Biometric Solutions for Fintech – 8 Reasons to Implement Them Today

Biometric solutions for fintech are shaking up security, authentication, and fraud prevention in financial services. Fintechs now lean on biometrics—it’s fast, precise, and leaves little room for fraudsters to slip through. Passwords? OTPs? Yeah, they ain’t cutting it anymore. Hackers crack them, and breaches happen. Biometrics? They wipe out those risks while making life easier for users. Cyber threats keep climbing. Identity theft? A never-ending headache. Compliance? Tougher by the day. Financial institutions can’t afford weak authentication. They gotta lock down transactions with biometric security—no backdoors, no loopholes. Fraudsters? They’re out of luck. People want speed, not friction. No one likes jumping through hoops to access their own money. Biometrics make onboarding smooth, mobile banking safer, and payments a breeze. Facial recognition, palm authentication, and doc verification—they all work together for ironclad identity checks. Fewer fraud risks. More trust. Happier customers. Fintech players can’t afford to drag their feet. Biometric authentication isn’t just an upgrade; it’s survival. It locks down security, nails compliance, and keeps operations sharp. The future? All about biometric-driven fintech. Are companies jumping in now? They’ll lead. They’ll set the standards. And fraud? It won’t stand a chance. Understanding Biometric Solutions for Fintech Biometric solutions for fintech change the way security and authentication work in digital finance. These technologies verify users through unique biological traits, making identity verification fast and fraud-proof. Passwords and OTPs? Too risky. Biometrics removes weak security links, giving fintechs a stronger defense against fraud while keeping up with compliance. Core Biometric Modalities in Fintech Fintech relies on biometric solutions to tighten security and improve user experience: Face Recognition: Scans facial features to verify identity with precision. Used in mobile banking and payment systems for seamless authentication. Palm Recognition: Reads vein structures, lines, and textures for secure, contactless verification. Perfect for high-security transactions and hygienic authentication. Face Liveness Detection: Detects real users by differentiating between live faces and spoofing attempts using photos, videos, or deepfakes. AI-Driven Biometrics for Advanced Fraud Detection AI-powered biometric solutions for fintech take fraud prevention to the next level. Machine learning catches anomalies, spots fraud patterns, and blocks spoofing attacks in real-time. Liveness detection stops identity theft by ensuring the user is physically present. AI-driven systems evolve to counter new fraud tactics, keeping security rock solid. Fintech firms using biometrics cut fraud risks, stay compliant, and streamline operations. Biometric authentication locks financial services in a secure, seamless, and efficient future. Investing in AI-driven biometrics? Smart move. It keeps fintechs ahead in security, trust, and customer confidence. Read full article here. https://faceplugin.com/biometric-solutions-for-fintech-8-reasons/

Biometric solutions for fintech are shaking up security, authentication, and fraud prevention in financial services. Fintechs now lean on biometrics—it’s fast, precise, and leaves little room for fraudsters to slip through.

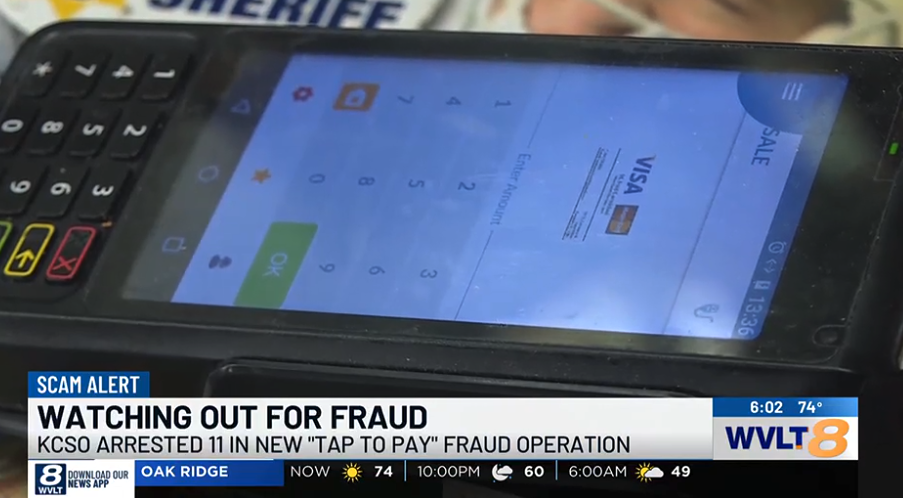

Passwords? OTPs? Yeah, they ain’t cutting it anymore. Hackers crack them, and breaches happen. Biometrics? They wipe out those risks while making life easier for users.

Cyber threats keep climbing. Identity theft? A never-ending headache. Compliance? Tougher by the day. Financial institutions can’t afford weak authentication. They gotta lock down transactions with biometric security—no backdoors, no loopholes. Fraudsters? They’re out of luck.

People want speed, not friction. No one likes jumping through hoops to access their own money. Biometrics make onboarding smooth, mobile banking safer, and payments a breeze. Facial recognition, palm authentication, and doc verification—they all work together for ironclad identity checks. Fewer fraud risks. More trust. Happier customers.

Fintech players can’t afford to drag their feet. Biometric authentication isn’t just an upgrade; it’s survival. It locks down security, nails compliance, and keeps operations sharp. The future? All about biometric-driven fintech. Are companies jumping in now? They’ll lead. They’ll set the standards. And fraud? It won’t stand a chance.

Understanding Biometric Solutions for Fintech

Biometric solutions for fintech change the way security and authentication work in digital finance. These technologies verify users through unique biological traits, making identity verification fast and fraud-proof.

Passwords and OTPs? Too risky. Biometrics removes weak security links, giving fintechs a stronger defense against fraud while keeping up with compliance.

Core Biometric Modalities in Fintech

Fintech relies on biometric solutions to tighten security and improve user experience:

Face Recognition: Scans facial features to verify identity with precision. Used in mobile banking and payment systems for seamless authentication.

Palm Recognition: Reads vein structures, lines, and textures for secure, contactless verification. Perfect for high-security transactions and hygienic authentication.

Face Liveness Detection: Detects real users by differentiating between live faces and spoofing attempts using photos, videos, or deepfakes.

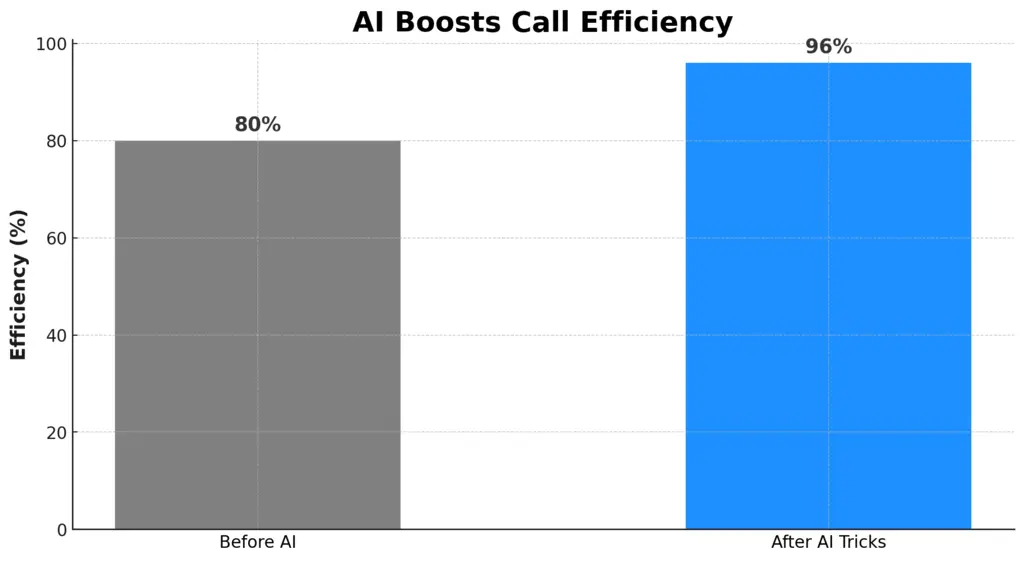

AI-Driven Biometrics for Advanced Fraud Detection

AI-powered biometric solutions for fintech take fraud prevention to the next level. Machine learning catches anomalies, spots fraud patterns, and blocks spoofing attacks in real-time. Liveness detection stops identity theft by ensuring the user is physically present. AI-driven systems evolve to counter new fraud tactics, keeping security rock solid.

Fintech firms using biometrics cut fraud risks, stay compliant, and streamline operations. Biometric authentication locks financial services in a secure, seamless, and efficient future. Investing in AI-driven biometrics? Smart move. It keeps fintechs ahead in security, trust, and customer confidence.

Read full article here.

https://faceplugin.com/biometric-solutions-for-fintech-8-reasons/

![Apple to Avoid EU Fine Over Browser Choice Screen [Report]](https://www.iclarified.com/images/news/96813/96813/96813-640.jpg)

![iOS 18.4 Release Candidate comes bundled with over 50 new changes and features [Video]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/03/iOS-18.4-Release-Candidate-Visual-Intelligence-Action-Button-iPhone-16e.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

-xl-xl.jpg)

_alon_harel_Alamy.jpg?#)

![[The AI Show Episode 140]: New AGI Warnings, OpenAI Suggests Government Policy, Sam Altman Teases Creative Writing Model, Claude Web Search & Apple’s AI Woes](https://www.marketingaiinstitute.com/hubfs/ep%20140%20cover.png)

![[The AI Show Episode 139]: The Government Knows AGI Is Coming, Superintelligence Strategy, OpenAI’s $20,000 Per Month Agents & Top 100 Gen AI Apps](https://www.marketingaiinstitute.com/hubfs/ep%20139%20cover-2.png)

.png?width=1920&height=1920&fit=bounds&quality=80&format=jpg&auto=webp#)

.png?width=1920&height=1920&fit=bounds&quality=80&format=jpg&auto=webp#)