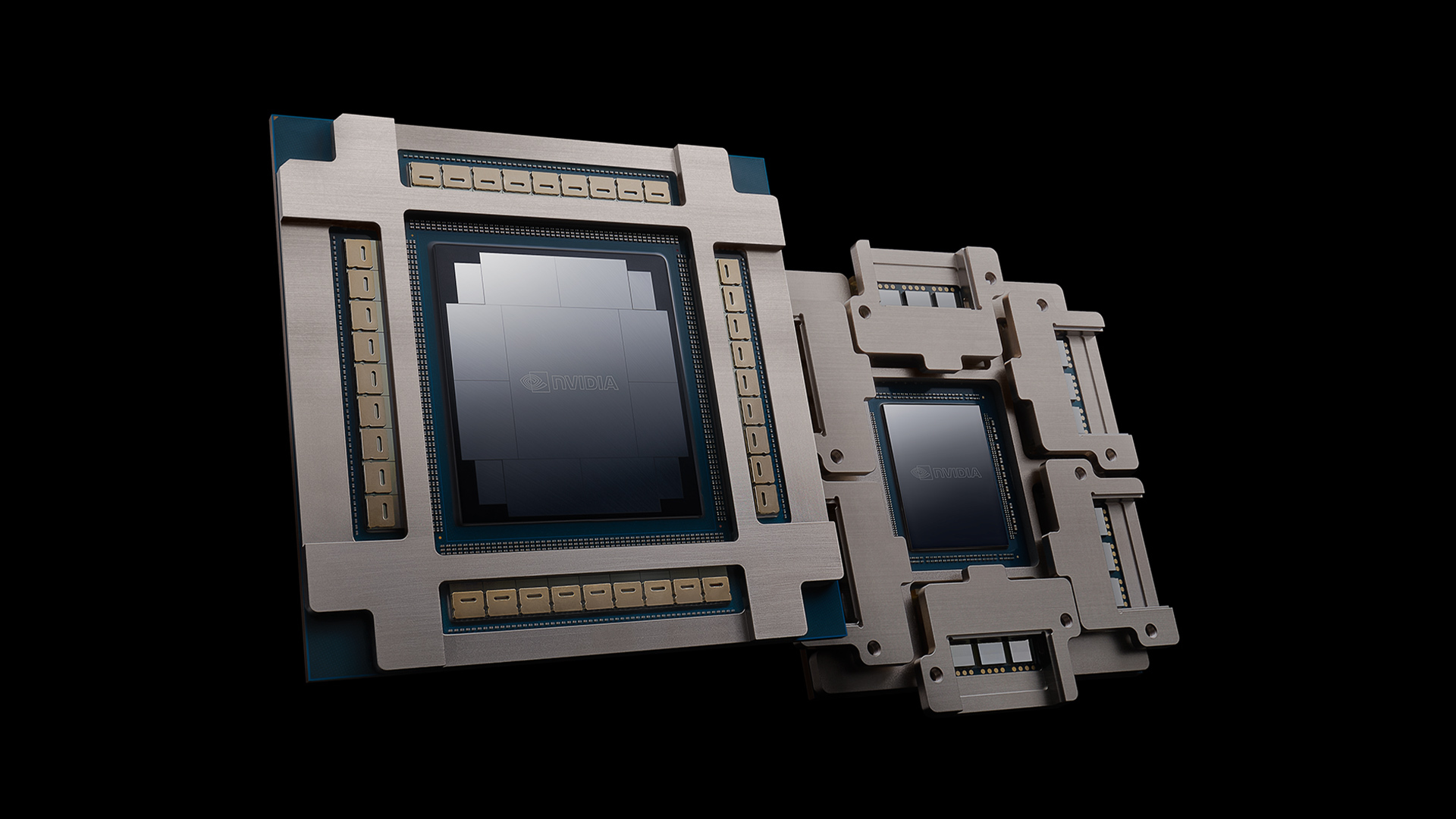

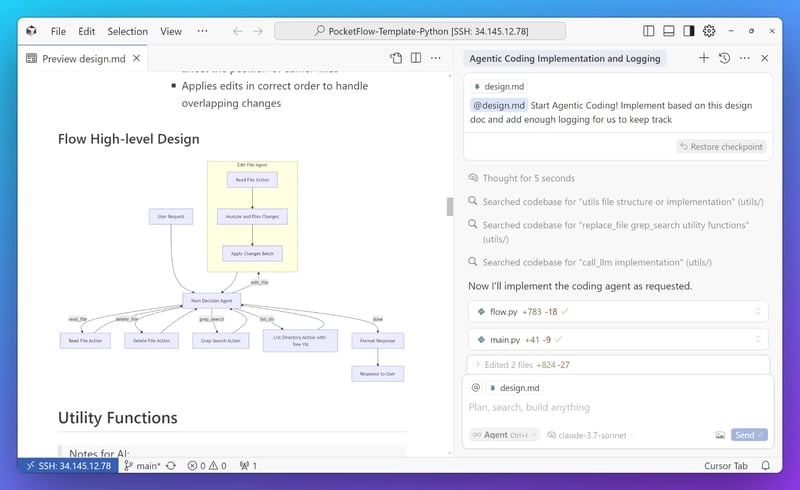

Merrill found that at least one of the Chinese phishing groups sells an Android app called “Z-NFC” that can relay a valid NFC transaction to anywhere in the world. The user simply waves their phone at a local payment terminal that accepts Apple or Google pay, and the app relays an NFC transaction over the Internet from a phone in China.

“I would be shocked if this wasn’t the NFC relay app,” Merrill said, concerning the arrested suspects in Tennessee.

Merrill said the Z-NFC software can work from anywhere in the world, and that one phishing gang offers the software for $500 a month.

“It can relay both NFC enabled tap-to-pay as well as any digital wallet,” Merrill said. “They even have 24-hour support.”

On March 16, the ABC affiliate in Sacramento (ABC10), Calif. aired a segment about two Chinese nationals who were arrested after using an app to run stolen credit cards at a local Target store. The news story quoted investigators saying the men were trying to buy gift cards using a mobile app that cycled through more than 80 stolen payment cards.

ABC10 reported that while most of those transactions were declined, the suspects still made off with $1,400 worth of gift cards. After their arrests, both men reportedly admitted that they were being paid $250 a day to conduct the fraudulent transactions.

Merrill said it’s not unusual for fraud groups to advertise this kind of work on social media networks, including TikTok.

A CBS News story on the Sacramento arrests said one of the suspects tried to use 42 separate bank cards, but that 32 were declined. Even so, the man still was reportedly able to spend $855 in the transactions.

Likewise, the suspect’s alleged accomplice tried 48 transactions on separate cards, finding success 11 times and spending $633, CBS reported.

“It’s interesting that so many of the cards were declined,” Merrill said. “One reason this might be is that banks are getting better at detecting this type of fraud. The other could be that the cards were already used and so they were already flagged for fraud even before these guys had a chance to use them. So there could be some element of just sending these guys out to stores to see if it works, and if not they’re on their own.”

Merrill’s investigation into the Telegram sales channels for these China-based phishing gangs shows their phishing sites are actively manned by fraudsters who sit in front of giant racks of Apple and Google phones that are used to send the spam and respond to replies in real time.

In other words, the phishing websites are powered by real human operators as long as new messages are being sent. Merrill said the criminals appear to send only a few dozen messages at a time, likely because completing the scam takes manual work by the human operators in China. After all, most one-time codes used for mobile wallet provisioning are generally only good for a few minutes before they expire.

For more on how these China-based mobile phishing groups operate, check out How Phished Data Turns Into Apple and Google Wallets.

The ashtray says: You’ve been phishing all night.

![Apple to Craft Key Foldable iPhone Components From Liquid Metal [Kuo]](https://www.iclarified.com/images/news/96784/96784/96784-640.jpg)

![Apple to Focus on Battery Life and Power Efficiency in Future Premium Devices [Rumor]](https://www.iclarified.com/images/news/96781/96781/96781-640.jpg)

_Federico_Caputo_Alamy.jpg?#)

![[The AI Show Episode 139]: The Government Knows AGI Is Coming, Superintelligence Strategy, OpenAI’s $20,000 Per Month Agents & Top 100 Gen AI Apps](https://www.marketingaiinstitute.com/hubfs/ep%20139%20cover-2.png)

![[The AI Show Episode 138]: Introducing GPT-4.5, Claude 3.7 Sonnet, Alexa+, Deep Research Now in ChatGPT Plus & How AI Is Disrupting Writing](https://www.marketingaiinstitute.com/hubfs/ep%20138%20cover.png)

![From hating coding to programming satellites at age 37 with Francesco Ciulla [Podcast #165]](https://cdn.hashnode.com/res/hashnode/image/upload/v1742585568977/09b25b8e-8c92-4f4b-853f-64b7f7915980.png?#)

.jpg?width=1920&height=1920&fit=bounds&quality=80&format=jpg&auto=webp#)

.png?#)