Understanding the Aadhaar Enabled Payment System

The digital revolution has transformed financial services worldwide, bringing innovative solutions for seamless transactions. In India, the Aadhaar Enabled Payment System (AEPS) has played a pivotal role in ensuring financial inclusion, particularly for the unbanked and underbanked populations. AEPS is a secure and efficient payment mechanism that leverages Aadhaar authentication to facilitate cash withdrawals, balance inquiries, and fund transfers without needing a debit card or PIN. This article provides a comprehensive understanding of AEPS, its features, benefits, working process, and its impact on digital financial inclusion. What is AEPS? AEPS is a payment system developed by the National Payments Corporation of India (NPCI) that enables banking transactions through Aadhaar authentication. It allows users to perform transactions using their Aadhaar number and biometric verification, making banking accessible to individuals in rural and remote areas. Key Features of AEPS: Interoperability: Works across different banks, enabling seamless transactions. Secure Transactions: Uses biometric authentication, reducing fraud risks. Paperless and PIN-less Banking: Eliminates the need for physical documents or debit cards. Multiple Banking Services: Supports cash withdrawals, deposits, balance inquiries, mini statements, and Aadhaar-to-Aadhaar fund transfers. Real-time Processing: Ensures instant transaction settlements. How AEPS Works? AEPS functions as a bridge between bank account holders, banking correspondents (BCs), and financial institutions. Here’s how the process works: User Authentication: The customer provides their Aadhaar number and biometric verification (fingerprint or iris scan) at a micro-ATM or banking agent. Transaction Request: The AEPS service provider forwards the transaction request to the respective bank. Bank Verification: The bank validates the Aadhaar details and biometric data before approving the transaction. Transaction Completion: Upon successful verification, the requested transaction (cash withdrawal, balance inquiry, fund transfer) is processed instantly. Benefits of AEPS 1. Promoting Financial Inclusion AEPS has been instrumental in bridging the financial gap for people living in remote and rural areas. It eliminates the need for traditional banking infrastructure, enabling people without debit cards or smartphones to access banking services. 2. Secure and Fraud-Proof Transactions The Aadhaar-based biometric authentication ensures that only the authorized user can initiate transactions, reducing the risk of fraud and unauthorized access. 3. Easy and Convenient Banking AEPS enables banking at business correspondent (BC) outlets, micro-ATMs, and banking kiosks, making financial services easily accessible to individuals in remote locations. 4. Cost-Effective for Banks and Customers Since AEPS transactions are paperless and PIN-less, they reduce banking infrastructure costs and operational expenses for banks, while also making transactions affordable for customers. 5. Supports Government Welfare Schemes AEPS plays a crucial role in direct benefit transfers (DBT), ensuring government subsidies, pensions, and welfare funds reach beneficiaries directly in their Aadhaar-linked bank accounts. Use Cases of AEPS 1. Rural and Semi-Urban Banking AEPS is widely used in villages and small towns where people have limited access to ATMs or traditional banking services. 2. Government Subsidy Disbursement Many government welfare schemes such as PM-KISAN, MNREGA, and social security pensions are disbursed through AEPS, ensuring transparency and efficiency. 3. Business Correspondents & Fintech Companies Banking correspondents (BCs), fintech startups, and payment service providers (PSPs) leverage AEPS to offer doorstep banking services and expand their reach. 4. Microfinance and Small-Scale Businesses AEPS is extensively used by microfinance institutions (MFIs) and non-banking financial companies (NBFCs) to facilitate financial transactions for low-income groups and small businesses. How to Use AEPS for Transactions? To use AEPS, a user needs: A bank account linked with Aadhaar. A business correspondent (BC) or micro-ATM enabled for AEPS transactions. Biometric authentication through a fingerprint or iris scan. Steps for Performing an AEPS Transaction: Visit an AEPS-enabled banking agent, BC, or micro-ATM. Provide your Aadhaar number and bank name. Select the transaction type (cash withdrawal, deposit, balance inquiry, or fund transfer). Authenticate using biometric verification. Once validated, the transaction is processed, and a confirmation receipt is generated. Choosing the Right AEPS API Provider Businesses and financial service providers looking to integrate AEPS must select a reliable AEPS API provider. Here’s what to consider: NPCI Compliance: Ensure the API provider is authorized by NPCI. Security Features: Look for data encryption and fraud

The digital revolution has transformed financial services worldwide, bringing innovative solutions for seamless transactions. In India, the Aadhaar Enabled Payment System (AEPS) has played a pivotal role in ensuring financial inclusion, particularly for the unbanked and underbanked populations. AEPS is a secure and efficient payment mechanism that leverages Aadhaar authentication to facilitate cash withdrawals, balance inquiries, and fund transfers without needing a debit card or PIN.

This article provides a comprehensive understanding of AEPS, its features, benefits, working process, and its impact on digital financial inclusion.

What is AEPS?

AEPS is a payment system developed by the National Payments Corporation of India (NPCI) that enables banking transactions through Aadhaar authentication. It allows users to perform transactions using their Aadhaar number and biometric verification, making banking accessible to individuals in rural and remote areas.

Key Features of AEPS:

Interoperability: Works across different banks, enabling seamless transactions.

Secure Transactions: Uses biometric authentication, reducing fraud risks.

Paperless and PIN-less Banking: Eliminates the need for physical documents or debit cards.

Multiple Banking Services: Supports cash withdrawals, deposits, balance inquiries, mini statements, and Aadhaar-to-Aadhaar fund transfers.

Real-time Processing: Ensures instant transaction settlements.

How AEPS Works?

AEPS functions as a bridge between bank account holders, banking correspondents (BCs), and financial institutions. Here’s how the process works:

User Authentication: The customer provides their Aadhaar number and biometric verification (fingerprint or iris scan) at a micro-ATM or banking agent.

Transaction Request: The AEPS service provider forwards the transaction request to the respective bank.

Bank Verification: The bank validates the Aadhaar details and biometric data before approving the transaction.

Transaction Completion: Upon successful verification, the requested transaction (cash withdrawal, balance inquiry, fund transfer) is processed instantly.

Benefits of AEPS

1. Promoting Financial Inclusion

AEPS has been instrumental in bridging the financial gap for people living in remote and rural areas. It eliminates the need for traditional banking infrastructure, enabling people without debit cards or smartphones to access banking services.

2. Secure and Fraud-Proof Transactions

The Aadhaar-based biometric authentication ensures that only the authorized user can initiate transactions, reducing the risk of fraud and unauthorized access.

3. Easy and Convenient Banking

AEPS enables banking at business correspondent (BC) outlets, micro-ATMs, and banking kiosks, making financial services easily accessible to individuals in remote locations.

4. Cost-Effective for Banks and Customers

Since AEPS transactions are paperless and PIN-less, they reduce banking infrastructure costs and operational expenses for banks, while also making transactions affordable for customers.

5. Supports Government Welfare Schemes

AEPS plays a crucial role in direct benefit transfers (DBT), ensuring government subsidies, pensions, and welfare funds reach beneficiaries directly in their Aadhaar-linked bank accounts.

Use Cases of AEPS

1. Rural and Semi-Urban Banking

AEPS is widely used in villages and small towns where people have limited access to ATMs or traditional banking services.

2. Government Subsidy Disbursement

Many government welfare schemes such as PM-KISAN, MNREGA, and social security pensions are disbursed through AEPS, ensuring transparency and efficiency.

3. Business Correspondents & Fintech Companies

Banking correspondents (BCs), fintech startups, and payment service providers (PSPs) leverage AEPS to offer doorstep banking services and expand their reach.

4. Microfinance and Small-Scale Businesses

AEPS is extensively used by microfinance institutions (MFIs) and non-banking financial companies (NBFCs) to facilitate financial transactions for low-income groups and small businesses.

How to Use AEPS for Transactions?

To use AEPS, a user needs:

A bank account linked with Aadhaar.

A business correspondent (BC) or micro-ATM enabled for AEPS transactions.

Biometric authentication through a fingerprint or iris scan.

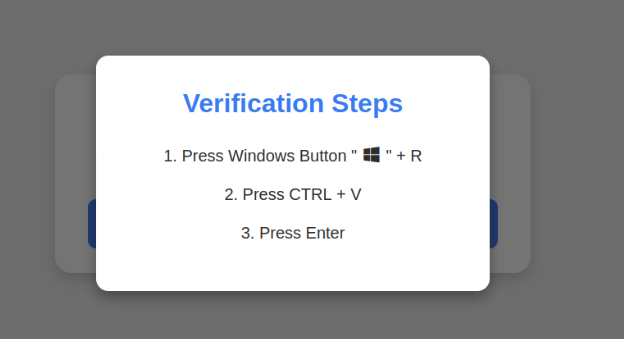

Steps for Performing an AEPS Transaction:

Visit an AEPS-enabled banking agent, BC, or micro-ATM.

Provide your Aadhaar number and bank name.

Select the transaction type (cash withdrawal, deposit, balance inquiry, or fund transfer).

Authenticate using biometric verification.

Once validated, the transaction is processed, and a confirmation receipt is generated.

Choosing the Right AEPS API Provider

Businesses and financial service providers looking to integrate AEPS must select a reliable AEPS API provider. Here’s what to consider:

NPCI Compliance: Ensure the API provider is authorized by NPCI.

Security Features: Look for data encryption and fraud detection mechanisms.

High Transaction Success Rate: Choose providers with minimal downtime and fast processing speeds.

24/7 Technical Support: Ensure easy API integration and developer assistance.

Competitive Pricing: Compare service charges and commission structures.

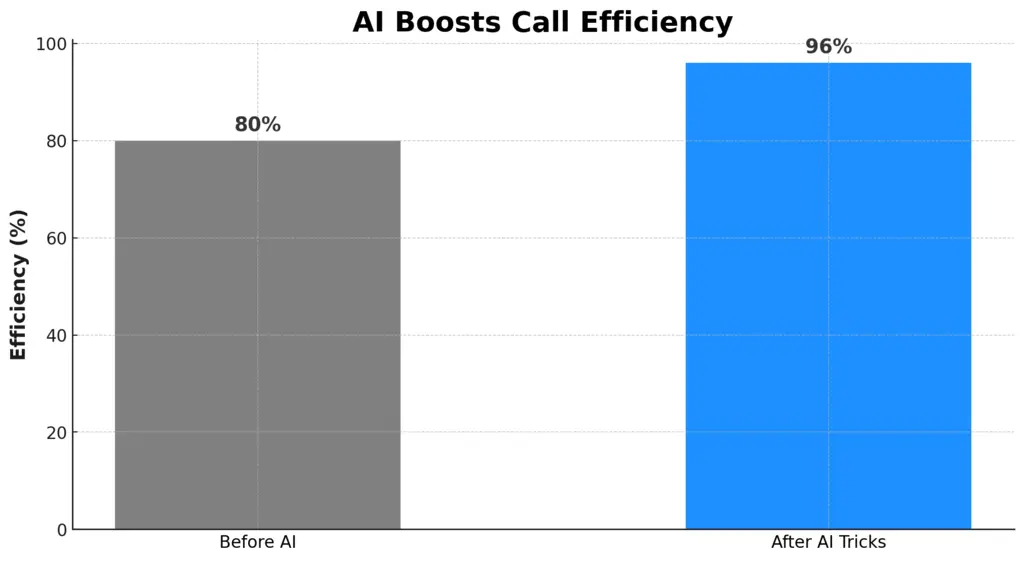

The Future of AEPS in India

With the increasing push towards digital payments and financial inclusion, AEPS is set to grow further. Some expected advancements include:

AI-driven fraud detection to enhance security.

Integration with UPI and mobile wallets for seamless transactions.

Expanding AEPS services for international remittances.

More fintech innovations leveraging AEPS APIs to create user-friendly solutions.

Conclusion

The Aadhaar Enabled Payment System (AEPS) is a game-changer in the realm of digital financial inclusion. By leveraging Aadhaar-based authentication, AEPS provides a secure, cost-effective, and accessible banking solution for millions of Indians, especially those in rural areas.

With continuous innovations and fintech adoption, AEPS is poised to revolutionize the digital payment ecosystem, making banking easier and more inclusive for all.

Businesses, financial institutions, and fintech companies must explore AEPS API integration to enhance accessibility and drive economic growth. As digital banking continues to evolve, AEPS will remain a cornerstone of India's financial empowerment strategy.

![iOS 19 Leak: First Look at Alleged VisionOS Inspired Redesign [Video]](https://www.iclarified.com/images/news/96824/96824/96824-640.jpg)

![OpenAI Announces 4o Image Generation [Video]](https://www.iclarified.com/images/news/96821/96821/96821-640.jpg)

![Do you care about Find My Device privacy settings? [Poll]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2024/06/Chipolo-One-Point-with-Find-My-Device-app.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![[The AI Show Episode 140]: New AGI Warnings, OpenAI Suggests Government Policy, Sam Altman Teases Creative Writing Model, Claude Web Search & Apple’s AI Woes](https://www.marketingaiinstitute.com/hubfs/ep%20140%20cover.png)

![[The AI Show Episode 139]: The Government Knows AGI Is Coming, Superintelligence Strategy, OpenAI’s $20,000 Per Month Agents & Top 100 Gen AI Apps](https://www.marketingaiinstitute.com/hubfs/ep%20139%20cover-2.png)

.png?width=1920&height=1920&fit=bounds&quality=80&format=jpg&auto=webp#)