Case Study: Successful AI-Driven Investment Strategies

Case Study: Successful AI-Driven Investment Strategies Introduction As someone who has witnessed the rapid transformation of financial markets, I am constantly fascinated by how technology shapes the way we invest. Among these innovations, artificial intelligence (AI) stands out. It’s not just a tool but a game-changer. Today, we’ll explore how AI revolutionizes investments, from optimizing portfolios to analyzing market trends. The goal? To understand the strategies that have led to tangible success and their implications for the future. The Evolution of AI in Financial Investments The evolution of AI in finance has been nothing short of extraordinary. Decades ago, trading […]

Case Study: Successful AI-Driven Investment Strategies

Introduction

As someone who has witnessed the rapid transformation of financial markets, I am constantly fascinated by how technology shapes the way we invest. Among these innovations, artificial intelligence (AI) stands out. It’s not just a tool but a game-changer.

Today, we’ll explore how AI revolutionizes investments, from optimizing portfolios to analyzing market trends. The goal? To understand the strategies that have led to tangible success and their implications for the future.

Table of Contents

The Evolution of AI in Financial Investments

The evolution of AI in finance has been nothing short of extraordinary. Decades ago, trading decisions relied solely on human intuition and limited data analysis. Fast forward to today, AI-powered algorithms dominate the financial landscape.

Milestones like algorithmic trading in the 1980s and the rise of neural networks in the 2000s paved the way for AI’s integration. Now, we see AI models making stock market predictions with remarkable accuracy, enabling investors to stay ahead of market fluctuations.

AI has proven beneficial across multiple facets:

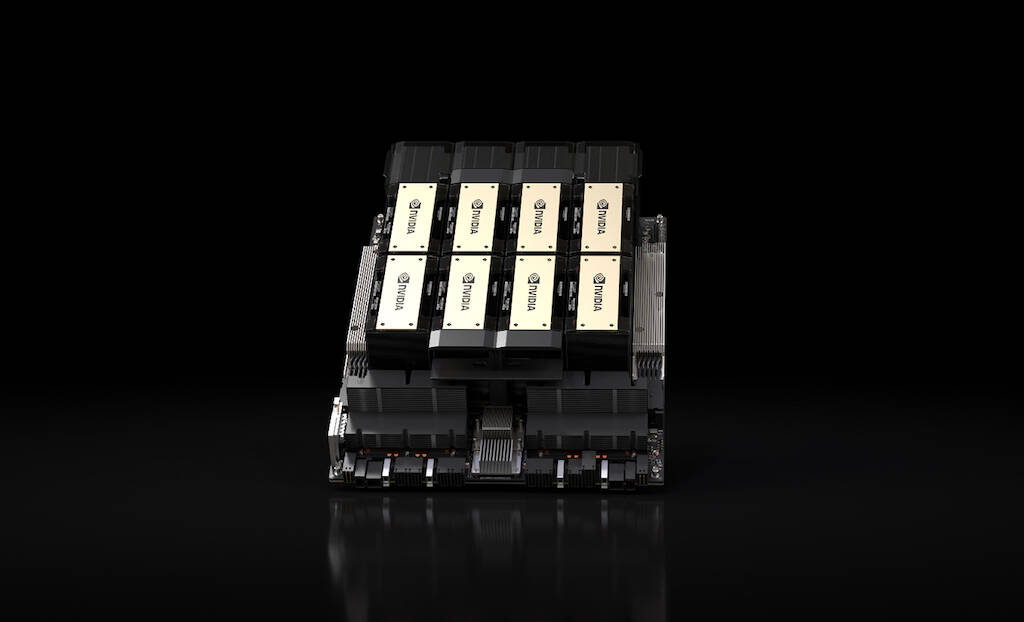

- Speed: High-frequency trading leverages millisecond execution.

- Accuracy: Algorithms minimize errors and emotional biases.

- Scalability: AI systems can process vast datasets, offering insights that humans would take weeks to uncover.

AI in Action: Core Strategies for Success

AI’s role in investments isn’t limited to just crunching numbers. Here’s how it drives success:

- Portfolio Optimization: AI helps investors balance risk and reward by analyzing historical data, market trends, and individual preferences.

- High-Frequency Trading (HFT): These systems execute thousands of trades per second, capitalizing on minute price differences.

- Risk Management: Predictive models analyze past market crises to foresee potential risks, ensuring better decision-making.

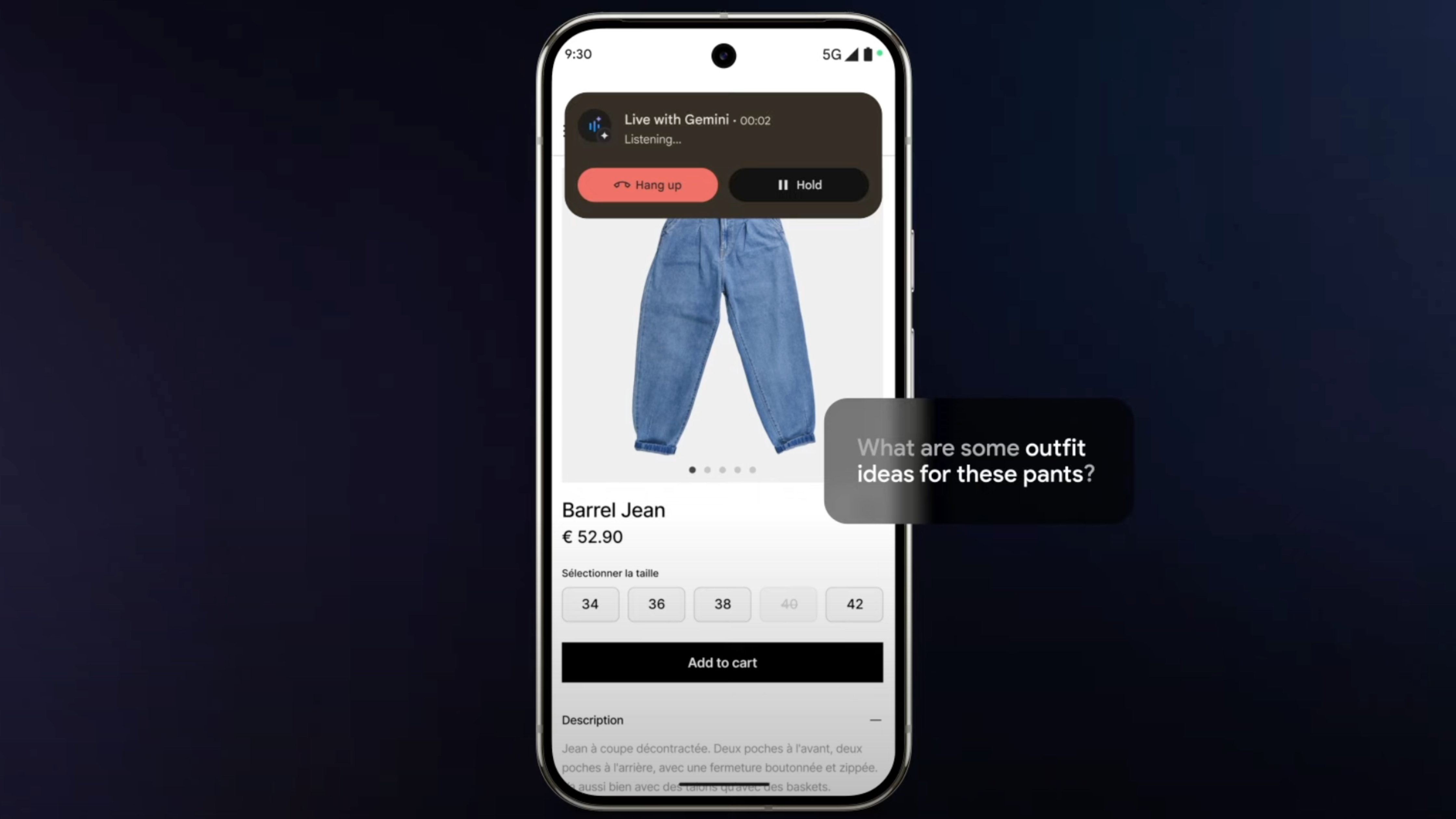

- Market Sentiment Analysis: Natural Language Processing (NLP) tools gauge public sentiment from news articles, social media, and earnings calls.

Together, these strategies form a robust framework for AI-driven success.

Case Study 1: Hedge Fund Success with AI

One of the most remarkable examples of AI’s power comes from hedge funds. Let’s look at Renaissance Technologies, a hedge fund renowned for its use of AI.

This fund employs machine learning models to analyze vast datasets, from historical prices to weather patterns. By identifying non-obvious correlations, these algorithms generate insights that human analysts might overlook.

The results? Consistently high returns, even during volatile market periods. The secret lies in their sophisticated use of reinforcement learning and advanced predictive analytics. Renaissance Technologies highlights how ai in stock market predictions can lead to groundbreaking success.

Case Study 2: AI in Retail Investing Platforms

The rise of AI isn’t limited to institutional players. Retail investors now have access to AI-powered platforms like Betterment and Wealthfront.

These platforms offer features such as:

- Robo-Advisors: AI-powered tools that create personalized portfolios based on user goals.

- Real-Time Insights: Market predictions and investment opportunities tailored to individual preferences.

- Automation: From rebalancing portfolios to optimizing tax strategies, everything is automated.

Such platforms democratize investing, allowing individuals to make informed decisions without requiring financial expertise. The challenges of AI in investment firms, however, remain evident here, as ensuring transparency and managing data privacy are ongoing concerns.

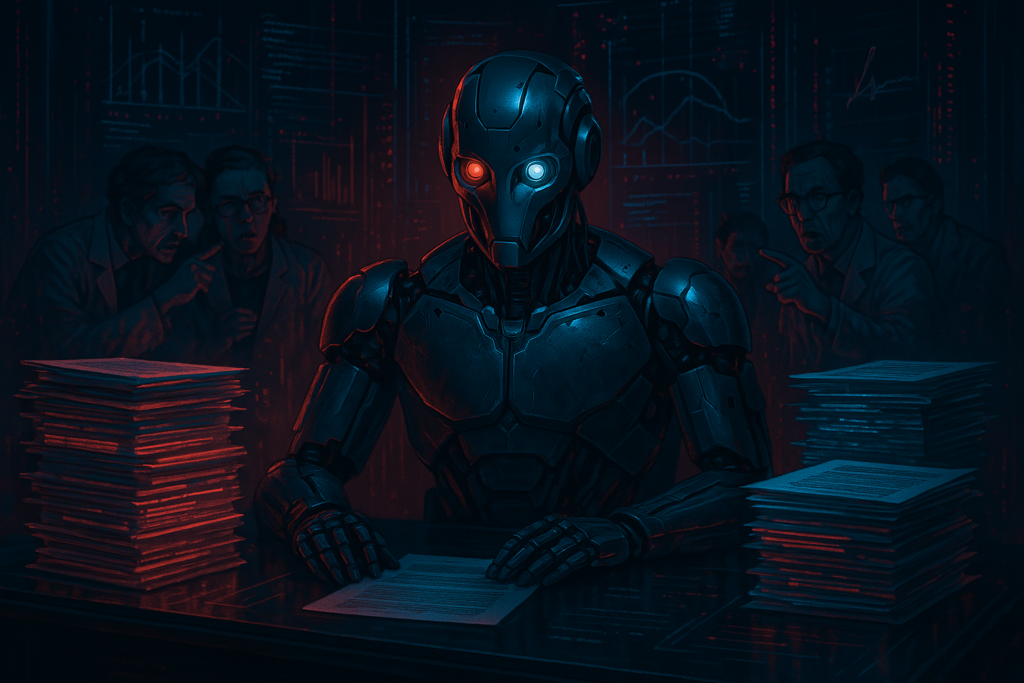

Challenges in Implementing AI-Driven Strategies

While AI’s benefits are immense, its implementation isn’t without hurdles. Here are some key challenges:

- Ethical Implications: How do we ensure fairness in AI decision-making?

- Data Quality: Poor-quality data can lead to incorrect predictions.

- Integration: Combining AI systems with legacy financial infrastructures is complex.

- Cost: Developing and maintaining AI systems is expensive, making it less accessible to smaller firms.

Addressing these challenges is crucial for AI’s sustainable growth in the financial sector.

Future Trends in AI-Driven Investments

Looking ahead, AI’s role in finance is set to expand further. Some trends to watch include:

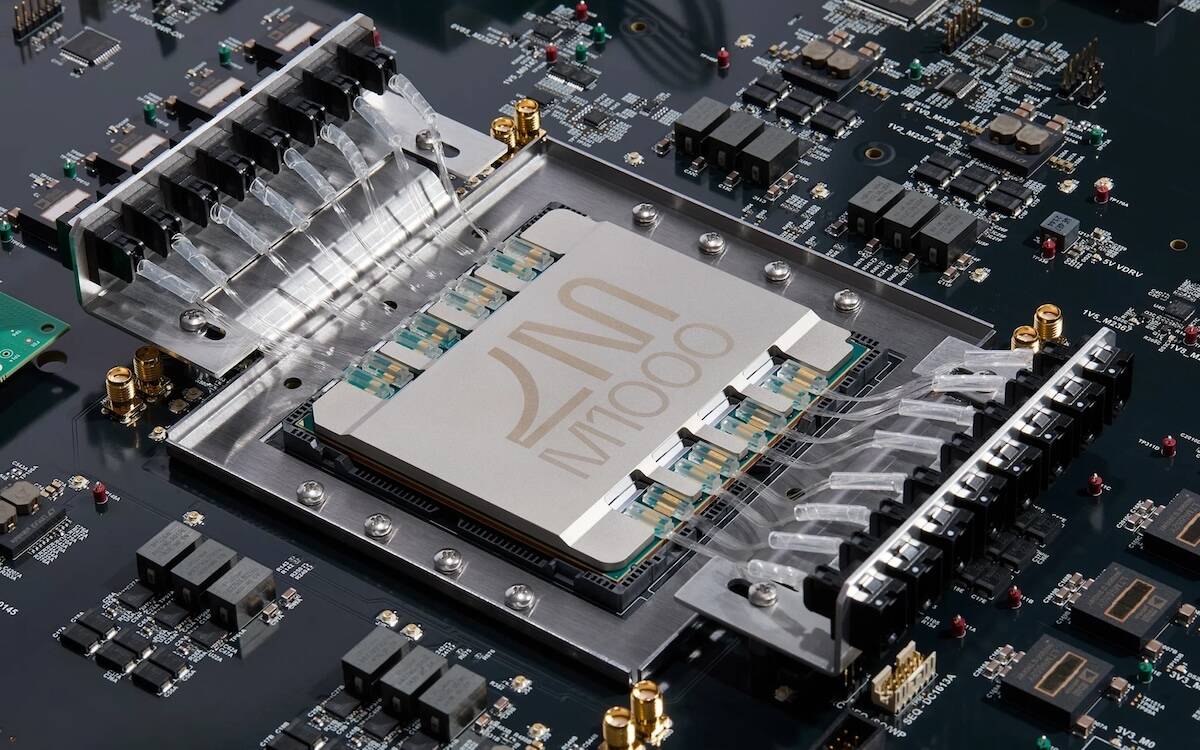

- Quantum Computing: Enhancing the speed and efficiency of AI algorithms.

- Blockchain Integration: Using decentralized technology for transparent transactions.

- Advanced Personalization: AI systems tailoring strategies even more precisely to individual investor needs.

These innovations promise to redefine the investment landscape, making it more inclusive and efficient.

Conclusion

Reflecting on the insights shared, it’s clear that AI is transforming how we approach investments. From institutional hedge funds to retail investors, the impact is far-reaching.

However, challenges like ethical dilemmas and technical limitations remind us of the need for caution. By embracing AI responsibly, we can unlock its full potential, paving the way for a smarter, more efficient financial future.

![T-Mobile says it didn't compromise its values to get FCC to approve fiber deal [UPDATED]](https://m-cdn.phonearena.com/images/article/169088-two/T-Mobile-says-it-didnt-compromise-its-values-to-get-FCC-to-approve-fiber-deal-UPDATED.jpg?#)

![Nomad Goods Launches 15% Sitewide Sale for 48 Hours Only [Deal]](https://www.iclarified.com/images/news/96899/96899/96899-640.jpg)

![Apple Watch Series 10 Prototype with Mystery Sensor Surfaces [Images]](https://www.iclarified.com/images/news/96892/96892/96892-640.jpg)

![[The AI Show Episode 142]: ChatGPT’s New Image Generator, Studio Ghibli Craze and Backlash, Gemini 2.5, OpenAI Academy, 4o Updates, Vibe Marketing & xAI Acquires X](https://www.marketingaiinstitute.com/hubfs/ep%20142%20cover.png)

![Is this a suitable approach to architect a flutter app? [closed]](https://i.sstatic.net/4hMHGb1L.png)

![From broke musician to working dev. How college drop-out Ryan Furrer taught himself to code [Podcast #166]](https://cdn.hashnode.com/res/hashnode/image/upload/v1743189826063/2080cde4-6fc0-46fb-b98d-b3d59841e8c4.png?#)