Open Source Funding and Blockchain Project Funding: Building a Community-Driven Future

Abstract This post explores the synergy between open source funding and blockchain project funding. We explain their background, core concepts, real-world applications, challenges, and future innovations. The discussion highlights how these funding models collectively empower communities, secure digital assets, and foster innovation. With technical insights, clear explanations, tables, and bullet lists, this guide is designed for developers, investors, and tech enthusiasts seeking to understand and benefit from sustainable, community-driven funding ecosystems. Introduction The technology landscape is evolving rapidly with open source and blockchain projects leading the way in innovation and community collaboration. Today, funding models are not only supporting creative software development but also ensuring sustainable ecosystems. In this post, we discuss how open source funding and blockchain project funding work together to build a resilient future. We will dive deep into how open source funding for community projects and blockchain project funding and community engagement promote transparency, innovation, and long-term sustainability. By blending traditional corporate sponsorships, crowdfunding, and innovative blockchain strategies such as Initial Coin Offerings (ICOs) and tokenization, we see a new era of funding that benefits developers, investors, and end users alike. Background and Context A Brief History Open source software began with the belief that collaboration leads to better innovation. Iconic projects like the Linux operating system and various development tools were built by diverse communities. Despite its spirit of community sharing, open source has always battled financial challenges. Many core contributors dedicate energy and time for free, a struggle detailed in discussions on Unpaid Volunteer Work. Financial Challenges and Alternatives Financial backing is essential to maintain and secure open source ecosystems. Without proper financial support, projects may stagnate or suffer from contributor burnout. To tackle this, new models have emerged: Crowdfunding: Platforms like Kickstarter and Patreon allow communities to directly support projects. Corporate Sponsorship: Companies such as Google, Red Hat, and others have recognized that sponsoring open source projects ensures robust technology that benefits their own products. Grants and Tokenization: Organizations like the Mozilla Foundation provide grants, while newer models explore token-based incentives. The Blockchain Revolution Blockchain technology introduces decentralized and transparent methods of managing funds. With immutable ledgers and smart contracts, blockchain funding methods such as ICOs, STOs, and even hybrid models provide new ways for communities to engage and invest. To learn more about the fundamentals of this technology, see What is Blockchain. Synergy Between Open Source and Blockchain Funding Both funding ecosystems prioritize community engagement and transparency. While open source thrives on collaborative code contributions, blockchain leverages tokenization and decentralized governance. Projects like The Sandbox Assets NFT Collection show how blockchain can integrate creative innovation with financial incentives. This synergy is paving the way for secure, sustainable, and community-powered digital ecosystems. Core Concepts and Features In this section, we break down key concepts of open source and blockchain funding models, highlighting their similarities and unique characteristics. Open Source Funding Models Traditional open source projects gain support from: Crowdfunding: Direct contributions from users. Platforms like Patreon help maintainers receive steady funding. Corporate Sponsorship: Large enterprises invest in projects that support their infrastructure. Grants: Support from foundations and institutions like Sustainable Funding for Open Source provides resources for long-term development. Tokenization and Dual Licensing: Some projects experiment with token-based rewards to incentivize contributors. Blockchain Funding Mechanisms Blockchain projects adopt innovative funding strategies such as: Initial Coin Offerings (ICOs) & Security Token Offerings (STOs): Raising capital by selling digital tokens that often grant rights, future profit-sharing, or governance privileges. Decentralized Crowdfunding: Mobilizing a wide pool of small investors through blockchain platforms. Hybrid Models: Combining traditional investments with blockchain token sales to mitigate risks and ensure steady capital. Comparative Table: Open Source vs. Blockchain Funding Feature Open Source Funding Blockchain Funding Revenue Sources Crowdfunding, Sponsorship, and Grants ICOs, STOs, and Hybrid Models Governance Model Community-led, with decentralized decision-making Decentralized gov

Abstract

This post explores the synergy between open source funding and blockchain project funding. We explain their background, core concepts, real-world applications, challenges, and future innovations. The discussion highlights how these funding models collectively empower communities, secure digital assets, and foster innovation. With technical insights, clear explanations, tables, and bullet lists, this guide is designed for developers, investors, and tech enthusiasts seeking to understand and benefit from sustainable, community-driven funding ecosystems.

Introduction

The technology landscape is evolving rapidly with open source and blockchain projects leading the way in innovation and community collaboration. Today, funding models are not only supporting creative software development but also ensuring sustainable ecosystems. In this post, we discuss how open source funding and blockchain project funding work together to build a resilient future. We will dive deep into how open source funding for community projects and blockchain project funding and community engagement promote transparency, innovation, and long-term sustainability.

By blending traditional corporate sponsorships, crowdfunding, and innovative blockchain strategies such as Initial Coin Offerings (ICOs) and tokenization, we see a new era of funding that benefits developers, investors, and end users alike.

Background and Context

A Brief History

Open source software began with the belief that collaboration leads to better innovation. Iconic projects like the Linux operating system and various development tools were built by diverse communities. Despite its spirit of community sharing, open source has always battled financial challenges. Many core contributors dedicate energy and time for free, a struggle detailed in discussions on Unpaid Volunteer Work.

Financial Challenges and Alternatives

Financial backing is essential to maintain and secure open source ecosystems. Without proper financial support, projects may stagnate or suffer from contributor burnout. To tackle this, new models have emerged:

- Crowdfunding: Platforms like Kickstarter and Patreon allow communities to directly support projects.

- Corporate Sponsorship: Companies such as Google, Red Hat, and others have recognized that sponsoring open source projects ensures robust technology that benefits their own products.

- Grants and Tokenization: Organizations like the Mozilla Foundation provide grants, while newer models explore token-based incentives.

The Blockchain Revolution

Blockchain technology introduces decentralized and transparent methods of managing funds. With immutable ledgers and smart contracts, blockchain funding methods such as ICOs, STOs, and even hybrid models provide new ways for communities to engage and invest. To learn more about the fundamentals of this technology, see What is Blockchain.

Synergy Between Open Source and Blockchain Funding

Both funding ecosystems prioritize community engagement and transparency. While open source thrives on collaborative code contributions, blockchain leverages tokenization and decentralized governance. Projects like The Sandbox Assets NFT Collection show how blockchain can integrate creative innovation with financial incentives. This synergy is paving the way for secure, sustainable, and community-powered digital ecosystems.

Core Concepts and Features

In this section, we break down key concepts of open source and blockchain funding models, highlighting their similarities and unique characteristics.

Open Source Funding Models

Traditional open source projects gain support from:

- Crowdfunding: Direct contributions from users. Platforms like Patreon help maintainers receive steady funding.

- Corporate Sponsorship: Large enterprises invest in projects that support their infrastructure.

- Grants: Support from foundations and institutions like Sustainable Funding for Open Source provides resources for long-term development.

- Tokenization and Dual Licensing: Some projects experiment with token-based rewards to incentivize contributors.

Blockchain Funding Mechanisms

Blockchain projects adopt innovative funding strategies such as:

- Initial Coin Offerings (ICOs) & Security Token Offerings (STOs): Raising capital by selling digital tokens that often grant rights, future profit-sharing, or governance privileges.

- Decentralized Crowdfunding: Mobilizing a wide pool of small investors through blockchain platforms.

- Hybrid Models: Combining traditional investments with blockchain token sales to mitigate risks and ensure steady capital.

Comparative Table: Open Source vs. Blockchain Funding

| Feature | Open Source Funding | Blockchain Funding |

|---|---|---|

| Revenue Sources | Crowdfunding, Sponsorship, and Grants | ICOs, STOs, and Hybrid Models |

| Governance Model | Community-led, with decentralized decision-making | Decentralized governance with token-based voting and staking mechanisms |

| Transparency | Open code repositories, public discussions | Blockchain ledger, smart contracts, and zero-knowledge proofs (ZK Proofs) |

| Security Measures | Peer reviews, community audits | Cryptography, smart contract audits, and privacy enhancements |

| Incentives | Recognition, sponsorship rewards, and grant funding | Token rewards, staking, yield farming, and direct investor participation |

Benefits of Integrated Funding Models

Integrating these funding models brings several key advantages:

- Enhanced Security: Guaranteed continuous updates and security patches.

- Improved Transparency: Public ledgers for blockchain and open discussions for open source ensure accountability.

- Stronger Community Engagement: Financial and reputation incentives keep communities active.

- Sustainable Growth: Stable funding streams allow long-term development and innovation.

- Faster Innovation: Reliable revenue fosters increased investment in research and quality improvements.

For further insights on how funding strengthens open source ecosystems, check out Exploring Open Source Funding Fueling Innovation and Sustainability.

Applications and Use Cases

Both funding models are finding success across multiple domains. Here are some illustrative real-world examples.

Case Study 1: Sustaining a Robust Open Source Project

Consider a Linux-based operating system that has been developed by global communities:

- Crowdfunding Campaigns: Monthly contributions via platforms like Patreon enable key developers to work full-time.

- Sponsorship Programs: Tech giants sponsor projects to secure critical infrastructures.

- Grants: Foundations provide targeted grants to cover security updates and new feature innovations.

This support system minimizes the risk of contributor burnout and keeps projects secure, vibrant, and up-to-date.

Case Study 2: Blockchain-Enabled NFT Ecosystems

NFT platforms are a prime example of blockchain-enabled community funding:

- Token Sales: Projects raise capital through ICOs, offering tokens that increase in value as community engagement grows.

- Token Rewards: NFT communities often reward participants with tokens for their contributions. This incentivizes persistent involvement and enhances overall project liquidity.

- Smart Contracts: Automated disbursement of funds via smart contracts adds a layer of trust and security, reinforcing the transparency of the ecosystem.

For example, The Sandbox Assets NFT Collection blends token economics with creative digital assets, driving community participation and revenue generation.

Case Study 3: Integrated Security Tools Development

Open source projects focused on cybersecurity benefit greatly from funding:

- Decentralized Grants: Foundations issue grants specifically to improve security measures.

- Sponsorships: Major tech companies invest in developing secure, scalable blockchain applications.

- Crowdsourced Code Contributions: Developers across the globe contribute to enhance security protocols and patch vulnerabilities.

These collaborative efforts ensure that projects not only remain relevant but also secure in an ever-changing threat landscape.

Practical Use Case Summary

Below is a bullet list summarizing the practical applications of open source and blockchain funding:

- Software Maintenance: Ensures regular updates and security patches.

- NFT Marketplaces: Facilitates the creation and trade of digital collectibles.

- Security Development: Provides continuous funding for critical security updates.

- Decentralized Finance (DeFi): Powers innovative financial services with token incentives.

- Blockchain Infrastructure: Supports scalable and sustainable blockchain ecosystems.

Challenges and Limitations

Despite many benefits, these funding models face significant challenges that require ongoing attention.

Technical Complexities

Developing robust funding mechanisms involves complex technical implementations:

- Smart Contract Development: Writing secure smart contracts that manage funds without vulnerabilities requires sophisticated programming and regular audits.

- Interoperability: Integrating blockchain with open source systems demands careful handling of compatibility, data integration, and performance issues.

- Scaling: Both funding systems must cope with high transaction volumes and growing community sizes while maintaining security and transparency.

Financial Volatility and Regulatory Hurdles

- Token Price Fluctuations: In blockchain projects, token values are often volatile, impacting available capital.

- Market Sentiment Dependency: Crowdfunding campaigns and token sales can be highly sensitive to external market conditions.

- Legal and Regulatory Issues: Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations increases administrative overhead and can restrict global participation. This is further complicated by differences between open source licenses and blockchain token regulations, as detailed in discussions on Copyleft Licenses Ultimate Guide.

Community and Adoption Barriers

Even with strong community engagement:

- Contributor Burnout: Without sustainable financial incentives, contributors may lose interest over time.

- Fragmented Ecosystems: With many funding platforms available, community efforts can become scattered, reducing the overall efficiency of support.

- Decentralized Governance Delays: Decentralized decision making can sometimes slow down project execution and cause conflicts within diverse communities.

Mitigation Strategies

To address these challenges:

- Invest in Secure Technical Infrastructure: Regular security audits of smart contracts and codebases are essential.

- Balanced Incentive Systems: Combine monetary rewards with recognition and community achievement programs.

- Clear Regulatory Guidelines: Establish and follow best practices for licensing and compliance, ensuring transparency and trust.

For further reading on the challenges of integrating these models, see Exploring the Symbiosis of Blockchain and Open Source Licensing.

Future Outlook and Innovations

Looking ahead, the landscape of open source and blockchain funding is poised for significant growth and evolution.

Emerging Trends

Several key trends indicate the direction for future innovations:

- Hybrid Funding Models: Combining traditional corporate sponsorships, crowdfunding, and blockchain token sales can balance stability with innovation.

- Tokenization of Contributions: Open source projects may increasingly reward contributions with tokens, aligning financial support with community engagement.

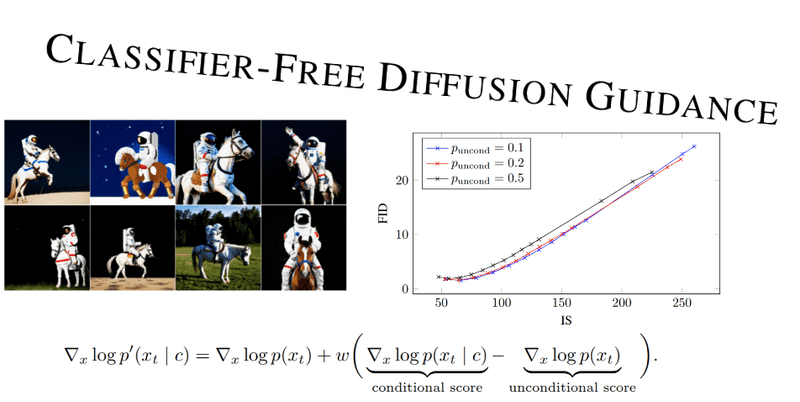

- Enhanced Security through Zero-Knowledge Proofs: As security remains critical, solutions such as zero-knowledge proofs will be more widely adopted to verify transactions without exposing sensitive data.

- AI-Driven Community and Funding Insights: Advanced data analytics and artificial intelligence can help predict funding trends and optimize community engagement, ensuring projects meet real-world demands.

Investment Opportunities

The future presents numerous opportunities:

- Developers benefit from a more stable financial model enabling full-time innovation.

- Investors can tap into early-stage funding opportunities in both blockchain and open source ecosystems.

- Communities enjoy greater influence on project directions through decentralized governance and token-based voting systems.

For additional perspectives on future trends, check out Exploring The Sandbox's Role in Musk's Metaverse Vision and Unlocking Innovation with Blockchain Grants.

Opportunities for Evolution

Innovative funding approaches will continue to break down silos between traditional and blockchain funding:

- Community-Driven Development: Open source initiatives will rely more on the combined power of grassroots contributions and blockchain-based rewards.

- Scalable Financial Mechanisms: Flux between traditional funding and token economies will improve financial resilience, thereby accelerating technological breakthroughs.

- Cross-Platform Integration: Future projects may see seamless integration between different ecosystems, ensuring interoperability and enhanced user experience.

Summary and Conclusion

In summary, the integration of open source funding and blockchain project funding represents a transformative shift in the technology landscape. By harnessing the power of community-driven initiatives, tokenization, and decentralized governance, both models create secure, transparent, and sustainable ecosystems.

Key takeaways from this discussion include:

- The evolution of open source funding from crowdfunding and sponsorships to innovative grant and tokenization models, ensuring project longevity.

- Blockchain funding mechanisms offer decentralized, transparent, and secure methods for raising capital, with smart contracts and ICOs at their core.

- Real-world applications illustrate robust support for Linux-based systems, NFT platforms, and cybersecurity tools.

- Challenges remain, including technical, financial, and regulatory hurdles; however, collaborative efforts and emerging hybrid models can address these effectively.

- Future trends point to further integrations of AI-driven insights, enhanced security protocols, and cross-community funding platforms that will continue to shape the digital innovation landscape.

By exploring and understanding these funding models, developers and investors can better support next-generation technologies. Empowered with financial sustainability, community contributions—and even regulatory frameworks—can align to create a digital future that is both innovative and secure.

We invite you to join this movement toward a community-driven future in technology. Embrace the power of open source and blockchain funding to drive innovation, foster collaboration, and build resilient ecosystems that benefit everyone involved.

For more detailed insights, visit the original article on Open Source Funding for Community Projects and explore the following resources:

- Unpaid Volunteer Work

- Sustainable Funding for Open Source

- What is Blockchain

- Zero-Knowledge Proofs on Blockchain

Additional relevant discussions from the developer community:

- Exploring Open Source Funding Fueling Innovation and Sustainability

- Exploring The Sandbox's Role in Musk's Metaverse Vision

- Exploring the Symbiosis of Blockchain and Open Source Licensing

- Unlocking Innovation with Blockchain Grants

By embracing innovative funding models and fostering community collaboration, we can build a future where technology is sustainable, secure, and driven by the passion of its creators. Join the conversation, share your thoughts, and help shape a community-driven future in technology.

_Wavebreakmedia_Ltd_IFE-240611_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

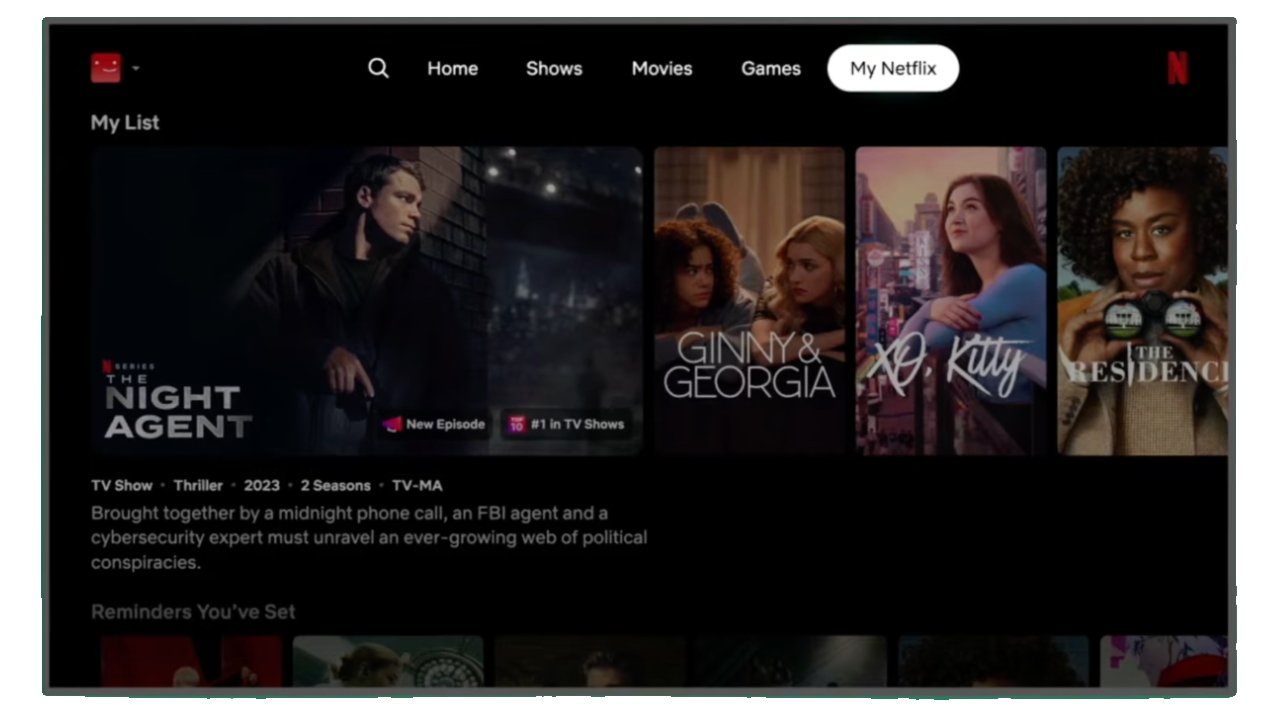

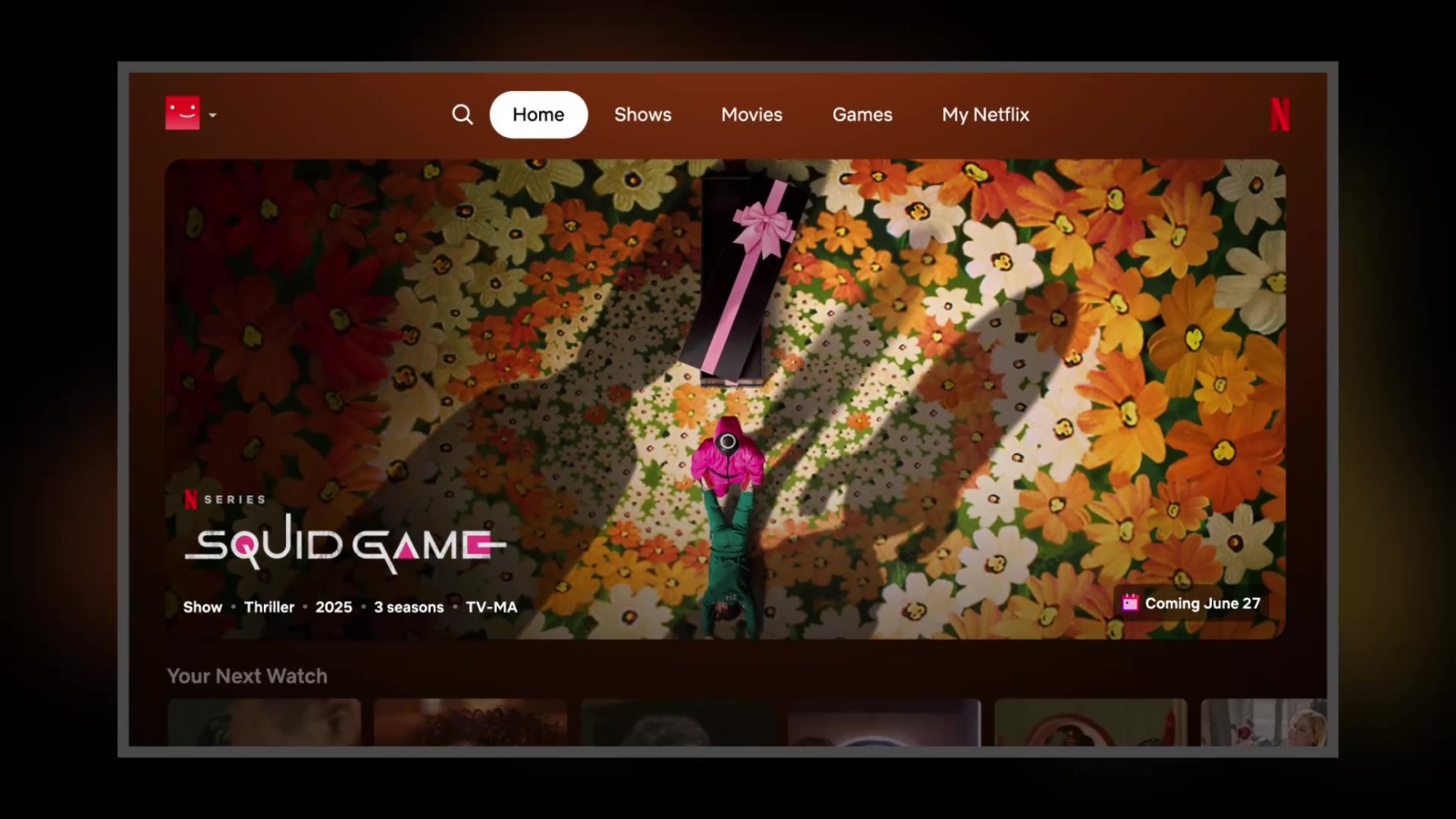

![Netflix Unveils Redesigned TV Interface With Smarter Recommendations [Video]](https://www.iclarified.com/images/news/97249/97249/97249-640.jpg)

![Apple Seeds watchOS 11.5 RC to Developers [Download]](https://www.iclarified.com/images/news/97235/97235/97235-640.jpg)

_Alexey_Kotelnikov_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Brian_Jackson_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

.jpg?#)