Larry Fink Says Bitcoin Could Replace the Dollar as the World's Reserve Currency Because of National Debt

With America's national debt sitting comfortably over the $36.2 trillion mark, BlackRock CEO Larry Fink is warning the burden could one day be the reason the dollar is dethroned as the reserve currency of the world. From a report: He argues that decentralized currencies like Bitcoin could replace the dollar as worldwide organizations lose faith in national currencies and seek an independent solution. Fink explained his theory in his 2025 letter to shareholders, writing: "The U.S. has benefited from the dollar serving as the world's reserve currency for decades. But that's not guaranteed to last forever. "The national debt has grown at three times the pace of GDP since Times Square's debt clock started ticking in 1989. This year, interest payments will surpass $952 billion -- exceeding defense spending. By 2030, mandatory government spending and debt service will consume all federal revenue, creating a permanent deficit. If the U.S. doesn't get its debt under control, if deficits keep ballooning, America risks losing that position to digital assets like Bitcoin." Read more of this story at Slashdot.

Read more of this story at Slashdot.

![Some T-Mobile customers can track real-time location of other users and random kids without permission [UPDATED]](https://m-cdn.phonearena.com/images/article/169135-two/Some-T-Mobile-customers-can-track-real-time-location-of-other-users-and-random-kids-without-permission-UPDATED.jpg?#)

![Apple Releases macOS Sequoia 15.5 Beta to Developers [Download]](https://www.iclarified.com/images/news/96915/96915/96915-640.jpg)

![Amazon Makes Last-Minute Bid for TikTok [Report]](https://www.iclarified.com/images/news/96917/96917/96917-640.jpg)

![Apple Releases iOS 18.5 Beta and iPadOS 18.5 Beta [Download]](https://www.iclarified.com/images/news/96907/96907/96907-640.jpg)

![Apple Seeds watchOS 11.5 to Developers [Download]](https://www.iclarified.com/images/news/96909/96909/96909-640.jpg)

![[The AI Show Episode 142]: ChatGPT’s New Image Generator, Studio Ghibli Craze and Backlash, Gemini 2.5, OpenAI Academy, 4o Updates, Vibe Marketing & xAI Acquires X](https://www.marketingaiinstitute.com/hubfs/ep%20142%20cover.png)

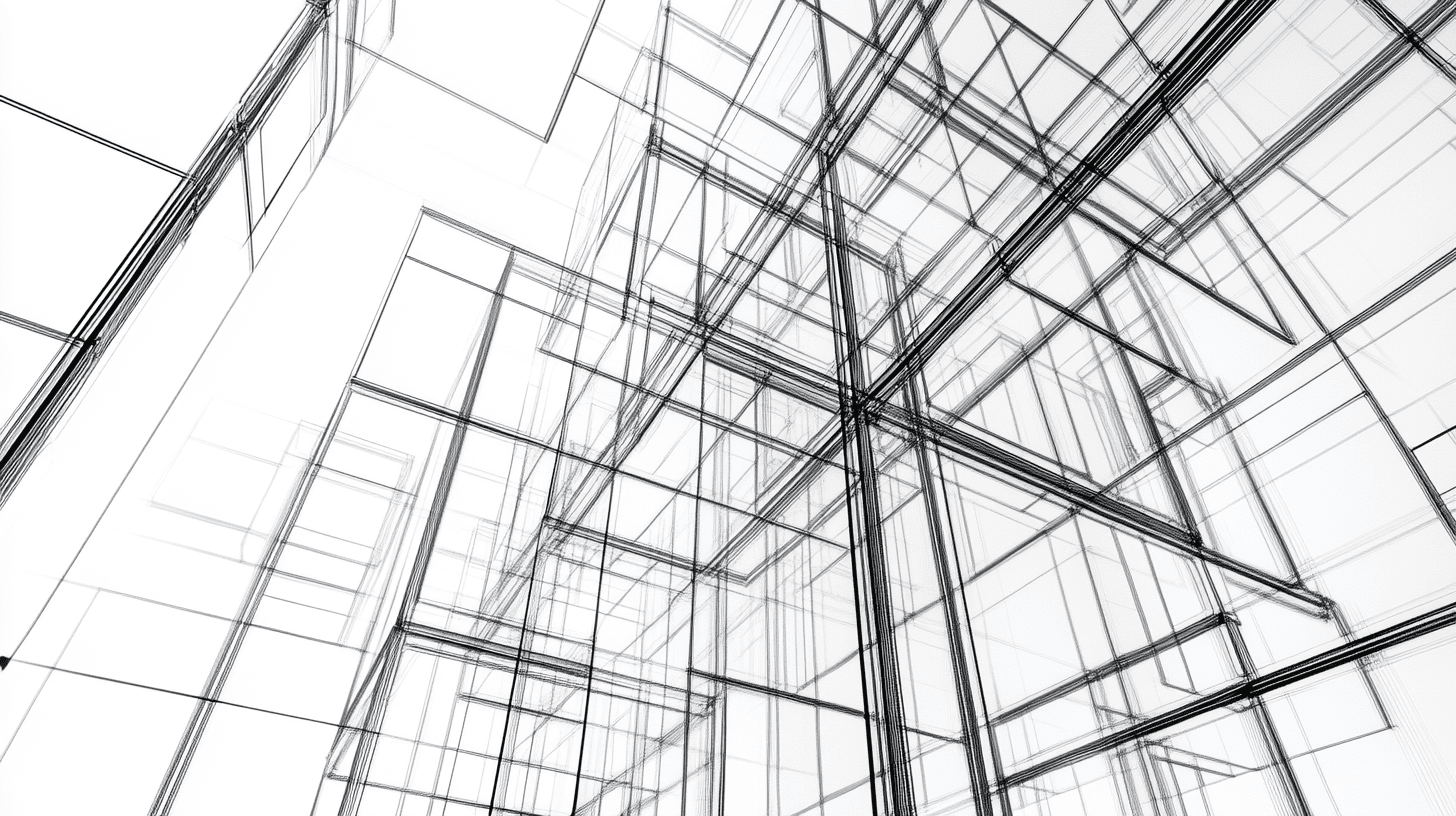

![Is this a suitable approach to architect a flutter app? [closed]](https://i.sstatic.net/4hMHGb1L.png)