Power BI vs Tableau in Financial Forecasting: Tools for Smarter Business Decisions

In the world of financial reporting and business forecasting, the debate of Power BI vs Tableau has become more relevant than ever. Finance teams must turn massive datasets into actionable insights quickly, and the right business intelligence (BI) platform can be the difference between forecasting success and missed opportunities. This article explores how both tools support financial professionals, from CFOs to analysts, in making more informed and forward-thinking decisions. The Unique Demands of Financial Reporting Financial data is dense, sensitive, and constantly evolving. Monthly close cycles, rolling forecasts, and what-if scenario modeling all require flexible, fast, and secure BI solutions. Both Tableau and Power BI serve this space well, but they differ significantly in how they approach financial analytics workflows. Power BI, tightly integrated with Microsoft Excel and Azure, provides a familiar environment for financial analysts. Its affordability and ease of use make it a go-to for organizations already in the Microsoft ecosystem. Tableau, by contrast, shines when deeper visual storytelling and live financial dashboards are required, especially in enterprises with large, complex data pipelines. Integration and Automation Capabilities Power BI connects effortlessly to Excel, SQL Server, Azure Synapse, and Dynamics 365—popular tools in finance departments. Through Power Query and built-in DAX formulas, financial professionals can create custom KPIs, variance analyses, and rolling forecast dashboards. The tool also supports automation through Power Automate, allowing scheduled reports and alerts for budget deviations or profit-margin changes. Tableau, while not as Excel-integrated, offers powerful data blending capabilities, ideal for consolidating disparate financial systems like Oracle, NetSuite, and Salesforce. Its live data connection features are ideal for high-frequency financial reporting and allow real-time performance tracking. Visualizing Forecasts and Variances Accurate visuals are critical in financial reporting. Tableau leads in this area, offering advanced options for variance analysis, waterfall charts, and interactive forecasting models. These visuals make it easier for executives to grasp trends, outliers, and financial risks at a glance. Power BI, while slightly limited in chart customization, does a solid job for most financial needs. It offers prebuilt templates for budget-to-actual comparisons, revenue tracking, and even predictive visuals via AI. These are valuable for teams needing standardized, repeatable financial reporting without heavy manual formatting. Scalability for Enterprise Finance Teams Large organizations with complex financial structures often need tools that scale well across departments, geographies, and regulatory requirements. Power BI supports this with row-level security, Azure-based scaling, and the ability to manage thousands of users under a unified workspace. Its scalability is cost-efficient but may require optimization for heavy, real-time use cases. Tableau handles large volumes of data more gracefully, especially when using Tableau Server or Tableau Cloud. For financial institutions processing millions of transactions daily, its VizQL engine supports fast, live analytics with minimal lag. Pricing Models and Total Cost for Finance Teams Price matters—especially in finance. Power BI is typically more cost-effective, with a Pro license starting at $14/user/month and Premium options that serve enterprise deployments. For many organizations, especially those using Microsoft 365, Power BI offers significant value at a low cost. Tableau is more expensive, starting around $70/user/month, but provides broader capabilities in terms of visualization, data blending, and user engagement. Larger firms often justify the cost with the depth of insight Tableau enables. Annual Cost Snapshot (Per User): Tier Power BI Tableau Basic Free N/A Pro $168/year $840/year Enterprise Custom pricing Custom pricing Financial Use Cases and Real-World Scenarios Corporate Finance teams use Power BI for monthly reports, P&L summaries, and quick turnaround dashboards tied to Excel-based models. Investment Analysts prefer Tableau for market trend visualization, historical price analysis, and multi-source data blending from APIs and financial feeds. Accounting Departments often choose Power BI for its ease of linking with ERP and payroll systems, simplifying reconciliations and cost center tracking. Private Equity Firms rely on Tableau’s flexibility for detailed portfolio performance dashboards and scenario planning. Making the Right Forecasting Choice When it comes to financial forecasting and reporting, both platforms offer unique advantages: Choose Power BI if your finance team needs tight integration with Microsoft products, lower total cost, and efficien

In the world of financial reporting and business forecasting, the debate of Power BI vs Tableau has become more relevant than ever. Finance teams must turn massive datasets into actionable insights quickly, and the right business intelligence (BI) platform can be the difference between forecasting success and missed opportunities. This article explores how both tools support financial professionals, from CFOs to analysts, in making more informed and forward-thinking decisions.

The Unique Demands of Financial Reporting

Financial data is dense, sensitive, and constantly evolving. Monthly close cycles, rolling forecasts, and what-if scenario modeling all require flexible, fast, and secure BI solutions. Both Tableau and Power BI serve this space well, but they differ significantly in how they approach financial analytics workflows.

Power BI, tightly integrated with Microsoft Excel and Azure, provides a familiar environment for financial analysts. Its affordability and ease of use make it a go-to for organizations already in the Microsoft ecosystem. Tableau, by contrast, shines when deeper visual storytelling and live financial dashboards are required, especially in enterprises with large, complex data pipelines.

Integration and Automation Capabilities

Power BI connects effortlessly to Excel, SQL Server, Azure Synapse, and Dynamics 365—popular tools in finance departments. Through Power Query and built-in DAX formulas, financial professionals can create custom KPIs, variance analyses, and rolling forecast dashboards. The tool also supports automation through Power Automate, allowing scheduled reports and alerts for budget deviations or profit-margin changes.

Tableau, while not as Excel-integrated, offers powerful data blending capabilities, ideal for consolidating disparate financial systems like Oracle, NetSuite, and Salesforce. Its live data connection features are ideal for high-frequency financial reporting and allow real-time performance tracking.

Visualizing Forecasts and Variances

Accurate visuals are critical in financial reporting. Tableau leads in this area, offering advanced options for variance analysis, waterfall charts, and interactive forecasting models. These visuals make it easier for executives to grasp trends, outliers, and financial risks at a glance.

Power BI, while slightly limited in chart customization, does a solid job for most financial needs. It offers prebuilt templates for budget-to-actual comparisons, revenue tracking, and even predictive visuals via AI. These are valuable for teams needing standardized, repeatable financial reporting without heavy manual formatting.

Scalability for Enterprise Finance Teams

Large organizations with complex financial structures often need tools that scale well across departments, geographies, and regulatory requirements.

- Power BI supports this with row-level security, Azure-based scaling, and the ability to manage thousands of users under a unified workspace. Its scalability is cost-efficient but may require optimization for heavy, real-time use cases.

- Tableau handles large volumes of data more gracefully, especially when using Tableau Server or Tableau Cloud. For financial institutions processing millions of transactions daily, its VizQL engine supports fast, live analytics with minimal lag.

Pricing Models and Total Cost for Finance Teams

Price matters—especially in finance. Power BI is typically more cost-effective, with a Pro license starting at $14/user/month and Premium options that serve enterprise deployments. For many organizations, especially those using Microsoft 365, Power BI offers significant value at a low cost.

Tableau is more expensive, starting around $70/user/month, but provides broader capabilities in terms of visualization, data blending, and user engagement. Larger firms often justify the cost with the depth of insight Tableau enables.

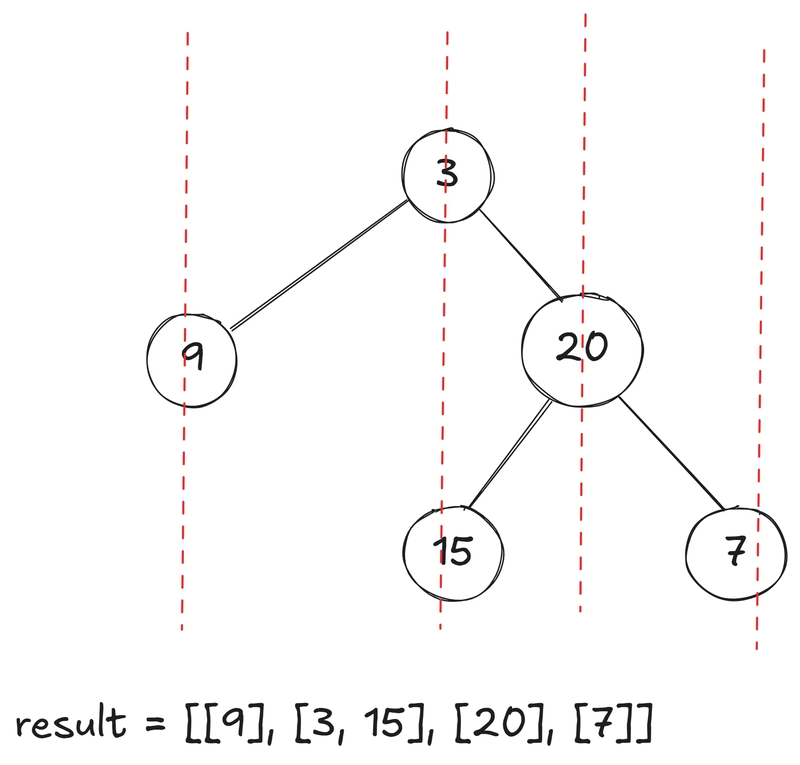

Annual Cost Snapshot (Per User):

| Tier | Power BI | Tableau |

|---|---|---|

| Basic | Free | N/A |

| Pro | $168/year | $840/year |

| Enterprise | Custom pricing | Custom pricing |

Financial Use Cases and Real-World Scenarios

- Corporate Finance teams use Power BI for monthly reports, P&L summaries, and quick turnaround dashboards tied to Excel-based models.

- Investment Analysts prefer Tableau for market trend visualization, historical price analysis, and multi-source data blending from APIs and financial feeds.

- Accounting Departments often choose Power BI for its ease of linking with ERP and payroll systems, simplifying reconciliations and cost center tracking.

- Private Equity Firms rely on Tableau’s flexibility for detailed portfolio performance dashboards and scenario planning.

Making the Right Forecasting Choice

When it comes to financial forecasting and reporting, both platforms offer unique advantages:

- Choose Power BI if your finance team needs tight integration with Microsoft products, lower total cost, and efficient dashboarding for recurring reports.

- Choose Tableau if you require deeper visualizations, live data access, and flexible modeling for complex or dynamic financial environments.

Final Thought

Both Tableau and Power BI are capable tools for financial forecasting—but your choice should align with your existing tools, data complexity, and reporting goals. Try both tools in a pilot environment to see which fits your forecasting needs best before making a long-term investment.

![Apple Developing Battery Case for iPhone 17 Air Amid Battery Life Concerns [Report]](https://www.iclarified.com/images/news/97208/97208/97208-640.jpg)

![Apple to Split iPhone Launches Across Fall and Spring in Major Shakeup [Report]](https://www.iclarified.com/images/news/97211/97211/97211-640.jpg)

![Apple to Move Camera to Top Left, Hide Face ID Under Display in iPhone 18 Pro Redesign [Report]](https://www.iclarified.com/images/news/97212/97212/97212-640.jpg)

![AirPods 4 On Sale for $99 [Lowest Price Ever]](https://www.iclarified.com/images/news/97206/97206/97206-640.jpg)

_Inge_Johnsson-Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

![From Art School Drop-out to Microsoft Engineer with Shashi Lo [Podcast #170]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746203291209/439bf16b-c820-4fe8-b69e-94d80533b2df.png?#)

![[DEALS] Microsoft 365: 1-Year Subscription (Family/Up to 6 Users) (23% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)