Unlocking Passive Income: Exploring Drip Network's Daily Rewards in the DeFi Universe

Abstract: In this post, we take a detailed look at the Drip Network and its innovative daily rewards system in decentralized finance (DeFi). We unpack its background, core concepts, use cases, challenges, and future outlook. By exploring topics such as staking, compounding yields, smart contract security, and community-driven referrals, we provide a holistic view of how Drip Network unlocks passive income. This post is designed for both technical enthusiasts and newcomers, offering clear insights and actionable guidance. Introduction Passive income in the blockchain and DeFi space has garnered significant attention. With rising interest in blockchain projects and novel yield generation models, platforms such as the Drip Network are making waves. Launched on Binance Smart Chain (BSC) in 2021, Drip Network uniquely combines smart contracts, row-by-row staking, and an innovative referral system to generate steady returns. This article explores the daily rewards system offered by Drip Network, providing a comprehensive guide that covers the platform’s context, significant features, practical applications, and potential hurdles. With a focus on keywords like passive income, DeFi rewards, staking, and daily yields, we shed light on one of the most compelling yield generation mechanics in decentralized finance today. Background and Context The Emergence of DeFi and Drip Network Decentralized Finance (DeFi) has revolutionized traditional finance by offering permissionless access to financial services. Simple yet revolutionary, the integration of smart contracts has allowed projects to automate yield generation without intermediaries. The genesis of Drip Network lies in this era of digital innovation. Since its inception in 2021 on the Binance Smart Chain, Drip Network has leveraged the blockchain’s inherent transparency and security to create a robust ecosystem for earning passive income. Notable components in this ecosystem include: Blockchain Technology: For a detailed overview of blockchain fundamentals, check out What is Blockchain. Smart Contracts: Automated scripts that execute on predetermined conditions. More can be learned about their security and intricacies at Smart Contracts on Blockchain. Yield Generation: Drip Network’s network design facilitates daily yield mechanisms that empower users to stake their tokens and generate consistent returns. Key Definitions and Ecosystem Concepts Before delving deeper, here are some core concepts: Staking: Committing a certain amount of cryptocurrency (in this case, $DRIP) to a smart contract to earn periodic returns. Smart Contract: Digital protocols on the blockchain that execute actions when conditions are met. Daily Rewards: The mechanism that pays out a fixed percentage (1% per day) on staked tokens, akin to having a high-yield savings account. Compounding Yield: Reinforcing your returns by reinvesting earned rewards, which can exponentially improve long-term benefits. Referral System: A network-enhancing strategy where users earn additional rewards by inviting others to join the platform. With these concepts in mind, let’s build on how they interconnect and power the Drip Network. Core Concepts and Features Drip Network distinguishes itself by its unique combination of features and rewards that appeal to both DeFi enthusiasts and passive income seekers. Here are the key components: 1. Daily Rewards System The platform provides a steady 1% daily return on staked $DRIP tokens. Users can think of this as a blockchain-based high-yield savings account. Each day’s reward is locked in, offering a simplified yet effective interest model in a volatile market. Compounding Gains: Reinvesting daily rewards can lead to exponential growth, thanks to the power of compound interest—a concept familiar to traditional finance enthusiasts. Maximum Payout Cap: The system limits payouts to 365% of the staked amount, providing a balance that ensures sustainability and protects against economic imbalances. 2. Staking and the Drip Faucet Drip Network’s staking mechanism is fundamental to its rewards system. By staking $DRIP tokens in the Drip Faucet smart contract, users qualify for daily returns: Secure Protocol: Built on the Binance Smart Chain, staked tokens are governed by smart contracts that have undergone audit checks. However, as with all smart contracts, some vulnerabilities might persist. Ease of Use: The process is simple, enabling even those new to cryptocurrency to start earning passive income. 3. Referral and Community Growth The referral system in Drip Network is key to the platform's community-driven growth model: Network Expansion: Users can invite friends to join the network and earn referral rewards, increasing the overall liquidity and resilience of the ecosystem. Bonus Incentives: Additional $DRIP tokens can be earned through referra

Abstract:

In this post, we take a detailed look at the Drip Network and its innovative daily rewards system in decentralized finance (DeFi). We unpack its background, core concepts, use cases, challenges, and future outlook. By exploring topics such as staking, compounding yields, smart contract security, and community-driven referrals, we provide a holistic view of how Drip Network unlocks passive income. This post is designed for both technical enthusiasts and newcomers, offering clear insights and actionable guidance.

Introduction

Passive income in the blockchain and DeFi space has garnered significant attention. With rising interest in blockchain projects and novel yield generation models, platforms such as the Drip Network are making waves. Launched on Binance Smart Chain (BSC) in 2021, Drip Network uniquely combines smart contracts, row-by-row staking, and an innovative referral system to generate steady returns. This article explores the daily rewards system offered by Drip Network, providing a comprehensive guide that covers the platform’s context, significant features, practical applications, and potential hurdles.

With a focus on keywords like passive income, DeFi rewards, staking, and daily yields, we shed light on one of the most compelling yield generation mechanics in decentralized finance today.

Background and Context

The Emergence of DeFi and Drip Network

Decentralized Finance (DeFi) has revolutionized traditional finance by offering permissionless access to financial services. Simple yet revolutionary, the integration of smart contracts has allowed projects to automate yield generation without intermediaries. The genesis of Drip Network lies in this era of digital innovation. Since its inception in 2021 on the Binance Smart Chain, Drip Network has leveraged the blockchain’s inherent transparency and security to create a robust ecosystem for earning passive income.

Notable components in this ecosystem include:

- Blockchain Technology: For a detailed overview of blockchain fundamentals, check out What is Blockchain.

- Smart Contracts: Automated scripts that execute on predetermined conditions. More can be learned about their security and intricacies at Smart Contracts on Blockchain.

- Yield Generation: Drip Network’s network design facilitates daily yield mechanisms that empower users to stake their tokens and generate consistent returns.

Key Definitions and Ecosystem Concepts

Before delving deeper, here are some core concepts:

- Staking: Committing a certain amount of cryptocurrency (in this case, $DRIP) to a smart contract to earn periodic returns.

- Smart Contract: Digital protocols on the blockchain that execute actions when conditions are met.

- Daily Rewards: The mechanism that pays out a fixed percentage (1% per day) on staked tokens, akin to having a high-yield savings account.

- Compounding Yield: Reinforcing your returns by reinvesting earned rewards, which can exponentially improve long-term benefits.

- Referral System: A network-enhancing strategy where users earn additional rewards by inviting others to join the platform.

With these concepts in mind, let’s build on how they interconnect and power the Drip Network.

Core Concepts and Features

Drip Network distinguishes itself by its unique combination of features and rewards that appeal to both DeFi enthusiasts and passive income seekers. Here are the key components:

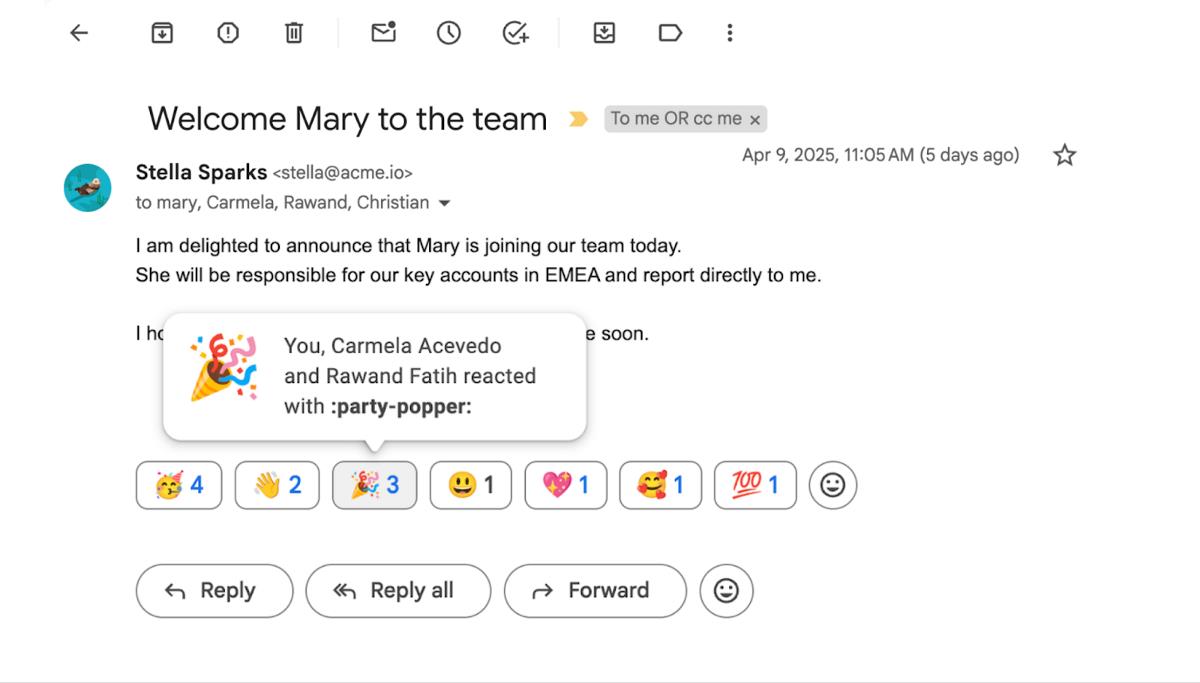

1. Daily Rewards System

The platform provides a steady 1% daily return on staked $DRIP tokens. Users can think of this as a blockchain-based high-yield savings account. Each day’s reward is locked in, offering a simplified yet effective interest model in a volatile market.

- Compounding Gains: Reinvesting daily rewards can lead to exponential growth, thanks to the power of compound interest—a concept familiar to traditional finance enthusiasts.

- Maximum Payout Cap: The system limits payouts to 365% of the staked amount, providing a balance that ensures sustainability and protects against economic imbalances.

2. Staking and the Drip Faucet

Drip Network’s staking mechanism is fundamental to its rewards system. By staking $DRIP tokens in the Drip Faucet smart contract, users qualify for daily returns:

- Secure Protocol: Built on the Binance Smart Chain, staked tokens are governed by smart contracts that have undergone audit checks. However, as with all smart contracts, some vulnerabilities might persist.

- Ease of Use: The process is simple, enabling even those new to cryptocurrency to start earning passive income.

3. Referral and Community Growth

The referral system in Drip Network is key to the platform's community-driven growth model:

- Network Expansion: Users can invite friends to join the network and earn referral rewards, increasing the overall liquidity and resilience of the ecosystem.

- Bonus Incentives: Additional $DRIP tokens can be earned through referrals, assisting users in boosting their overall stake.

For more details on the referral process, please visit the Drip Network Referral System.

4. Risk Management and Security

While the platform offers lucrative daily rewards, risk management remains crucial:

- Market Volatility: Cryptocurrency markets, including $DRIP price fluctuations, can impact returns.

- Smart Contract Risk: As with any blockchain system, the risk associated with smart contract vulnerabilities exists.

- Liquidity Considerations: Sustained withdrawals may impact overall liquidity.

- Regulatory Impact: Shifts in global and local blockchain regulations may affect operations. To gain more insight into managing these risks, consider exploring Risk Management Strategies.

Table: Key Features vs. Benefits of Drip Network

| Feature | Benefit | Notes |

|---|---|---|

| Daily 1% Return | Consistent passive income generation | Works well as a stable investment |

| Compounding Yield | Exponential growth over time | Maximizes long-term gains |

| Referral System | Encourages community building and network effect | Earn bonus rewards |

| Maximum Payout Cap | Prevents system overload and ensures sustainability | Limited to 365% payout |

| Staking on BSC | Low transaction fees and quick transactions | Trusted blockchain platform |

Applications and Use Cases

Drip Network's innovative structure lends itself to a variety of practical applications in the expanding DeFi landscape. Here are a couple of real-world use cases:

1. Passive Income for Crypto Enthusiasts

For many crypto users, earning passive income is a prime motivator. Drip Network offers a straightforward mechanism to consistently generate income through staking and daily rewards. Users who reinvest their rewards can see their portfolio grow over time without active trading.

- Example: A user stakes 1,000 $DRIP tokens, earning 10 tokens daily (1%). With regular compounding, their earnings grow exponentially, creating a significant passive income stream even during volatile market periods.

2. Community-Driven Ecosystems and Referral Benefits

Drip Network’s referral system not only enhances user benefits but also bolsters the network’s overall stability. Enthusiasts can invite peers into the ecosystem, and through a simple sharing process, the platform gains increased liquidity and resilience.

- Example: Consider a scenario where an early adopter invites five friends. The additional $DRIP tokens received through referrals boost their overall stake, leading to higher daily earnings across the entire network. Such a community-driven mechanism ensures sustainability and a stable reward flow.

3. Integrated DeFi and Open-Source Collaborations

Growing interest in open-source development and blockchain sustainability has led to integrations where community-driven projects can benefit from consistent yield generation. By channeling profits generated on platforms like Drip Network into other open-source initiatives or decentralized projects, communities can fund further innovations.

This collaborative approach is bolstered by projects discussed in Decentralized Finance (DeFi) and NFTs and supports a cycle of reinvestment into educational, open-source, and developmental projects.

Challenges and Limitations

While Drip Network offers many benefits, it is important to address the inherent challenges:

1. Market Volatility

Like all cryptocurrencies, the value of $DRIP is subject to market fluctuations. Unpredictable price changes can diminish the real-world value of daily rewards even if the percentage return remains constant.

- Risk Mitigation: Users are encouraged to balance their portfolios and only stake funds they can afford to risk.

2. Smart Contract Vulnerabilities

Despite audits and rigorous testing, no smart contract is completely immune to bugs or vulnerabilities. While Drip Network aims to provide secure interactions, the risk of potential breaches always exists.

- Best Practices: Continuous monitoring and community feedback are crucial for mitigating risks. For an in-depth look at this area, review Smart Contracts on Blockchain.

3. Liquidity Constraints

A sudden increase in withdrawal requests (especially during downturns) can strain the liquidity pools in DeFi networks. Drip Network's design includes a payout cap to help manage liquidity, but external factors may still play a role.

4. Regulatory Environment

The regulatory landscape for DeFi is evolving. Changes in laws or regulatory frameworks could have a significant impact on the operation of platforms like Drip Network.

- Ongoing Adaptation: Users and platform developers must stay informed about any changes in blockchain regulation. Explore further insights via Blockchain Regulation.

Bullet List: Key Challenges

- Market Volatility: The value of $DRIP tokens can fluctuate significantly.

- Smart Contract Risks: Despite audits, vulnerabilities may still exist.

- Liquidity Issues: Sudden high withdrawal demands can impact liquidity.

- Regulatory Uncertainty: Changes in laws could affect platform operations.

Future Outlook and Innovations

The future of platforms like Drip Network is promising, yet it is intertwined with broader trends in DeFi, blockchain interoperability, and community governance.

Trends to Watch

- Enhanced Security Protocols: As smart contract audits become more rigorous and technologies like zero-knowledge proofs advance, platforms can reduce vulnerabilities.

- Interoperability Across Chains: Improvements in blockchain interoperability (for example, using bridges between BSC, Ethereum, and emerging networks) may increase liquidity and user adoption. This development could enable a smoother transition of assets between different DeFi applications.

- Community Governance Evolution: With a solid referral system already in place, future updates may integrate decentralized governance models, empowering the community to vote on critical decisions.

- Integration with NFTs and Digital Assets: The fusion of DeFi with NFT technologies is an emerging trend. Projects like NFT Treasure and other digital collectibles further blur the lines between passive income mechanisms and asset ownership. Continuing to follow these developments can provide valuable insights into creating diversified portfolios.

Notable Innovations

Recent discussions on platforms such as Dev.to highlight the innovative spirit behind Drip Network and similar projects. Innovations include:

- Advanced Yield Farming Techniques: New methods may allow even more efficient use of staked tokens through layered yield strategies.

- Community-Driven Upgrades: Future roadmap elements might include features such as cross-chain staking and enhanced security modules.

- Expanded Referral Programs: Next-generation referral systems may offer multi-tiered rewards, further incentivizing community building and network sustainability.

By tracking topics like blockchain interoperability, smart contract auditing, and community governance, both users and developers can anticipate how the landscape will evolve.

Summary

Drip Network represents an exciting fusion of innovative DeFi mechanics, smart contract technology, and community-driven growth. Its daily rewards system, built on staking $DRIP tokens, offers consistent passive income through a simple yet effective yield generation model. With a capped payout approach that helps mitigate liquidity risks, along with a robust referral system encouraging network expansion, the platform has positioned itself as a noteworthy player in the DeFi space.

This detailed guide has taken you through:

- An Introduction where we explained the relevance and potential of passive income in DeFi.

- Background and Context that elaborated on the origins and fundamental principles behind Drip Network.

- Core Concepts and Features that broke down mechanisms such as daily rewards, staking, and referral benefits.

- Practical Applications including real-world scenarios where users can generate steady returns.

- Potential Challenges and Limitations like market volatility, smart contract vulnerabilities, liquidity constraints, and regulatory hurdles.

- Future Outlook and Innovations that shed light on exciting trends, including enhanced security, interoperability, and community governance advancements.

For more details on the original project overview, refer to the Original Article on Drip Network's Daily Rewards.

Additional Resources and Further Reading

To further enrich your understanding and keep updated with the latest in blockchain and open source developments, explore these authoritative resources:

- What is Blockchain – A primer on blockchain technology and its applications.

- Drip Network Referral System – An in-depth look at community growth strategies.

- Risk Management Strategies – Tips to safeguard your investments in DeFi.

- Blockchain Regulation – An overview of the shifting regulatory landscape for blockchain projects.

- Decentralized Finance (DeFi) and NFTs – Explore how DeFi can work in tandem with digital collectibles.

Furthermore, some insightful perspectives on blockchain and open source can be found in various Dev.to posts such as:

- Exploring the Drip Network: The Community-Driven DeFi Revolution

- Unlocking Blockchains' Potential: Arbitrum, Fraud Proofs, NFTs and Open Source

- Navigating the Funding Maze for Open Source Developers

Conclusion

Drip Network’s daily rewards feature embodies a significant shift in how digital assets can be used to generate passive income. Leveraging staking, compounding yields, and a community-driven referral system, it stands out in a crowded DeFi space. However, as with any emerging technology, it is important to balance the potential rewards against the inherent risks, including smart contract vulnerabilities, market volatility, and liquidity issues.

For investors and tech aficionados alike, understanding the operational mechanics and challenges of platforms such as Drip Network is crucial. As security protocols are enhanced and the regulatory framework mature, the prospects for consistent, reliable passive income in this arena seem promising.

By staying informed through authoritative resources and community feedback, users can take advantage of this innovative ecosystem while managing risk effectively. Whether you are a DeFi novice or a seasoned blockchain veteran, Drip Network’s approach to incentivized yield generation makes it an exciting project to watch in the evolving world of digital finance.

Happy staking and may your crypto journey be rewarding!

![Apple Ships 55 Million iPhones, Claims Second Place in Q1 2025 Smartphone Market [Report]](https://www.iclarified.com/images/news/97185/97185/97185-640.jpg)

![Android Auto light theme surfaces for the first time in years and looks nearly finished [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2023/01/android-auto-dashboard-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

_Andreas_Prott_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

![[DEALS] Mail Backup X Individual Edition: Lifetime Subscription (72% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)